- Norway

- /

- Industrials

- /

- OB:BONHR

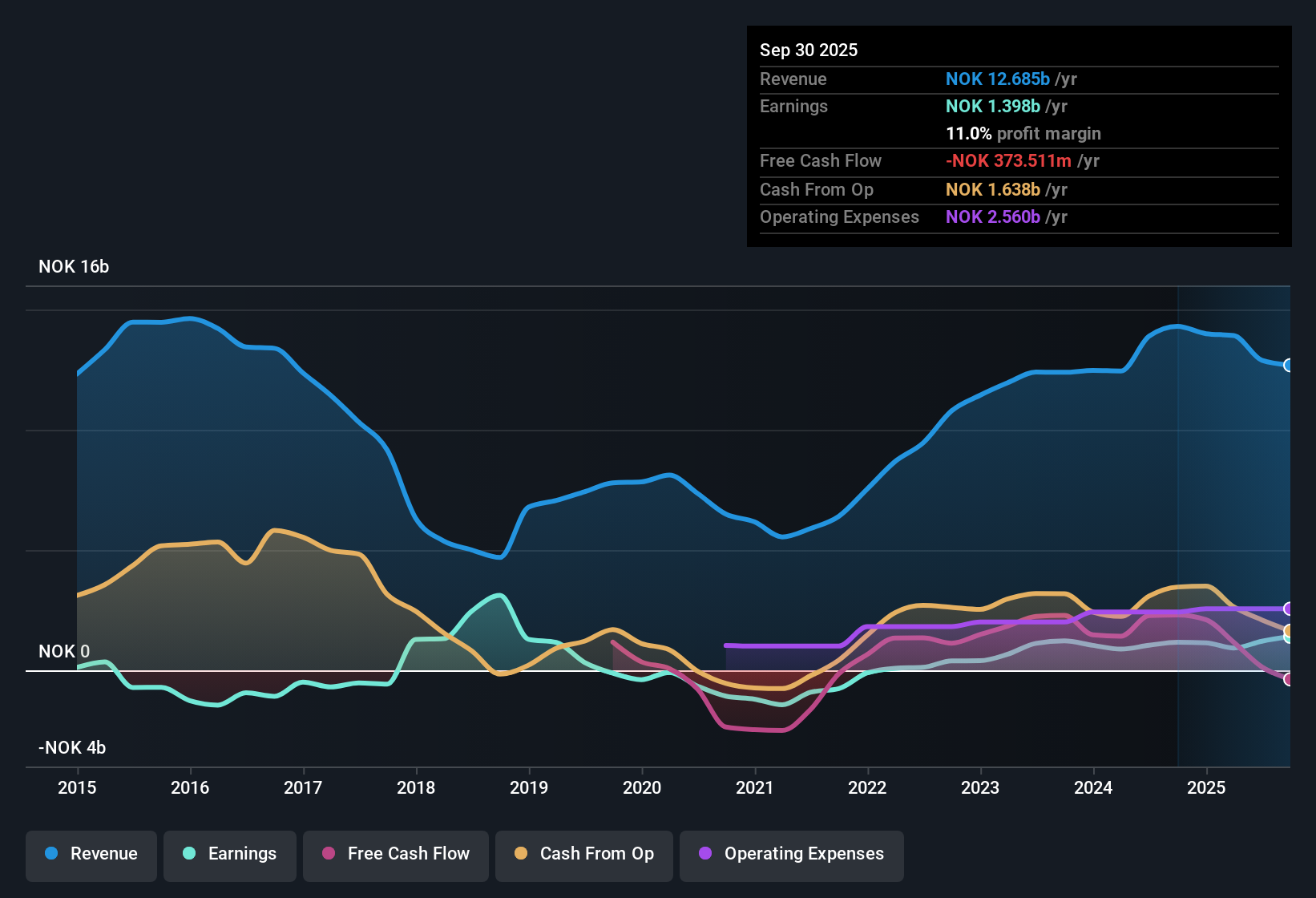

Bonheur (OB:BONHR) Profit Margin Rises but Guidance for Revenue and Earnings Decline Reinforces Cautious Outlook

Reviewed by Simply Wall St

Bonheur (OB:BONHR) reported a net profit margin of 9.4% in its most recent period, up from 7.5% last year. This signals higher profitability. EPS has continued its upward trajectory over the past five years, growing by an impressive 67.1% annually. However, last year’s earnings growth moderated to 16.3%. Despite shares trading at NOK224.5 and attractive valuation multiples, expectations for the next three years are tempered by forecast declines in both revenue (down 0.09% annually) and EPS (down 15.9% per year). This presents investors with a nuanced set of risks and rewards.

See our full analysis for Bonheur.The next section dives deeper, comparing these headline results with the narratives and consensus views held across the market to reveal where the numbers back up the story and where surprises emerge.

See what the community is saying about Bonheur

Wind Service Expansion Faces Headwinds

- Revenue from Bonheur's Wind Service segment is projected to contract by 0.6% annually over the next three years, even though analysts see strong order intake and limited vessel supply supporting future growth.

- Analysts' consensus view expects that, while new wind farm investments like Windy Standard III and Crystal Rig IV are seen as catalysts for revenue and earnings, operational downtime and energy price drops may offset these gains.

- Operational challenges, such as technical downtime on Brave Tern and Bold Tern, create friction in the growth narrative.

- Analysts note Bonheur’s strategic capital allocation aims to minimize risk, but external pressures from supply chain delays and regulatory hurdles remain material obstacles.

- To see whether the earnings trends are strengthening or stalling the market's view, read the full consensus narrative for Bonheur. 📊 Read the full Bonheur Consensus Narrative.

Margins Projected to Narrow Despite Recent Gains

- Profit margins, which currently stand at 9.4%, are expected by analysts to shrink to 7.6% over the next three years, reflecting both sector pressure and asset utilization risks.

- According to the consensus narrative, rising operational downtime and weaker energy markets are putting downward pressure on profitability, challenging bullish hopes for margin resilience.

- Recent technical failures at projects like Mid Hill and Crystal Rig I, as well as supply chain delays, are specifically highlighted by analysts as key headwinds to sustaining profit margins.

- Slower energy prices, especially in Sweden, directly squeeze EBITDA and threaten the expected margin trajectory.

Discount Valuation Keeps Stock in the Spotlight

- Bonheur trades at a Price-To-Earnings ratio of 7.9x, which is well below the European Industrials average of 22.5x and the peer average of 30.4x. However, its share price of NOK224.5 still sits over 47% above the DCF fair value of NOK151.82.

- The consensus narrative highlights that, despite analyst price targets that are just modestly higher (NOK250), the market is assigning Bonheur a discount relative to peers, even though revenue and earnings are projected to decline.

- To match analysts' consensus, Bonheur would need to command a 14.1x PE by 2028, up from now, despite earnings-per-share dropping to NOK25.99 from higher recent levels.

- This creates a tension; Bonheur appears cheap by traditional multiples, but the fair value gap and negative growth forecasts suggest investor skepticism runs deeper than headline ratios reveal.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bonheur on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story behind Bonheur's numbers deserves a new perspective? Share your own take and shape the narrative in just a few minutes: Do it your way.

A great starting point for your Bonheur research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Bonheur’s profit margins are expected to shrink, and both revenue and earnings are forecast to decline. This creates concern over long-term growth prospects.

If steady progress is your priority, use our stable growth stocks screener (2099 results) to target companies with more consistent results and reliable expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonheur might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BONHR

Bonheur

Engages in the renewable energy, wind service, and cruise businesses in the United Kingdom, Norway, Europe, Asia, the Americas, Africa, and Internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives