- Norway

- /

- Hospitality

- /

- OB:G2MNO

Analysts Just Shaved Their Gaming Innovation Group Inc. (OB:GIG) Forecasts Dramatically

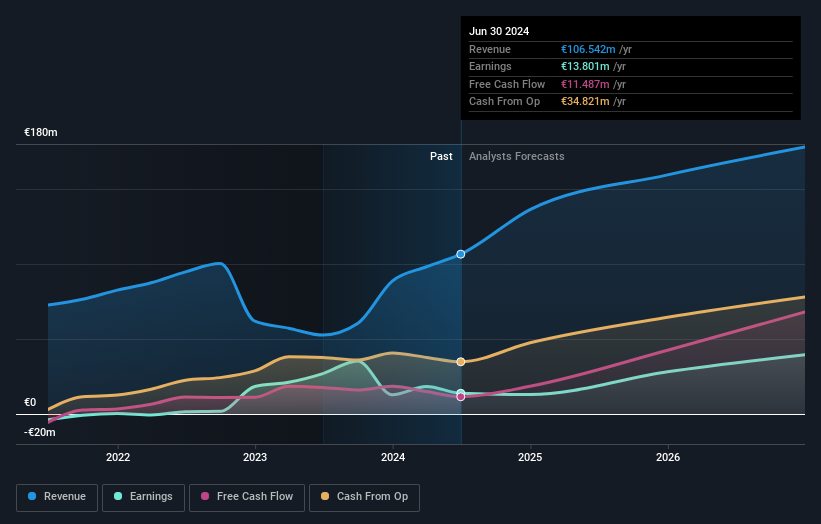

The analysts covering Gaming Innovation Group Inc. (OB:GIG) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

Following the downgrade, the most recent consensus for Gaming Innovation Group from its four analysts is for revenues of €136m in 2024 which, if met, would be a sizeable 28% increase on its sales over the past 12 months. Per-share earnings are expected to bounce 41% to €0.14. Prior to this update, the analysts had been forecasting revenues of €155m and earnings per share (EPS) of €0.18 in 2024. Indeed, we can see that the analysts are a lot more bearish about Gaming Innovation Group's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Gaming Innovation Group

It'll come as no surprise then, to learn that the analysts have cut their price target 11% to €3.44.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Gaming Innovation Group's rate of growth is expected to accelerate meaningfully, with the forecast 64% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 22% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.7% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Gaming Innovation Group to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Gaming Innovation Group.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Gaming Innovation Group's financials, such as its declining profit margins. Learn more, and discover the 2 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:G2MNO

Gentoo Media

An iGaming technology company, together with its subsidiaries, provides solutions, products, and services to iGaming operators in Nordic countries, other European countries, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives