- Norway

- /

- Construction

- /

- OB:NORCO

Exploring Three Undiscovered Gems in Europe's Stock Market

Reviewed by Simply Wall St

Amidst a backdrop of modest growth in the eurozone and rising optimism from economic stimulus measures, European markets have shown resilience, with the STOXX Europe 600 Index climbing 1.32% recently. As investors navigate these dynamic conditions, identifying promising opportunities involves looking for stocks that demonstrate strong fundamentals and potential for growth within this evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 7.49% | 44.78% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Norconsult (OB:NORCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Norconsult ASA is a consultancy firm specializing in community planning, engineering design, and architecture across the Nordics and internationally, with a market capitalization of NOK13.68 billion.

Operations: Revenue primarily comes from Norway Head Office at NOK3.14 billion and Norway Regions at NOK2.93 billion, with significant contributions from Sweden and Digital and Techno-Garden segments. The Renewable Energy segment adds NOK947 million, while Denmark contributes NOK891 million to the total revenue.

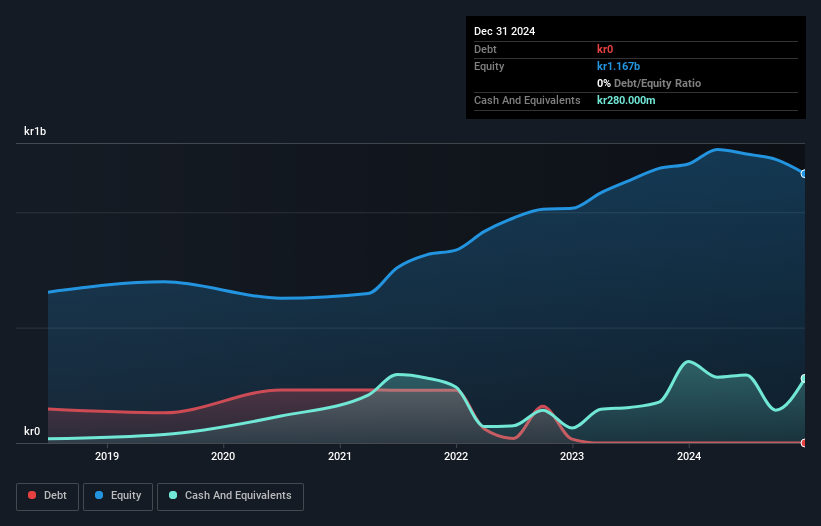

Norconsult, a nimble player in the European market, has shown remarkable financial performance with earnings surging 93.5% over the past year, outpacing industry growth of 5.4%. Trading at 26.7% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. The company is debt-free and boasts high-quality earnings, reflecting sound financial health. Recent strategic moves include securing a NOK 60 million contract for Bergen's Light Rail project and announcing an acquisition agreement with Aas-Jakobsen Group. These developments align with Norconsult's robust growth trajectory and commitment to expanding its engineering consultancy footprint in Europe.

RVRC Holding (OM:RVRC)

Simply Wall St Value Rating: ★★★★★★

Overview: RVRC Holding AB (publ) operates in the e-commerce outdoor clothing sector across Germany, Sweden, Finland, and other international markets with a market capitalization of approximately SEK4.78 billion.

Operations: RVRC generates revenue primarily from its retail apparel segment, amounting to SEK1.93 billion. The company's net profit margin reflects its profitability in the e-commerce outdoor clothing sector.

RVRC Holding, a small cap in the specialty retail sector, offers an intriguing mix of financial stability and growth potential. Despite recent negative earnings growth of 3%, the company stands out with its debt-free status, having eliminated a 31.8% debt-to-equity ratio over five years. Its levered free cash flow reached SEK 339 million as of June 2024, signaling strong operational efficiency. Recent expansions include a new store in Stockholm and enhanced logistics partnerships to bolster delivery capabilities across Nordic regions. However, challenges like reliance on Asian production could impact supply chains amidst rising costs and market exposure risks in Germany.

Newag (WSE:NWG)

Simply Wall St Value Rating: ★★★★★★

Overview: Newag S.A. is a Polish company specializing in the production and sale of railway locomotives and rolling stock, with a market capitalization of PLN 3.33 billion.

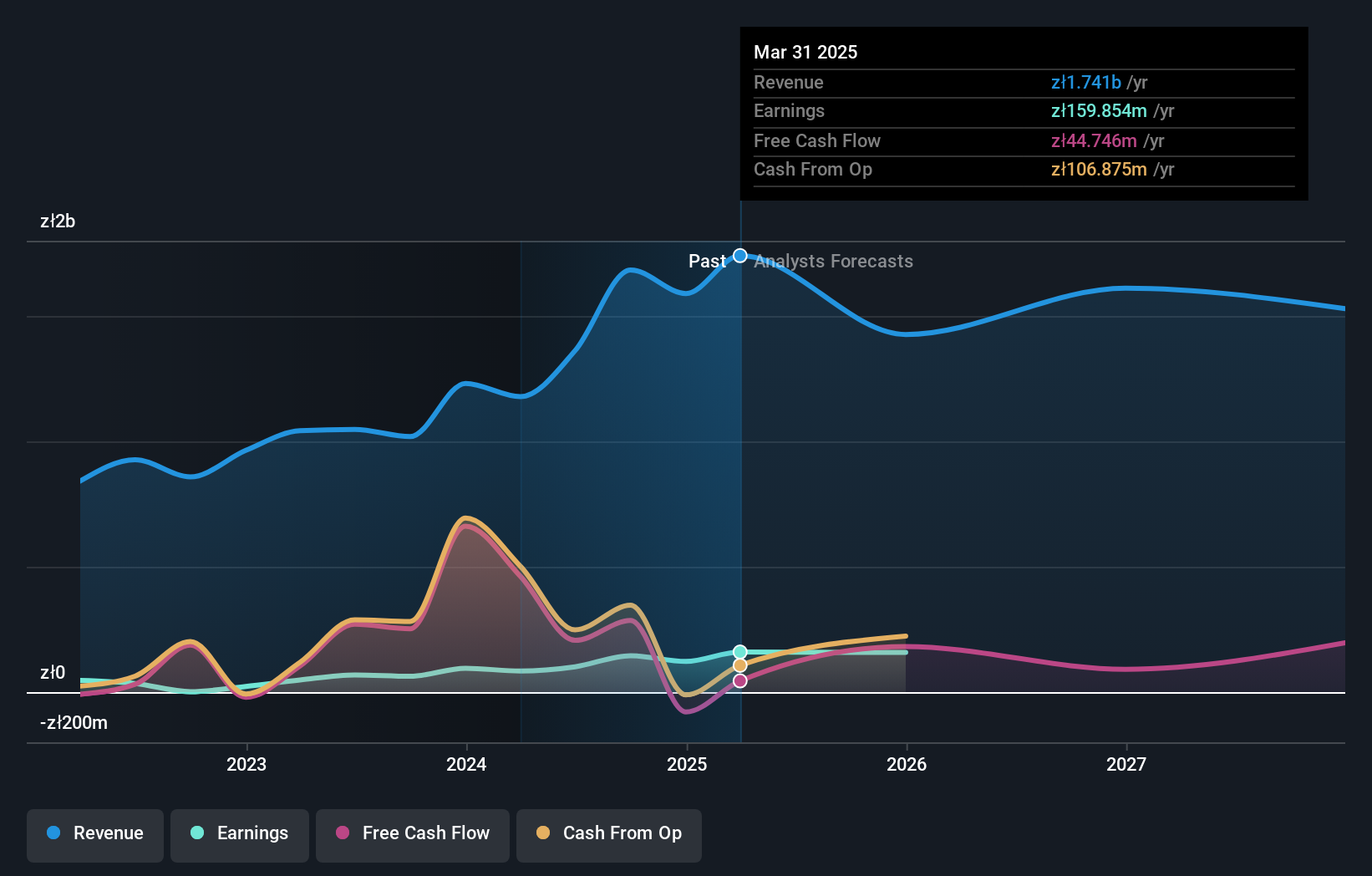

Operations: Newag S.A. generates revenue primarily from repair services, modernization of rolling stock, and production of rolling stock and control systems, amounting to PLN 1.85 billion. The company also earns PLN 85.80 million from activities related to financial holdings.

Newag, a notable player in the European market, has shown impressive financial strides recently. Their debt to equity ratio improved significantly from 56.8% to 11.1% over five years, indicating prudent financial management. In the past year, earnings surged by 90.4%, outpacing the broader Machinery industry which saw a -13.7%. Their Q1 2025 sales reached PLN 374.6 million compared to PLN 223.37 million last year, while net income rose to PLN 52.3 million from PLN 14.67 million previously reported for the same period last year; basic earnings per share increased from PLN 0.33 to PLN 1.17 during this time frame as well.

- Click to explore a detailed breakdown of our findings in Newag's health report.

Review our historical performance report to gain insights into Newag's's past performance.

Next Steps

- Gain an insight into the universe of 335 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives