- Norway

- /

- Aerospace & Defense

- /

- OB:KOG

Kongsberg Gruppen (OB:KOG) Margin Expansion to 12.6% Reinforces Bullish Profitability Narratives

Reviewed by Simply Wall St

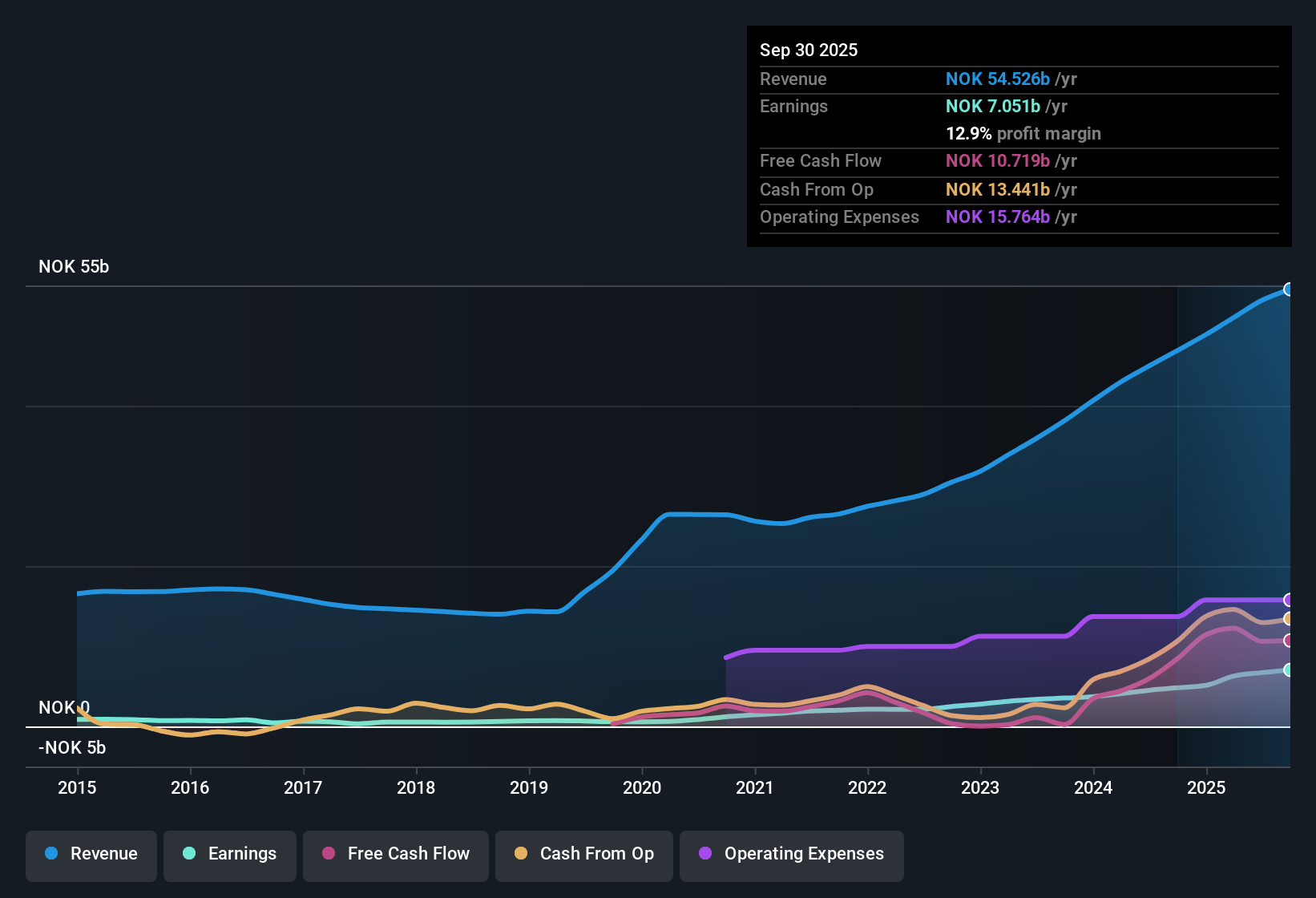

Kongsberg Gruppen (OB:KOG) delivered a net profit margin of 12.6%, an improvement from last year’s 10%, while earnings grew a robust 48.9% in the most recent year and have compounded at 31.6% annually over the past five years. Revenue is forecast to rise by 11.7% per year, significantly faster than the broader Norwegian market’s 2.3%, and earnings are expected to increase by 9.85% per year. With both profit margins and earnings quality described as high, investors have additional reason to interpret the latest results positively.

See our full analysis for Kongsberg Gruppen.Now, let’s see how these latest figures measure up against the prevailing market narratives. Some expectations may get confirmed, while others could be upended.

See what the community is saying about Kongsberg Gruppen

Margins Expected to Tighten After Big Gains

- Analysts forecast that profit margins, after reaching 12.6% this year, will narrow to 10.9% in three years. This signals that recent margin expansion may slow.

- Analysts' consensus view points out that while geopolitical tensions and heightened defense spending are fueling revenue resilience and a strong backlog, management remains cautious about whether these peak margins are sustainable.

- Consensus narrative notes that large-scale order wins and advanced solutions could maintain high revenue. However, it also warns that project mix and regulatory scrutiny may limit further margin upside.

- Analysts also highlight potential budget shifts toward sustainability, which could restrict future defense orders and compress margins.

- For a deeper dive into the full outlook and where analysts agree or disagree, check the Consensus Narrative for Kongsberg Gruppen: 📊 Read the full Kongsberg Gruppen Consensus Narrative.

Revenue Growth Seen Outpacing Market Average

- Kongsberg Gruppen’s revenue is projected to rise by 11.7% annually, considerably faster than the broader Norwegian market’s 2.3% growth expectation.

- Analysts' consensus view flags that investors may be overvaluing the company’s ability to sustain this accelerated pace. Geopolitical-driven demand and large backlogs provide visibility, but there is notable uncertainty around future order flows.

- Consensus narrative points to market optimism that may be underweighting execution risks, such as longer lead times, fleet upgrades, and uneven newbuild activity. All of these factors could introduce volatility in revenue realization.

- Bears highlight that expectations may not fully consider the possibility that recent elevated order intake and backlogs could represent a near-term peak rather than a steady baseline.

Trading Below Fair Value and Peer Averages

- Kongsberg Gruppen’s price-to-earnings ratio matches the industry average but is below the peer group average. The current share price of 259.05 is also below its DCF fair value of 291.02.

- Analysts' consensus view argues that this valuation gap supports a positive outlook. However, investors should sense-check whether robust earnings and revenue forecasts are realistic given execution and regulatory risks.

- Consensus narrative indicates that backing the analyst target price of 301.43 requires believing in continued revenue and earnings growth, while also accepting a narrowing profit margin and sustained geopolitical tailwinds.

- What stands out is the degree of analyst disagreement: price targets range from as low as 250.00 to as high as 420.00. This underscores differing views on long-term fundamentals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kongsberg Gruppen on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the results that others might overlook? Shape your own interpretation and add your narrative in just a few minutes. Do it your way

A great starting point for your Kongsberg Gruppen research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Kongsberg Gruppen faces uncertainty around sustaining its elevated growth and profit margins, with analysts divided on whether recent results represent a near-term peak.

If reliable growth and steadier earnings are essential for your strategy, use our stable growth stocks screener (2103 results) to find companies delivering consistent performance through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KOG

Kongsberg Gruppen

Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives