- Norway

- /

- Construction

- /

- OB:NORCO

Norconsult (OB:NORCO): Evaluating Valuation After Strong Q3 Revenue and Profit Growth

Reviewed by Simply Wall St

Norconsult (OB:NORCO) delivered third quarter earnings that caught the attention of many investors, with both revenue and net income seeing meaningful jumps compared to last year. The company credits this growth to increased headcount and stronger billing rates.

See our latest analysis for Norconsult.

Recent momentum in Norconsult’s share price has tapered a little after its earnings jump, with a 1-day share price return of -0.89% and a 7-day return of -5.32%. Still, the stock’s 18.75% total shareholder return over the past year shows that investors who held on through the ups and downs have been handsomely rewarded.

If Norconsult’s leap in profit has you looking for your next opportunity, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading nearly 20% below analyst price targets and strong fundamentals driving this quarter’s beat, is Norconsult offering investors a hidden value, or is the market already factoring in its future growth?

Most Popular Narrative: 13.6% Undervalued

Norconsult’s most popular narrative places its fair value noticeably above the recent close, indicating that analysts believe there is still significant upside potential. This view is built on the expectation of a continued boost from strong sector trends and effective execution.

Ongoing public infrastructure investment and modernization initiatives across the Nordic region are delivering a robust and growing order backlog (NOK 7.1 billion). This signals visibility into future revenue growth and is underpinned by long-term urban migration and infrastructure renewal trends.

Is a wave of infrastructure projects about to reshape Norconsult’s bottom line? This narrative is betting on sustained growth and improved profitability. Want to know which bold financial forecasts underpin that optimism? Unlock the numbers driving this valuation.

Result: Fair Value of $51.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growth could slow if Nordic government spending falters or if rising wage inflation puts more pressure on Norconsult’s profit margins than anticipated.

Find out about the key risks to this Norconsult narrative.

Another View: Elevated Multiples Create Caution

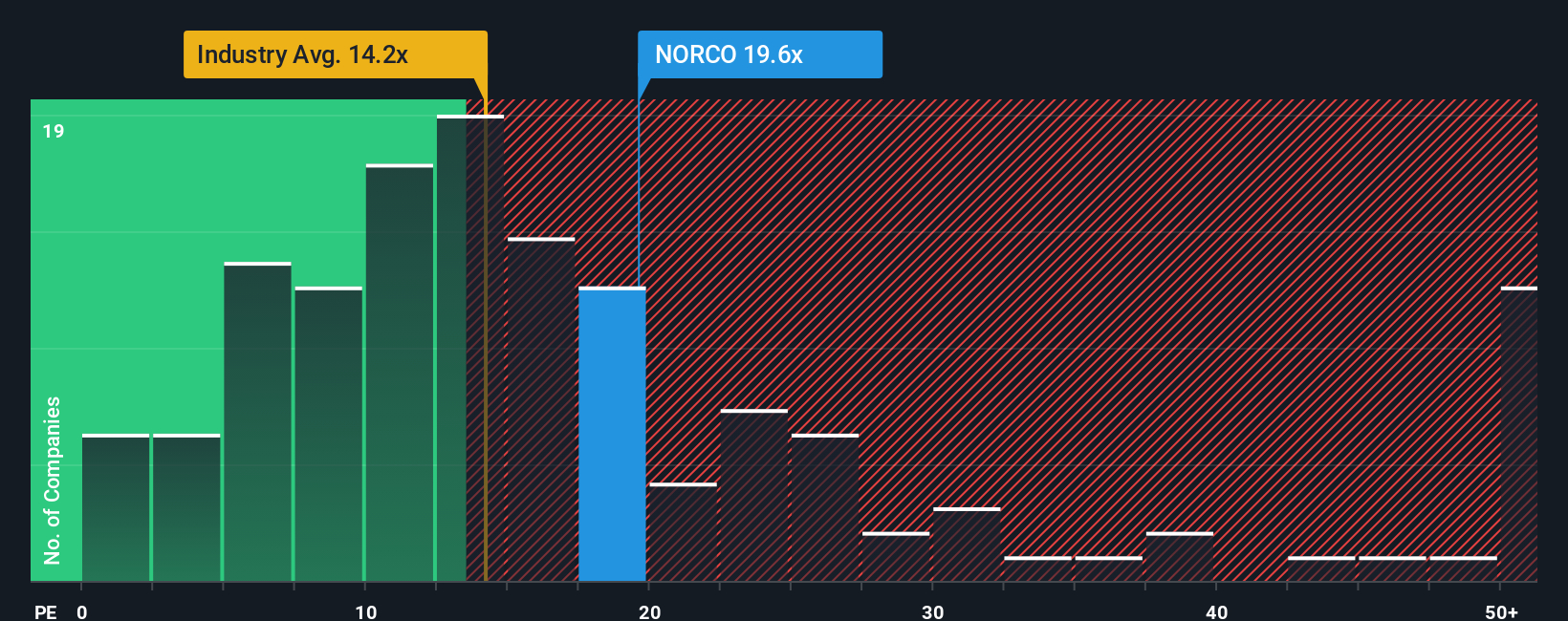

Looking at Norconsult through the lens of its price-to-earnings ratio paints a more cautious picture. The current multiple stands at 19.6x, notably higher than both the industry average of 14.3x and the peer average of 14.1x. Even compared to its fair ratio of 15.3x, the stock appears pricey, suggesting the market may be factoring in a lot of optimistic assumptions. Is Norconsult’s premium justified, or does it set the stage for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norconsult Narrative

If these perspectives do not align with your own or you want to see what the numbers really say, you can craft your own interpretation in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Norconsult.

Ready for Your Next Big Investment Idea?

Smart investors do not settle for just one opportunity. Expand your outlook and access fresh, actionable ideas with specialized stock screens only on Simply Wall St.

- Target consistent income and stability by scanning the market for companies with robust yields through these 15 dividend stocks with yields > 3%.

- Gain an edge in future tech by checking out these 27 quantum computing stocks and get in early on groundbreaking companies powering quantum innovations.

- Capitalize on mispriced assets and find bargains faster with these 876 undervalued stocks based on cash flows to spot shares trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives