ABL Group ASA (OB:ABL) will increase its dividend from last year's comparable payment on the 15th of June to $0.35. This will take the dividend yield to an attractive 4.5%, providing a nice boost to shareholder returns.

View our latest analysis for ABL Group

ABL Group Is Paying Out More Than It Is Earning

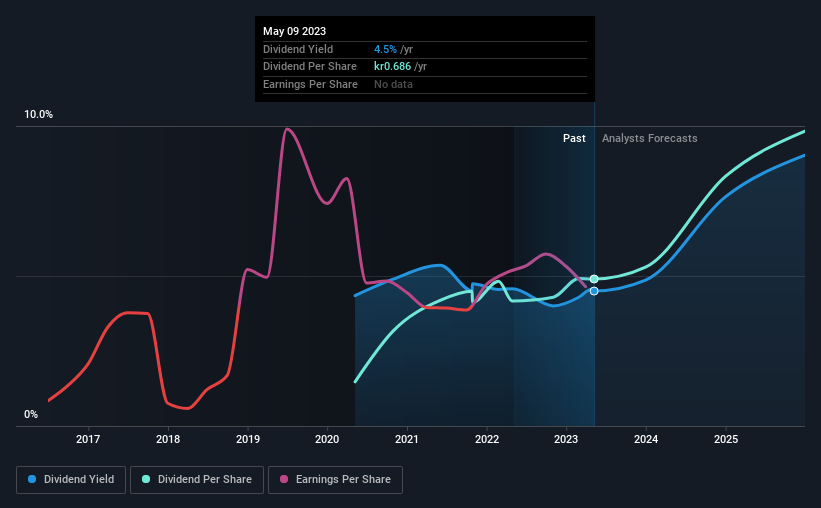

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, the company was paying out 105% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 52%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

EPS is forecast to rise very quickly over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio could reach 396%, which is unsustainable.

ABL Group Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2020, the dividend has gone from $0.0195 total annually to $0.0648. This works out to be a compound annual growth rate (CAGR) of approximately 49% a year over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

ABL Group's Dividend Might Lack Growth

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. ABL Group has impressed us by growing EPS at 20% per year over the past five years. While EPS is growing at a decent rate, but future growth could be limited by the amount of earnings being paid out to shareholders.

An additional note is that the company has been raising capital by issuing stock equal to 27% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On ABL Group's Dividend

In summary, while it's always good to see the dividend being raised, we don't think ABL Group's payments are rock solid. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think ABL Group is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 4 warning signs for ABL Group that investors should know about before committing capital to this stock. Is ABL Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ABL

ABL Group

An investment holding company, provides energy, and marine and engineering consultancy services to renewables, maritime, and oil and gas industries worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026