- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Aker BP (OB:AKRBP) Valuation in Focus After $1 Billion Notes Offering and Earnings Update

Reviewed by Simply Wall St

Aker BP (OB:AKRBP) has priced a $1 billion senior notes offering at a 5.25% coupon. The company aims to boost its balance sheet and provide flexibility for general corporate needs. This move comes alongside fresh quarterly results and updated production guidance.

See our latest analysis for Aker BP.

Between the upbeat Q3 earnings report, a higher production outlook, and fresh capital on hand, Aker BP has drawn more investor attention lately. The stock is showing clear momentum, with a 12.8% gain in year-to-date share price and an impressive 28.4% total shareholder return over the last year. This underscores growing confidence in its outlook despite pockets of volatility.

If the recent burst of activity in the energy sector has you watching for the next standout, now is the perfect moment to discover fast growing stocks with high insider ownership

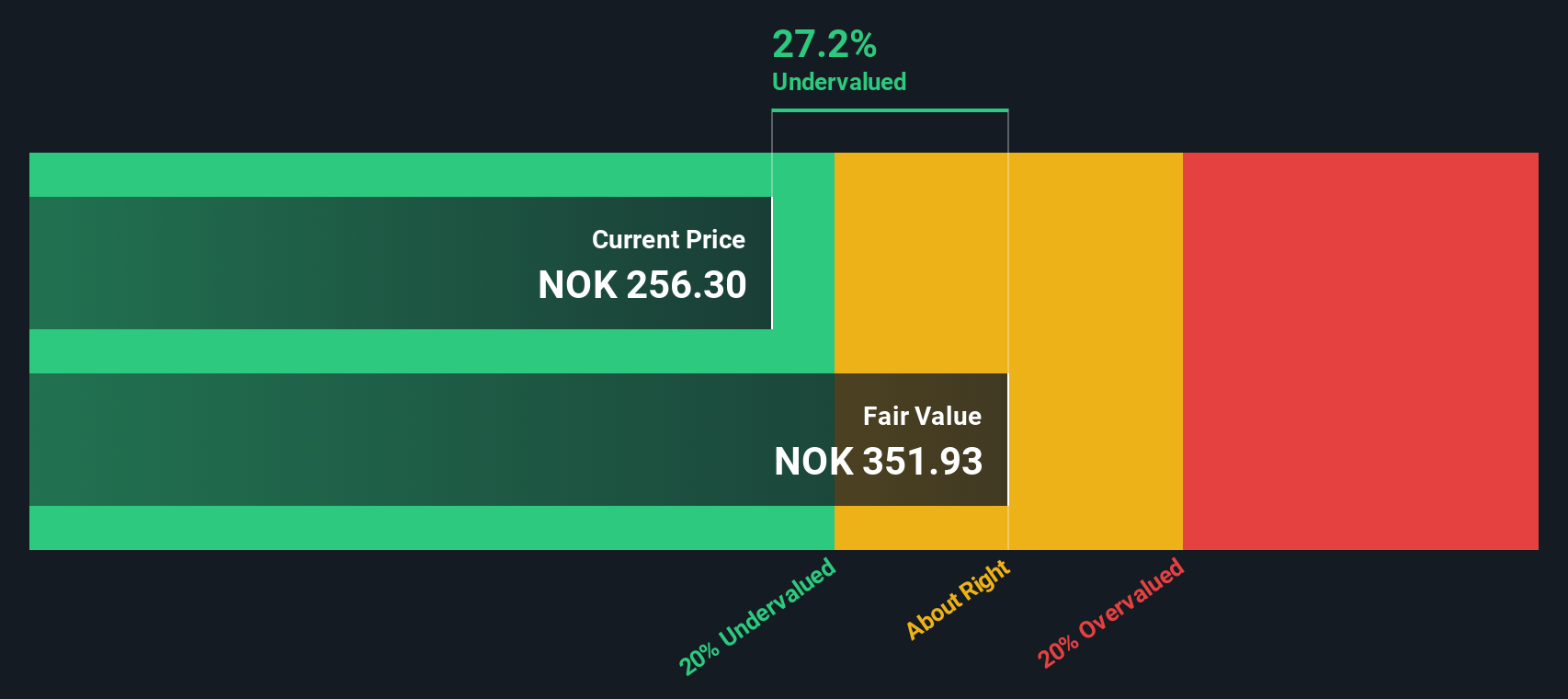

Yet even with robust financial news and rising investor enthusiasm, the key question remains: is Aker BP undervalued at current levels, or has the market already priced in the company’s next phase of growth?

Most Popular Narrative: Fairly Valued

Aker BP’s most widely followed narrative pegs the current fair value at NOK 260.53, virtually matching the recent close of NOK 262.8. This alignment suggests investors see the share price as tracking with fundamentals after the latest batch of results and guidance tweaks.

Aker BP aims to sustain production above 500,000 barrels per day beyond 2030, driven by their 2 billion barrel opportunity and projects like Yggdrasil and Johan Sverdrup. This supports long-term revenue growth through extended production capacities.

Wondering what bold production targets and margin forecasts are driving this valuation? There is a surprising blend of advanced technology, profit expansion, and closely-watched earnings projections at its core. See which numbers shifted the fair value and how far this growth story could stretch.

Result: Fair Value of NOK 260.53 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing concerns about rising emissions costs and heavy reliance on a handful of key assets could impact Aker BP’s earnings trajectory in the years ahead.

Find out about the key risks to this Aker BP narrative.

Another View: SWS DCF Model Points to Undervaluation

Looking through the lens of the SWS DCF model, the outlook for Aker BP shifts dramatically. The model suggests the shares are trading at a steep 46.4% discount to fair value, which points to much greater upside than the current market price implies. Does this disconnect reveal hidden value, or could it signal extra risks that the multiples do not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aker BP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aker BP Narrative

If the market consensus does not fit your perspective, or you are keen to dig into the figures yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Ready to expand your investment strategy? Give yourself an edge by checking out unique market opportunities in sectors with explosive growth and strong fundamentals.

- Tap into the power of innovative health and tech companies by reviewing these 34 healthcare AI stocks that are improving lives and pushing medical boundaries.

- Capitalize on the potential behind high-yield returns with these 24 dividend stocks with yields > 3% offering attractive payouts and sustainable business models.

- Catch the momentum of a rapidly evolving market and check out these 26 AI penny stocks set to shape the next generation of technology and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives