- Sweden

- /

- Capital Markets

- /

- OM:RATO B

Exploring Undiscovered European Gems In November 2025

Reviewed by Simply Wall St

As European markets grapple with concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, the pan-European STOXX Europe 600 Index has seen a decline of 2.21%. Despite these challenges, early readings indicate steady expansion in eurozone business activity, suggesting potential opportunities within the region's small-cap landscape. Identifying promising stocks in such an environment often involves looking for companies that demonstrate resilience and adaptability amidst shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Grupo Empresarial San José (BME:GSJ)

Simply Wall St Value Rating: ★★★★★★

Overview: Grupo Empresarial San José, S.A. operates in the construction industry both in Spain and internationally, with a market capitalization of €480.54 million.

Operations: San José generates revenue primarily from its construction activities, operating both domestically and internationally. The company's cost structure is heavily influenced by project-specific expenses, which can impact profitability. Net profit margin trends provide insights into the efficiency of cost management relative to revenue generation.

San José, a construction player in Europe, showcases a promising profile with its debt to equity ratio dropping from 100% to 46.6% over five years and earnings growth of 19.6%, outpacing the industry average of 7%. The company is financially robust, having more cash than total debt and enjoys high-quality earnings. Its price-to-earnings ratio at 12.8x remains attractive compared to the Spanish market's average of 17x. Recently added to the S&P Global BMI Index, San José reported net income for nine months ending September at €27.59 million, up from €23.17 million last year, although future earnings are expected to decline by an average of 7.9% annually over three years.

Norconsult (OB:NORCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Norconsult ASA is a consultancy firm specializing in community planning, engineering design, and architecture across the Nordics and internationally, with a market capitalization of NOK14.06 billion.

Operations: Norconsult ASA generates revenue primarily from its operations in Norway, Sweden, and Denmark, with significant contributions from the Renewable Energy and Digital and Techno-Garden segments. The Norway Head Office is the largest revenue contributor at NOK3.33 billion, followed by the Norway Regions segment at NOK2.99 billion.

Norconsult, a promising player in the European engineering consultancy market, is making strides with its focus on renewable energy and climate-resilient infrastructure. The company reported a robust order backlog of NOK 7.1 billion, reflecting strong future revenue potential. Recent earnings showcased significant growth, with Q3 sales reaching NOK 2.47 billion from NOK 2.20 billion last year and net income jumping to NOK 132 million from NOK 51 million. Despite challenges like wage inflation and integration hurdles from acquisitions such as Aas-Jakobsen, Norconsult's strategic positioning in high-margin sectors supports its projected profit margin increase to 8.5% by September 2028.

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★★☆

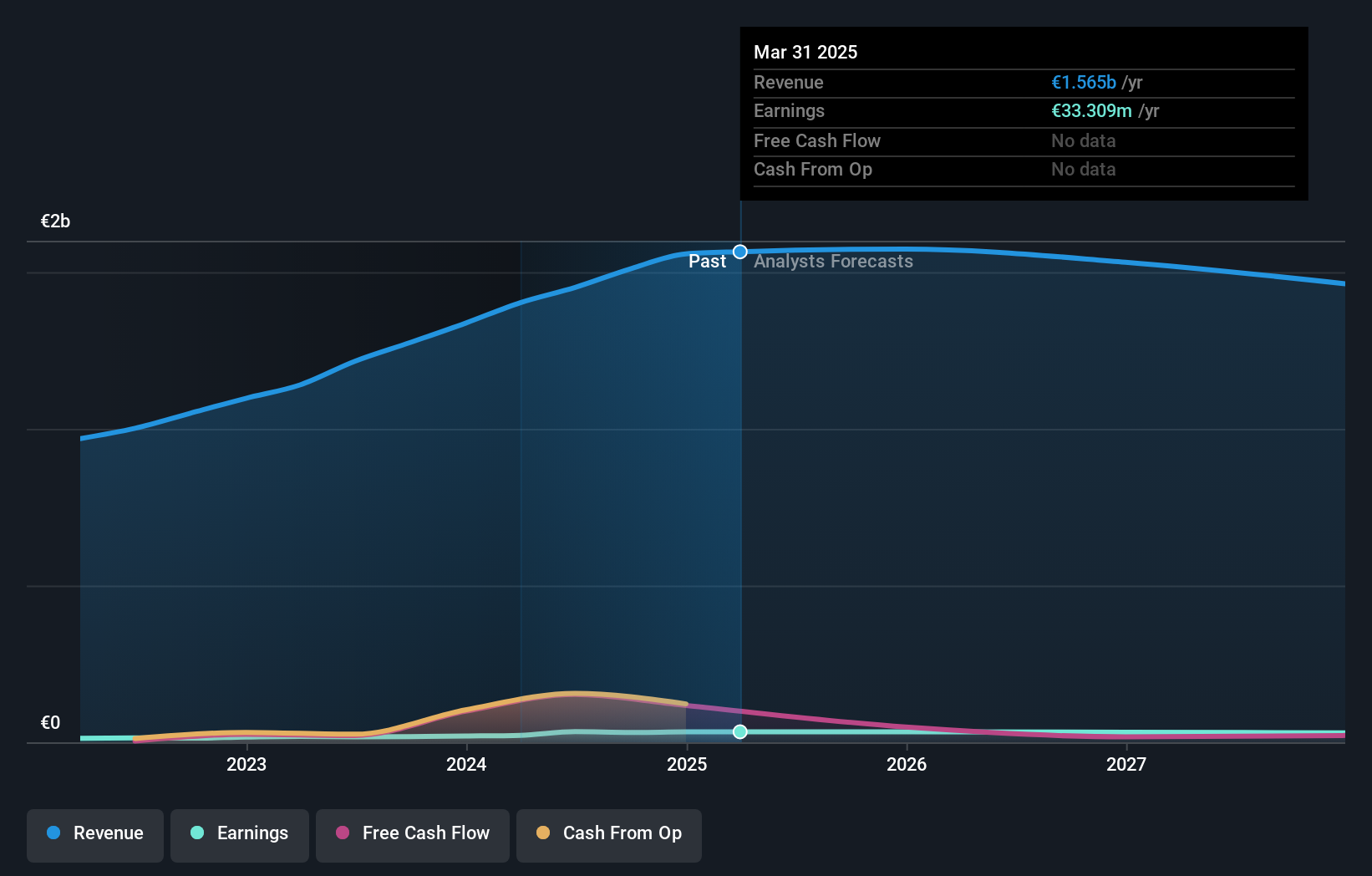

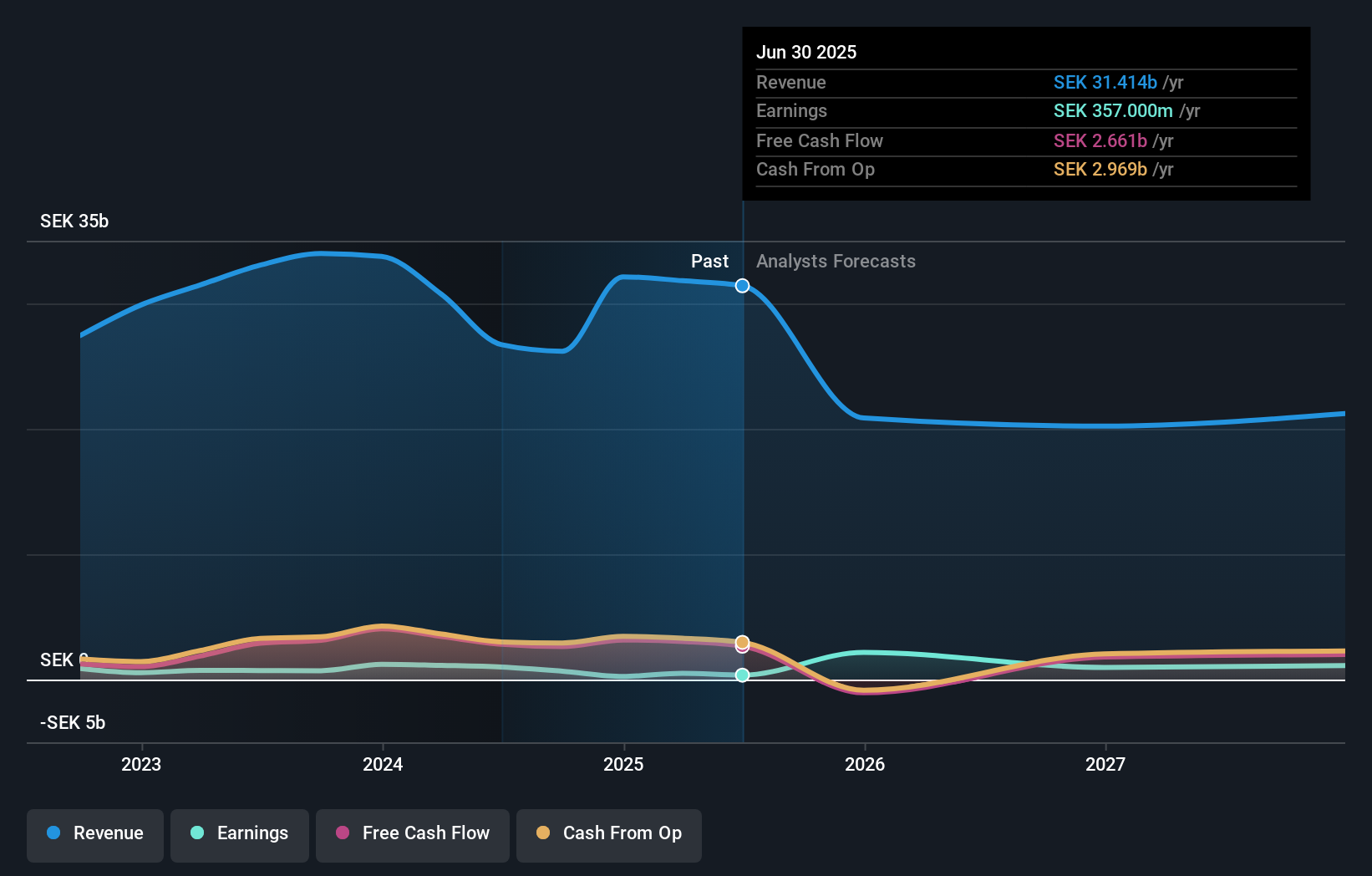

Overview: Ratos AB (publ) is a private equity firm that focuses on buyouts, turnarounds, add-on acquisitions, and middle market transactions with a market cap of approximately SEK12.04 billion.

Operations: Ratos generates revenue primarily from its Consumer segment, contributing SEK4.65 billion. The company experiences a segment adjustment of SEK26.33 billion, impacting overall financial performance.

Ratos, a dynamic player in the private equity space, is making strategic moves into sustainable infrastructure and high-growth sectors. This shift is likely to drive profitability and margin expansion. Recent earnings show a remarkable turnaround with net income at SEK 395 million for Q3 2025, compared to a net loss of SEK 146 million last year. The company's debt management appears sound with the debt-to-equity ratio decreasing from 39.1% to 25.8% over five years, while its EBIT covers interest payments by 5.7 times. Despite anticipated revenue declines of about 17% annually over three years, profit margins are expected to improve significantly under new CEO Gustaf Salford's leadership starting December.

Turning Ideas Into Actions

- Discover the full array of 314 European Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RATO B

Ratos

A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success