- Norway

- /

- Aerospace & Defense

- /

- OB:NUMND

Take Care Before Jumping Onto Nordic Unmanned ASA (OB:NUMND) Even Though It's 72% Cheaper

The Nordic Unmanned ASA (OB:NUMND) share price has fared very poorly over the last month, falling by a substantial 72%. For any long-term shareholders, the last month ends a year to forget by locking in a 96% share price decline.

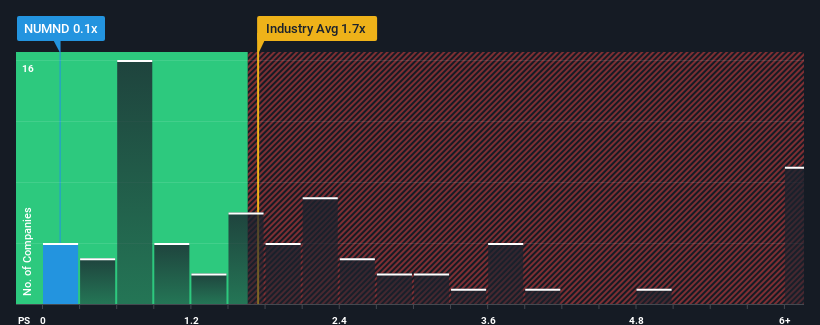

Following the heavy fall in price, it would be understandable if you think Nordic Unmanned is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Norway's Aerospace & Defense industry have P/S ratios above 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Nordic Unmanned

How Has Nordic Unmanned Performed Recently?

As an illustration, revenue has deteriorated at Nordic Unmanned over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Nordic Unmanned will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Nordic Unmanned, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Nordic Unmanned's Revenue Growth Trending?

In order to justify its P/S ratio, Nordic Unmanned would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 148% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 16%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Nordic Unmanned's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Nordic Unmanned's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nordic Unmanned revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 5 warning signs we've spotted with Nordic Unmanned.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Unmanned might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NUMND

Nordic Unmanned

Provides drones, data capture products, and flight services worldwide.

Slight and slightly overvalued.

Market Insights

Community Narratives