- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

How Investors May Respond To Aker BP (OB:AKRBP) Gaining Expanded Control and Operatorship in Kjottkake Deal

Reviewed by Sasha Jovanovic

- Aker BP ASA announced that it has entered into agreements with DNO ASA to exchange ownership interests across several licences, transfer operatorship of the Kjottkake discovery, and enhance its positions in the Alvheim area.

- This move allows Aker BP to use its fast-track development expertise to accelerate project execution and unlock integrated development opportunities linked to existing infrastructure.

- We’ll now explore how Aker BP’s expanded operational control in Kjottkake could shape its investment narrative and future outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Aker BP Investment Narrative Recap

To be comfortable as a shareholder in Aker BP, you need to believe in the company’s ability to deliver production growth and execute on complex projects while actively managing risks related to cost, execution, and energy transition policy. The recent licence exchange and operatorship transfer with DNO enhances Aker BP’s position in the Alvheim and Kjottkake areas, but does not fundamentally shift near-term catalysts or address the persistent risk from high exposure to project execution and integration challenges. Among Aker BP’s recent moves, the successful refinancing of over US$3.2 billion in revolving credit facilities stands out as particularly relevant, supporting the company’s liquidity in tandem with its push for accelerated project delivery in new fields like Kjottkake. This improved financial flexibility could help buffer against potential cash flow pressures if major project timelines slip or encounter unexpected hurdles. However, investors should also be aware that, despite greater operational control, Aker BP’s growth ambitions continue to carry heightened exposure to...

Read the full narrative on Aker BP (it's free!)

Aker BP's narrative projects $12.1 billion in revenue and $1.6 billion in earnings by 2028. This requires 1.0% yearly revenue growth and a $872.7 million earnings increase from current earnings of $727.3 million.

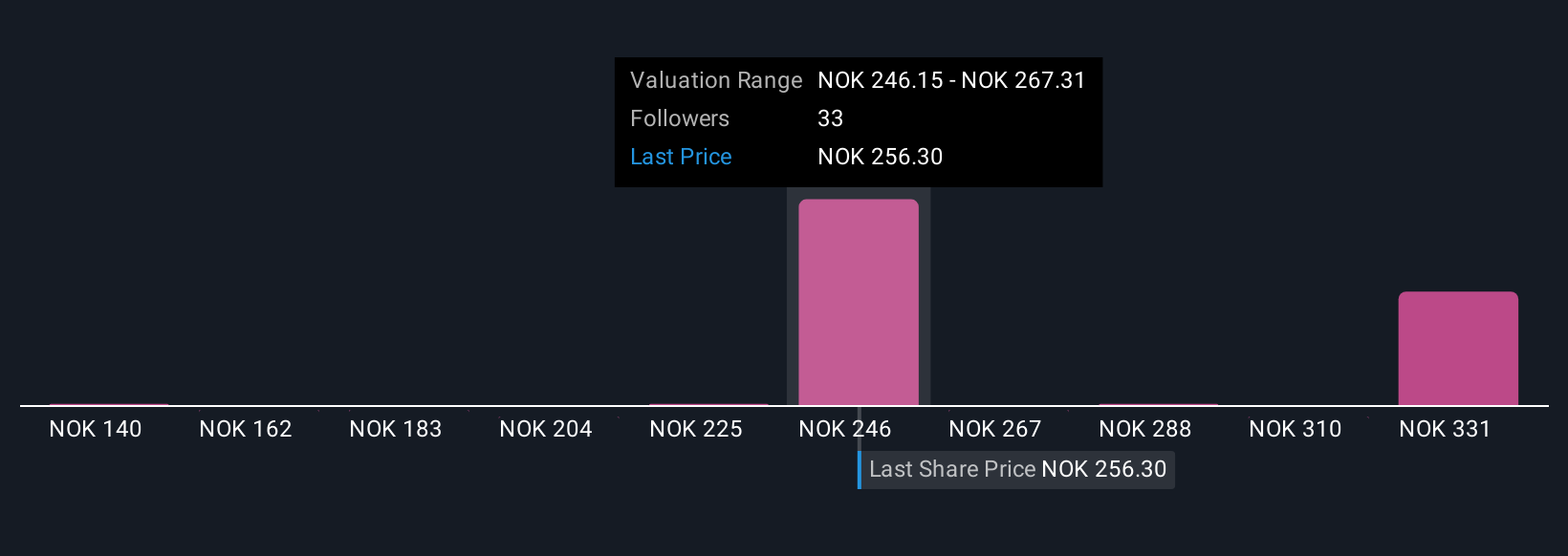

Uncover how Aker BP's forecasts yield a NOK261.41 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community peg Aker BP’s fair value estimates between NOK140 and NOK677, reflecting broad differences in outlook. With significant exposure to execution risks as the company accelerates development, it’s important to explore how these varying perspectives might align with your own views on future performance.

Explore 10 other fair value estimates on Aker BP - why the stock might be worth over 2x more than the current price!

Build Your Own Aker BP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aker BP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aker BP's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives