- Denmark

- /

- Electrical

- /

- CPSE:VWS

3 European Stocks Estimated To Be Undervalued By Up To 36.7%

Reviewed by Simply Wall St

As European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index slightly lower and major stock indexes showing varied results, investors are keenly assessing monetary policy decisions and economic indicators. In this environment, identifying undervalued stocks becomes crucial as they can offer potential opportunities for growth despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.24 | SEK85.35 | 49.3% |

| Trifork Group (CPSE:TRIFOR) | DKK88.20 | DKK170.57 | 48.3% |

| Rheinmetall (XTRA:RHM) | €1912.00 | €3794.92 | 49.6% |

| Prosegur Cash (BME:CASH) | €0.706 | €1.38 | 48.8% |

| Hanza (OM:HANZA) | SEK109.40 | SEK215.01 | 49.1% |

| Green Oleo (BIT:GRN) | €0.775 | €1.51 | 48.7% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.76 | 49.6% |

| cyan (XTRA:CYR) | €2.26 | €4.39 | 48.5% |

| Atea (OB:ATEA) | NOK144.20 | NOK278.86 | 48.3% |

| adidas (XTRA:ADS) | €185.25 | €369.56 | 49.9% |

Let's uncover some gems from our specialized screener.

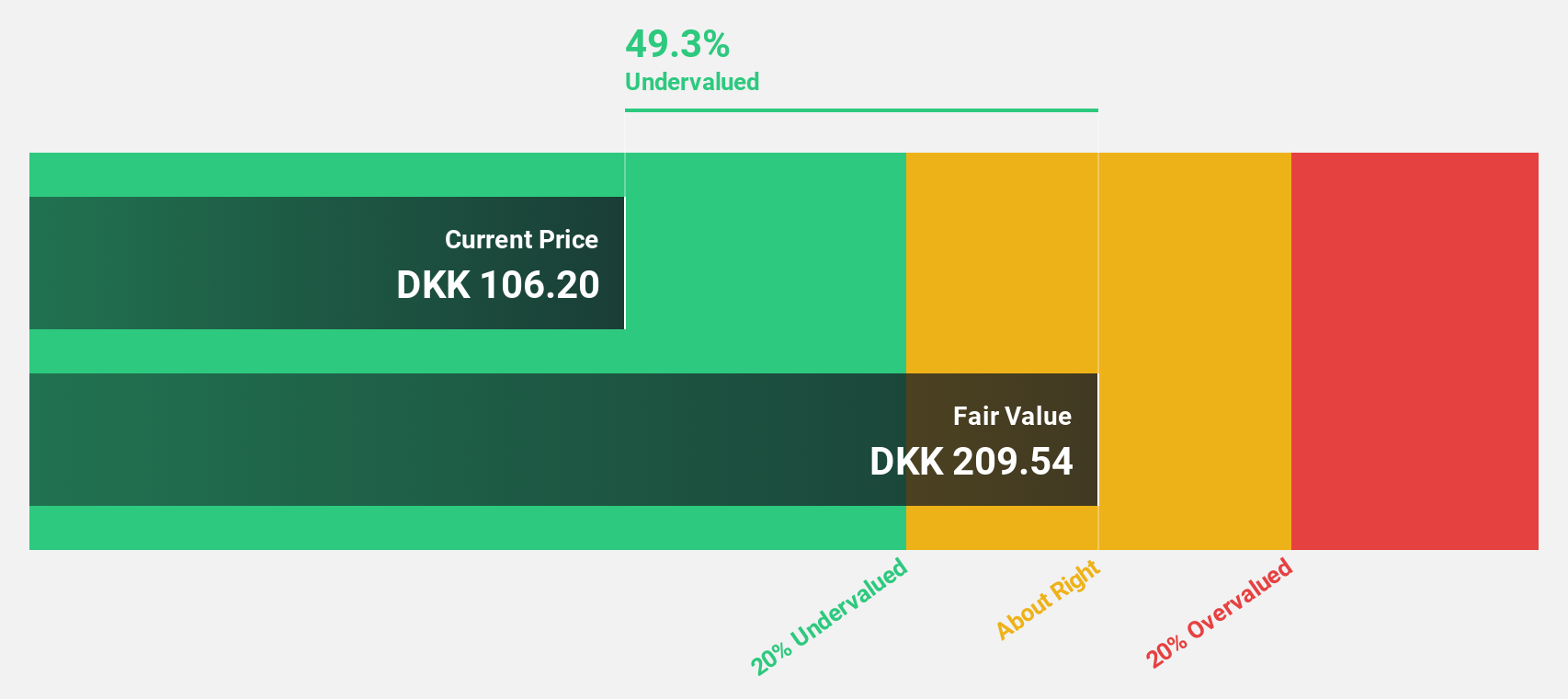

Vestas Wind Systems (CPSE:VWS)

Overview: Vestas Wind Systems A/S designs, manufactures, installs, and services wind turbines in the United States, Denmark, and internationally with a market cap of DKK116.98 billion.

Operations: Vestas Wind Systems generates revenue through its Service segment, contributing €3.99 billion, and its Power Solutions segment, which accounts for €14.54 billion.

Estimated Discount To Fair Value: 36.4%

Vestas Wind Systems, trading at DKK117.15, is undervalued based on discounted cash flow analysis with a fair value estimate of DKK184.13. The company recently reported a positive turnaround in earnings and revenue growth, achieving profitability this year with EUR 32 million net income for Q2 2025. It continues to secure significant orders across Europe and North America, supporting future cash flows. However, its volatile share price may concern some investors despite strong earnings growth forecasts exceeding the Danish market average.

- Insights from our recent growth report point to a promising forecast for Vestas Wind Systems' business outlook.

- Take a closer look at Vestas Wind Systems' balance sheet health here in our report.

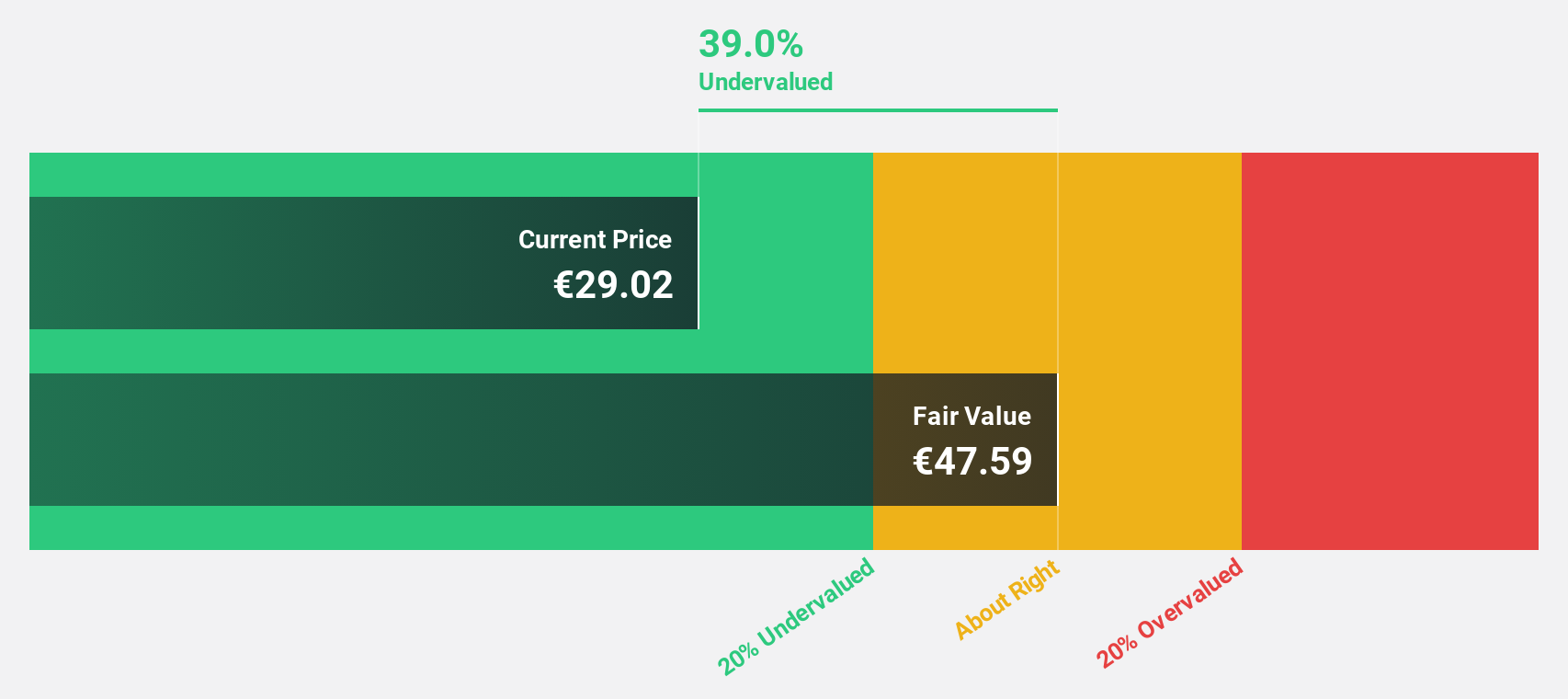

Valmet Oyj (HLSE:VALMT)

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various global regions, with a market cap of €5.71 billion.

Operations: Valmet Oyj generates its revenue from three primary segments: Services (€1.91 billion), Automation (€1.49 billion), and Process Technologies (€1.85 billion).

Estimated Discount To Fair Value: 36.7%

Valmet Oyj, priced at €31, is significantly undervalued with a fair value estimate of €48.95 based on discounted cash flow analysis. Despite recent earnings challenges and a dividend not fully covered by earnings, the company's projected annual profit growth of 24.5% outpaces the Finnish market average. Valmet's strategic agreements in China and with Petrobras enhance its future cash flow potential while reinforcing its commitment to operational efficiency and sustainability initiatives globally.

- The analysis detailed in our Valmet Oyj growth report hints at robust future financial performance.

- Dive into the specifics of Valmet Oyj here with our thorough financial health report.

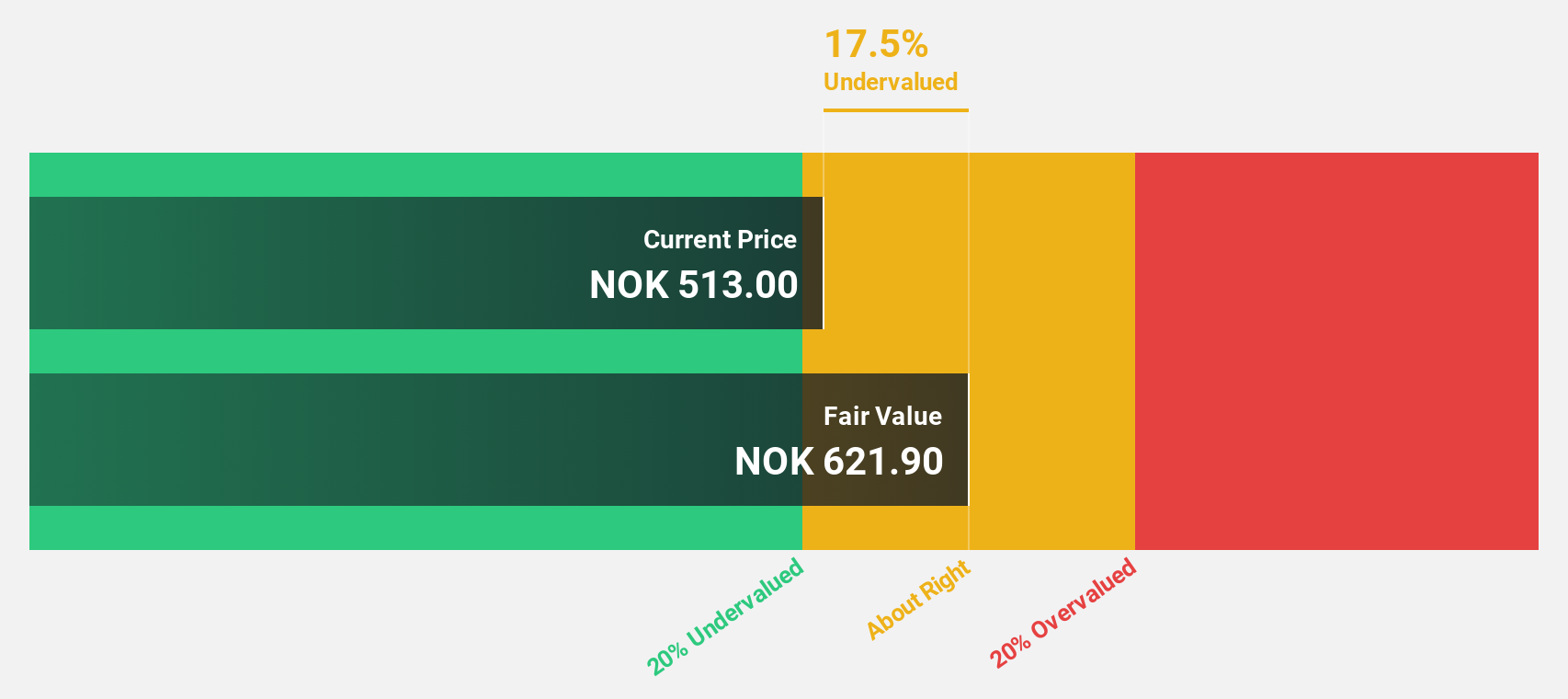

BlueNord (OB:BNOR)

Overview: BlueNord ASA is an oil and gas company focused on producing and developing resources for energy transition in Norway, Denmark, the Netherlands, and the United Kingdom, with a market cap of NOK11.60 billion.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, amounting to $794.30 million.

Estimated Discount To Fair Value: 29.4%

BlueNord ASA, trading at NOK454.5, is significantly undervalued with a fair value estimate of NOK643.99 based on discounted cash flow analysis. The company anticipates revenue growth of 10.9% annually, surpassing the Norwegian market average, and expects to achieve profitability within three years. Despite recent production challenges and interest payments not well covered by earnings, BlueNord's strong return on equity forecast and analyst consensus for a price increase highlight its potential as an undervalued investment opportunity in Europe.

- Our expertly prepared growth report on BlueNord implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of BlueNord stock in this financial health report.

Key Takeaways

- Explore the 210 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success