- Norway

- /

- Energy Services

- /

- OB:AKSO

Is Aker Solutions' String of Major Contract Wins Shaping the Outlook for OB:AKSO’s Earnings Visibility?

Reviewed by Sasha Jovanovic

- Aker Solutions recently announced it secured two major multi-year contract extensions: a five-year agreement with ExxonMobil Canada Properties for maintenance and modifications on the Hebron platform, and a four-year extension for inspection services across over 15 Norwegian facilities.

- The contracts, combined with strong third-quarter earnings growth, highlight Aker Solutions' continued expansion in both the Canadian and Norwegian offshore energy sectors.

- We'll explore how these significant contract wins underpin Aker Solutions’ revenue visibility and could influence its earnings outlook going forward.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Aker Solutions Investment Narrative Recap

Owning Aker Solutions today hinges on confidence in the company’s ability to sustain high order intake and deliver margin improvements amid a shifting energy landscape. The company’s recent contract extensions in Canada and Norway offer some visibility on future revenues, but the biggest short-term catalyst remains the performance of its backlog, while the main risk centers on legacy renewables projects that could pressure margins into 2025; the new contracts, though positive, do not appear to be material enough to offset this risk in the near term.

Among recent announcements, Aker Solutions' guidance for 2025, expecting revenues to top NOK 60 billion, directly relates to the short-term catalysts at play. This forward-looking outlook signals management’s confidence in ongoing contract execution and order intake, yet investors may weigh this optimism against persistent cost and commercial challenges in existing renewables obligations.

However, investors should be aware that ongoing commercial issues in legacy renewables projects could continue to impact profitability if not resolved...

Read the full narrative on Aker Solutions (it's free!)

Aker Solutions' outlook anticipates NOK35.0 billion in revenue and NOK1.6 billion in earnings by 2028. This implies a 15.2% annual decline in revenue and a decrease in earnings of NOK0.6 billion from the current NOK2.2 billion.

Uncover how Aker Solutions' forecasts yield a NOK33.88 fair value, a 9% upside to its current price.

Exploring Other Perspectives

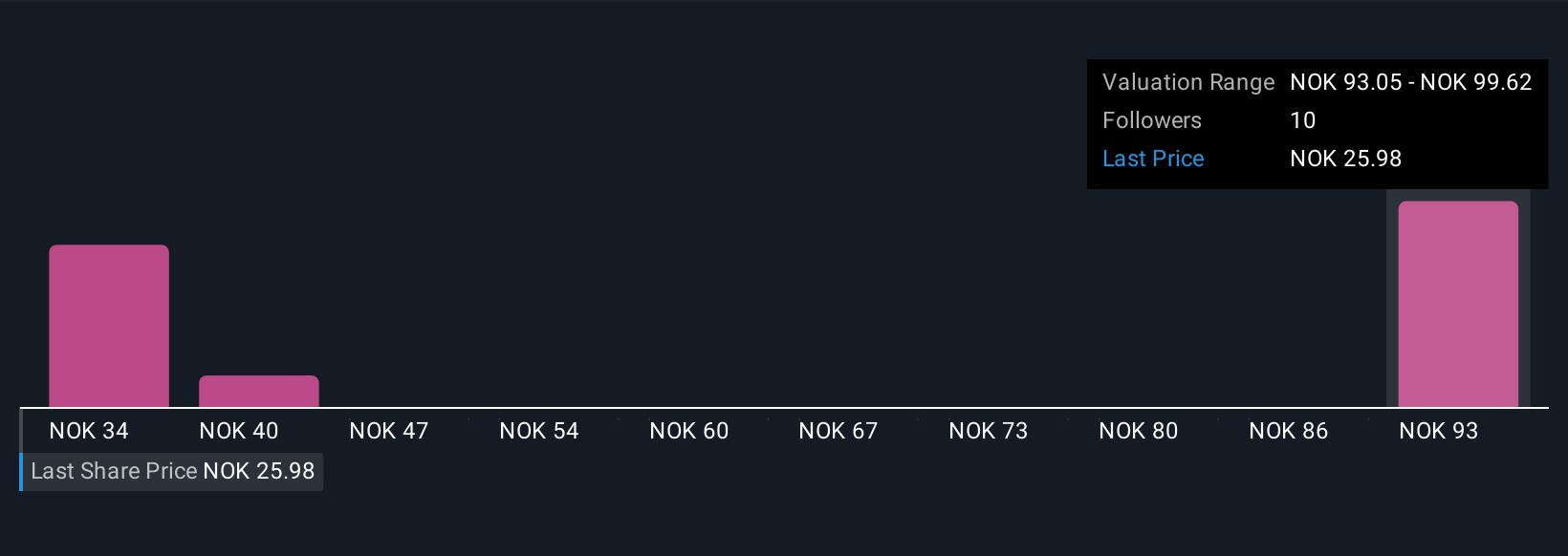

Simply Wall St Community fair value estimates for Aker Solutions range widely from NOK 33.88 to NOK 156.82, based on four unique analyses. While expectations differ, many participants remain focused on whether new contract wins can meaningfully outweigh profit risks from challenged renewables projects ahead.

Explore 4 other fair value estimates on Aker Solutions - why the stock might be worth over 5x more than the current price!

Build Your Own Aker Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aker Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aker Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aker Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKSO

Aker Solutions

Provides solutions, products, systems, and services to the oil and gas industry in Norway, the United States, Brazil, the United Kingdom, Malaysia, Angola, Brunei, Canada, India, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives