- Norway

- /

- Construction

- /

- OB:VEI

A Closer Look at Veidekke (OB:VEI) Valuation Following Q3 Earnings Growth and Major Oslo Contract Win

Reviewed by Simply Wall St

Veidekke (OB:VEI) shared third-quarter earnings showing growth in both sales and net income, giving investors a clearer picture of the company’s operational momentum. In addition to these results, Veidekke secured a substantial new construction contract in Oslo.

See our latest analysis for Veidekke.

Off the back of these upbeat results and a major new contract win, Veidekke’s share price has built solid momentum in 2025, rising over 15% year-to-date. Longer-term performance has also been strong, with a one-year total shareholder return of nearly 28% and an impressive 118% over three years. This reflects growing confidence in the business’s direction.

If you’re interested in finding what else makes the market tick, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares rallying and recent results fueling optimism, investors must now ask whether Veidekke remains undervalued or if the market is already fully pricing in the company’s future growth potential.

Price-to-Earnings of 16.2x: Is it justified?

Veidekke’s shares are currently trading at a price-to-earnings (P/E) ratio of 16.2x, noticeably higher than both its industry peers and the estimated fair P/E based on company fundamentals.

The P/E ratio measures how much investors are willing to pay per unit of earnings, making it a key gauge of market confidence and earnings expectations in the construction sector.

The data reveals that Veidekke’s P/E of 16.2x stands above the average for the European Construction industry (14.2x) and the company’s peer group (14.9x). Furthermore, it exceeds the estimated fair P/E ratio of 13.1x. This may indicate the market is pricing in stronger earnings growth or higher quality relative to peers, possibly in response to Veidekke’s robust return on equity and consistent profitability. If sentiment shifts or results falter, the valuation could move closer to the fair ratio level.

Explore the SWS fair ratio for Veidekke

Result: Price-to-Earnings of 16.2x (OVERVALUED)

However, slower revenue and net income growth, or any negative surprises in upcoming earnings reports, could challenge the current optimism around Veidekke’s valuation.

Find out about the key risks to this Veidekke narrative.

Another View: Is Veidekke Actually Undervalued?

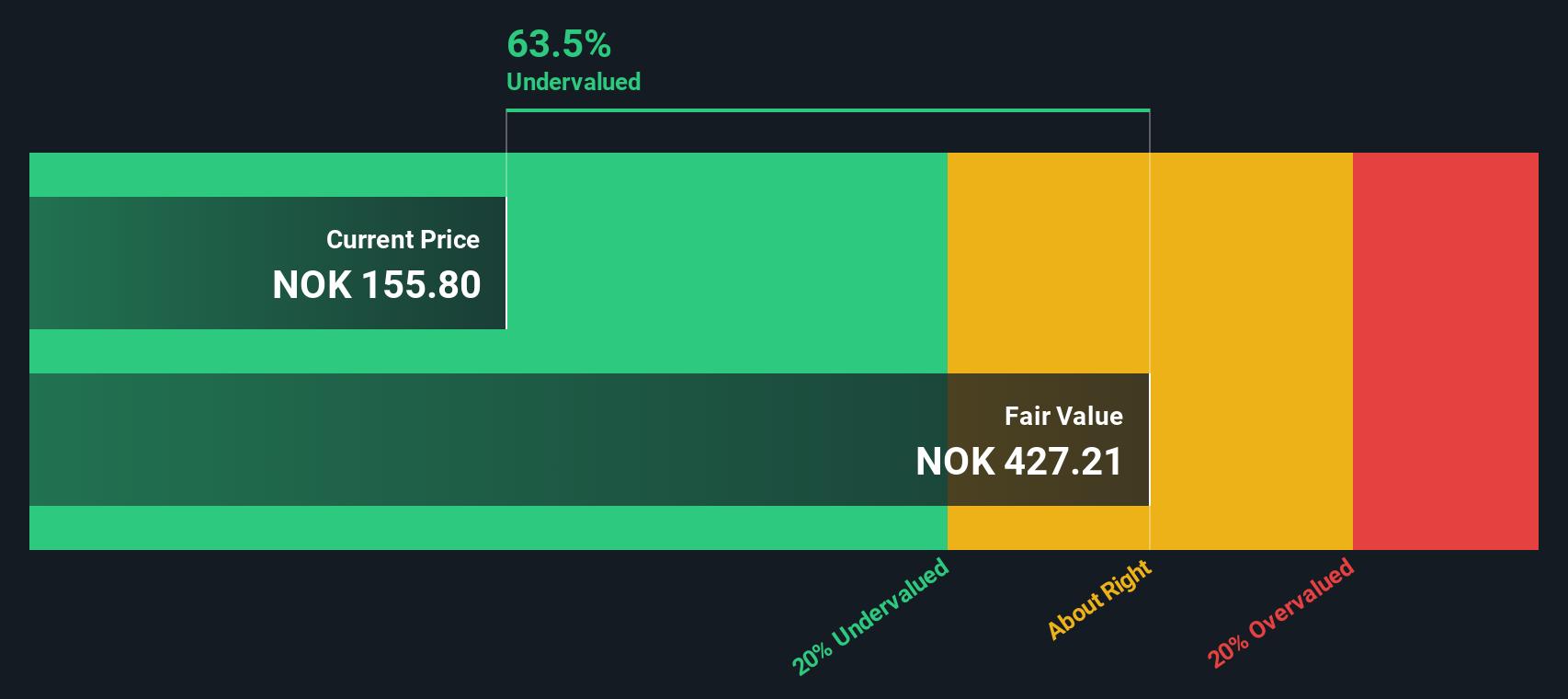

But a different approach, using our SWS DCF model, suggests Veidekke is trading far below its estimated fair value. The DCF method indicates the stock could be undervalued and may offer upside that the current market optimism has not accounted for. Could this signal a hidden opportunity for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veidekke for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veidekke Narrative

If you have a different perspective or want to reach your own conclusions, it takes just a few minutes to analyze the numbers and shape your own story. Do it your way

A great starting point for your Veidekke research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Ways to Grow Your Wealth?

Don’t let the big opportunities slip through your fingers. The Simply Wall Street Screener puts the market’s most compelling investment ideas right at your fingertips today.

- Spot companies poised for a turnaround and tap into potential with these 886 undervalued stocks based on cash flows that are showing real strength in their cash flows.

- Seize the explosive potential of artificial intelligence by getting ahead with these 25 AI penny stocks revolutionizing industries right now.

- Unlock steady income by targeting these 16 dividend stocks with yields > 3% offering attractive yields well above the average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEI

Veidekke

Operates as a construction and property development company in Norway, Sweden, and Denmark.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives