- Norway

- /

- Construction

- /

- OB:NORCO

Exploring Wavestone And 2 Other Undiscovered European Gems

Reviewed by Simply Wall St

As European markets navigate a landscape marked by mixed performances among major indices and economic indicators, investors are increasingly looking toward small-cap stocks for potential opportunities. In this environment, identifying companies with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Wavestone (ENXTPA:WAVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Wavestone SA offers consulting services both in France and internationally, with a market capitalization of approximately €1.22 billion.

Operations: Wavestone generates revenue primarily from its Management Consulting and Information System Services segment, which reported €943.67 million. The company has a market capitalization of approximately €1.22 billion.

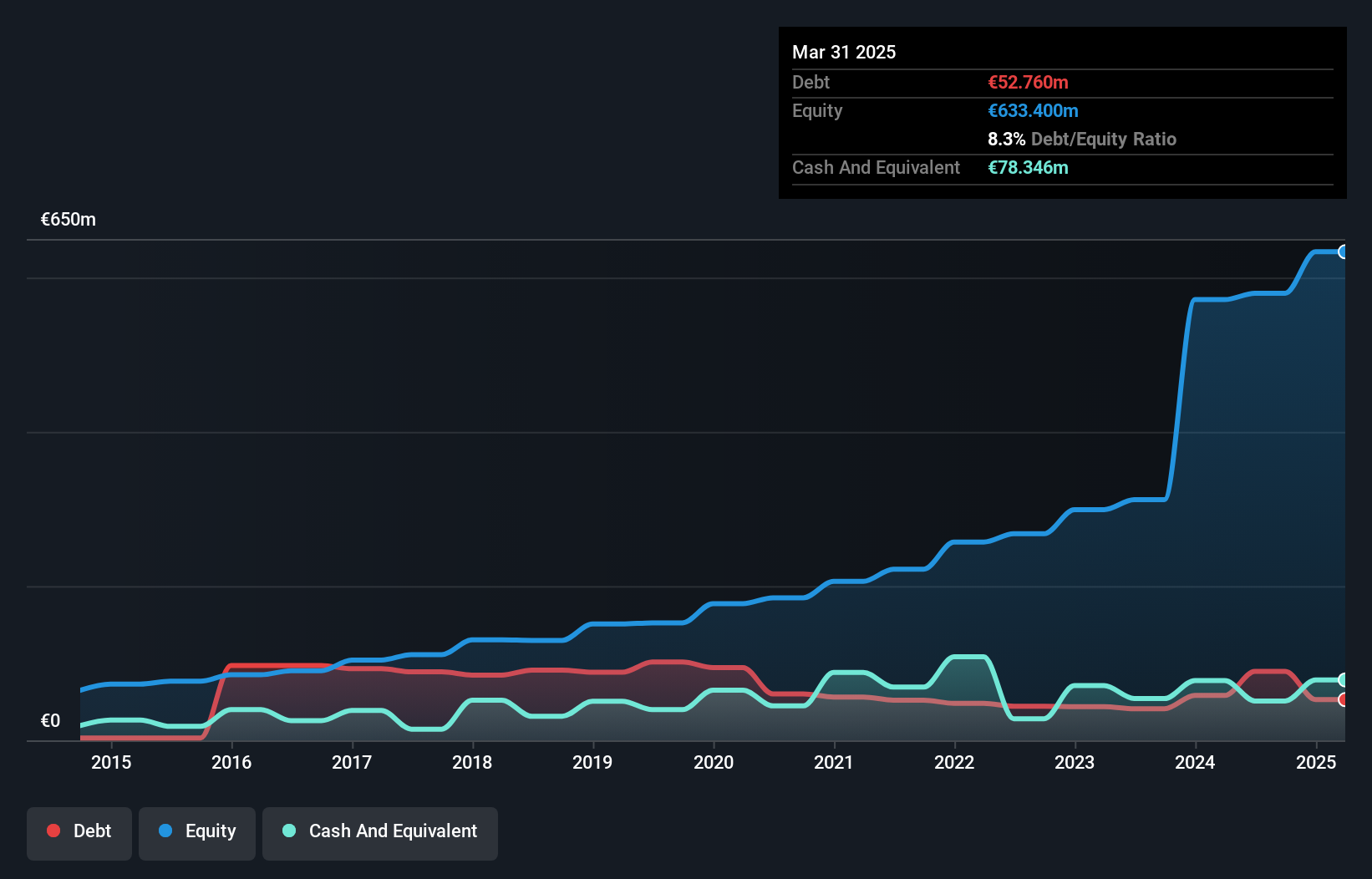

Wavestone, a nimble player in the consulting sector, has shown impressive financial resilience with its earnings growing by 29.8% over the past year, outpacing the IT industry's -1.9%. Trading at 23.1% below estimated fair value, it presents an attractive valuation for potential investors. The company's debt management is commendable; its debt-to-equity ratio has significantly decreased from 53.2% to 8.3% over five years, and interest payments are well-covered by EBIT at a multiple of 23.9 times. Despite a slight dip in recent quarterly revenue to €231.5 million from €232.4 million last year, Wavestone remains financially robust with high-quality earnings and positive free cash flow generation.

- Dive into the specifics of Wavestone here with our thorough health report.

Explore historical data to track Wavestone's performance over time in our Past section.

Atea (OB:ATEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Atea ASA is a company that offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market capitalization of approximately NOK16.37 billion.

Operations: Atea ASA generates revenue primarily from its operations in Norway (NOK9.02 billion), Sweden (NOK13.50 billion), Denmark (NOK8.48 billion), Finland (NOK3.55 billion), and the Baltics (NOK1.89 billion). Group Shared Services contribute NOK11.45 billion, while Group Costs amount to -NOK11.60 billion, impacting overall profitability.

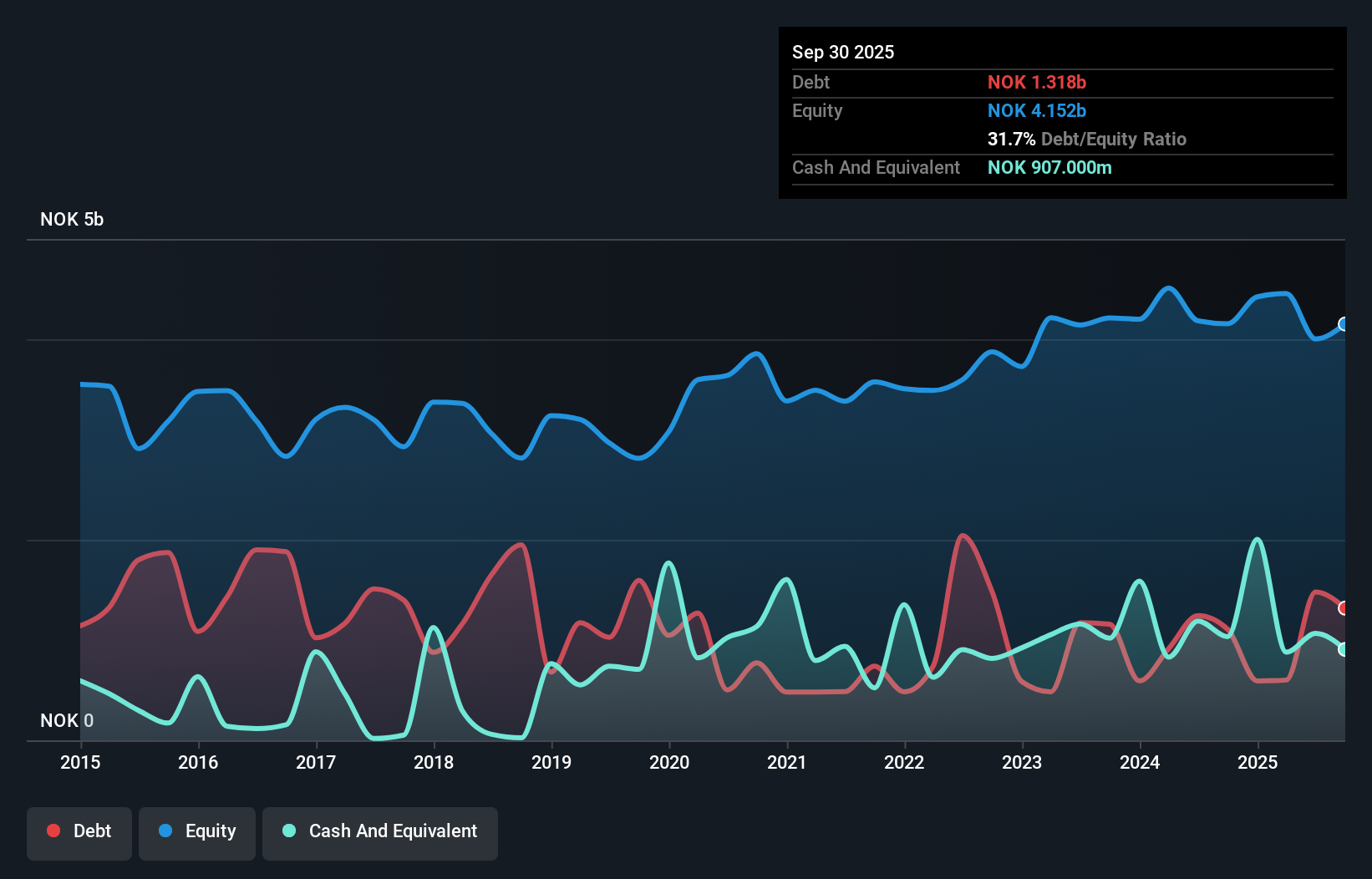

Atea, an IT infrastructure provider in the Nordic and Baltic regions, is poised for notable growth with strategic agreements in Denmark and Finland. Earnings are projected to grow 22.92% annually, outpacing the industry average. The company trades at a significant discount of 50.3% below its estimated fair value, presenting a potential opportunity for investors. Atea's debt to equity ratio has risen from 13.8% to 36.9% over five years but remains satisfactory with interest coverage of 7.4 times EBIT, indicating manageable debt levels. Recent share repurchase plans could enhance shareholder value if executed effectively within authorized limits.

Norconsult (OB:NORCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Norconsult ASA is a consultancy firm specializing in community planning, engineering design, and architecture across the Nordics and internationally, with a market capitalization of NOK14.97 billion.

Operations: Norconsult ASA generates revenue primarily from its operations in Norway, Sweden, and Denmark, with significant contributions from the Norway Head Office (NOK3.14 billion) and Norway Regions (NOK2.95 billion). The company's net profit margin trends can be insightful for understanding profitability dynamics within these segments.

Norconsult, a prominent player in the Nordic infrastructure sector, is capitalizing on robust public investment trends and energy transition efforts. With earnings growing 57.6% over the past year and trading at 47.4% below estimated fair value, it shows potential for value appreciation. The company boasts a NOK 7.1 billion order backlog, highlighting strong future revenue prospects despite regional economic risks and rising costs due to wage inflation. Recent acquisitions like Aas-Jakobsen enhance its market position but may present integration challenges affecting short-term earnings stability. As analysts project profit margins rising from 5.8% to 8.5%, Norconsult's growth outlook remains promising amidst industry dynamics.

Make It Happen

- Dive into all 328 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives