- Norway

- /

- Oil and Gas

- /

- OB:DNO

Did DNO's Asset Deals and Dividend Boost Just Shift Its (OB:DNO) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, DNO ASA announced a series of major developments including new agreements with Aker BP to accelerate the Kjottkake project, the transfer of asset interests, confirmation of a NOK0.375 per share dividend, and third-quarter results with sales increasing to US$546.8 million from a year ago.

- These updates highlight DNO's focus on operational expansion, improving production guidance, and reinforcing capital returns to shareholders through both project growth and direct dividends.

- We'll explore how DNO's asset agreements with Aker BP, combined with rising production guidance, influence its investment narrative going forward.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

DNO Investment Narrative Recap

To be a DNO shareholder, you need to believe in the company’s ability to expand its North Sea operations, manage geopolitical volatility in Kurdistan, and deliver sustainable cash returns even with current unprofitability and high debt levels. The latest agreements with Aker BP may increase North Sea growth, but do not materially shift the biggest short-term risk: ongoing geopolitical challenges and payment uncertainty in Kurdistan, which continue to threaten near-term production and revenue reliability.

Among the recent announcements, DNO’s new production guidance for Q4, which expects net North Sea production to approach 90,000 boepd and Kurdistan at 60,000 boepd, stands out. This is especially relevant as asset agreements with Aker BP and incremental fields like Andvare and Verdande become operational, supporting near-term volume catalysts yet leaving longer-term risk factors largely intact.

However, while optimism for North Sea output is rising, the unpredictable payment landscape in Kurdistan remains a critical pressure point for investors to watch...

Read the full narrative on DNO (it's free!)

DNO's narrative projects $2.7 billion revenue and $453.5 million earnings by 2028. This requires 50.4% yearly revenue growth and a $544.3 million increase in earnings from -$90.8 million.

Uncover how DNO's forecasts yield a NOK18.17 fair value, a 22% upside to its current price.

Exploring Other Perspectives

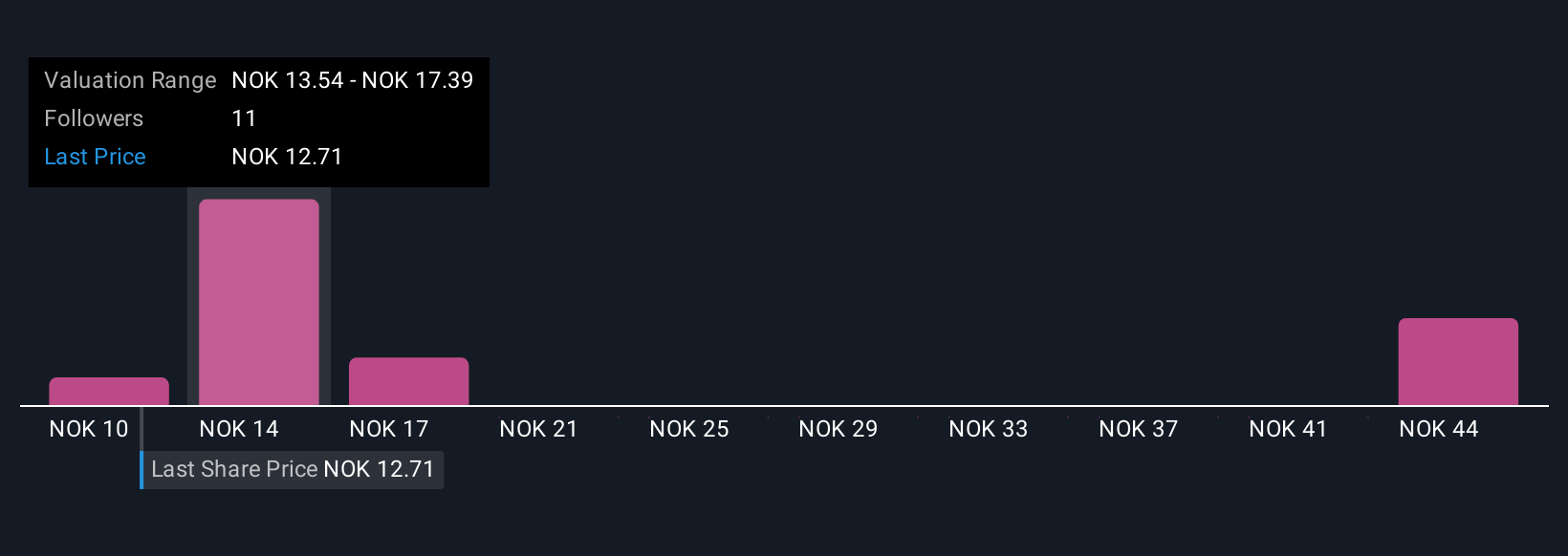

Simply Wall St Community members have assigned fair values for DNO ranging from NOK9.68 to NOK92.45 across six different estimates, showing broad differences in outlook. Against this backdrop of contrasting opinions, the persistent risk from Kurdistan’s political and payment uncertainty can be a key variable shaping future performance, take time to review other viewpoints.

Explore 6 other fair value estimates on DNO - why the stock might be worth over 6x more than the current price!

Build Your Own DNO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DNO research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DNO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DNO's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNO

DNO

Engages in the exploration, development, and production of oil and gas assets in the Middle East, the North Sea, and West Africa.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives