As global markets continue to navigate the complexities of rising inflation and shifting economic policies, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing their value counterparts. Despite small-cap stocks lagging behind larger indices like the S&P 500, there remains a wealth of opportunity in identifying lesser-known companies that possess strong fundamentals and potential for growth. In this article, we explore three such undiscovered gems on None Exchange as of February 2025, highlighting key attributes that make them stand out amidst current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

AF Gruppen (OB:AFG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AF Gruppen ASA is a Norwegian and Swedish contracting and industrial company offering services in civil engineering, environmental solutions, construction, property development, energy, and offshore sectors with a market capitalization of NOK18.39 billion.

Operations: AF Gruppen generates revenue through its diverse service offerings in civil engineering, environmental solutions, construction, property development, energy, and offshore sectors across Norway and Sweden. The company's net profit margin has shown fluctuations over recent periods.

AF Gruppen, a notable player in the construction industry, has shown impressive earnings growth of 76.1% over the past year, outpacing the sector's 11.2%. The company boasts a favorable price-to-earnings ratio of 26x compared to the industry's average of 36.2x, suggesting it might be undervalued. With interest payments well-covered by EBIT at a ratio of 16.2x and cash exceeding total debt levels, AF Gruppen demonstrates financial robustness. Recent announcements include a proposed dividend increase to NOK 5 per share and promising contract wins such as building apartments in Solna valued at SEK 211 million and rehabilitating Oslo office spaces for NOK 360 million.

- Unlock comprehensive insights into our analysis of AF Gruppen stock in this health report.

Understand AF Gruppen's track record by examining our Past report.

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic Region, Europe, North America, Asia, and internationally with a market cap of approximately SEK11.93 billion.

Operations: Beijer Alma generates revenue primarily from its Lesjöfors segment, contributing SEK 4.90 billion, and its Beijer Tech segment, which adds SEK 2.31 billion.

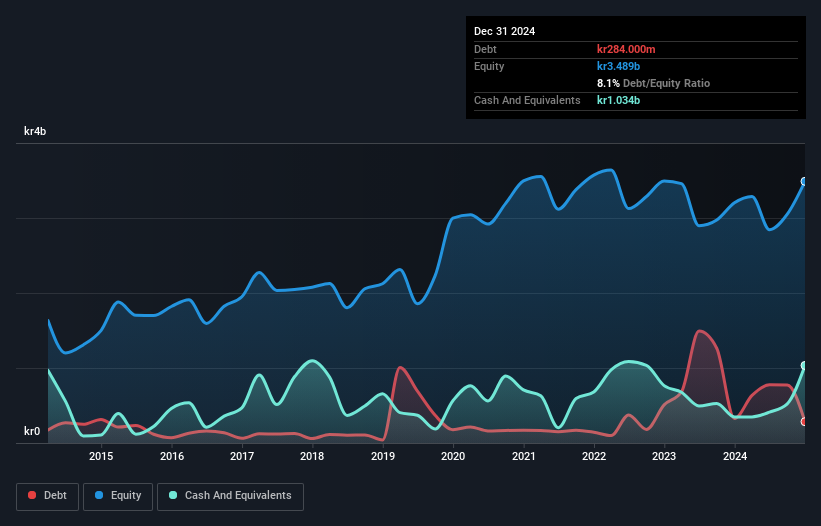

Beijer Alma, a notable player in the machinery sector, has shown impressive earnings growth of 37.6% over the past year, outpacing its industry peers. Despite a high net debt to equity ratio of 50.6%, interest payments are well-covered with EBIT at 4.7 times coverage. The company recently reported annual sales of SEK 7.20 billion and net income of SEK 714 million for 2024, reflecting solid financial performance despite large one-off gains impacting results by SEK168 million. With shares trading at an estimated 32% below fair value and free cash flow positive, Beijer Alma presents potential opportunities amidst leadership transitions as they seek a new CEO and President by April 2025.

PLAIDInc (TSE:4165)

Simply Wall St Value Rating: ★★★★★☆

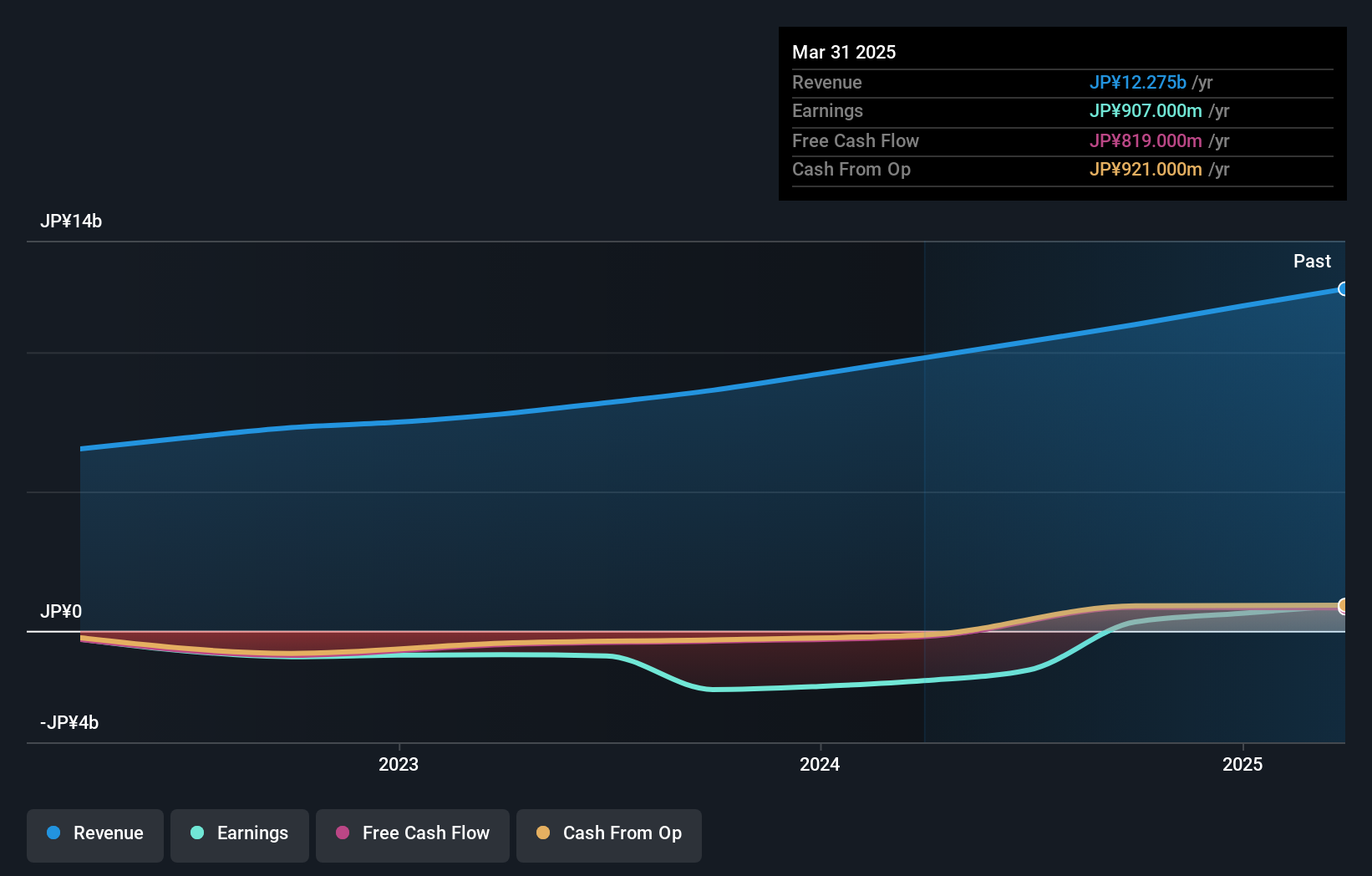

Overview: PLAID Inc. is a Japanese company that develops and operates KARTE, a customer experience SaaS platform, with a market cap of ¥45.01 billion.

Operations: PLAID Inc. generates revenue primarily through its SaaS and advertising businesses, amounting to ¥669.60 million. The company's financial performance is influenced by the cost structures associated with these segments, impacting its overall profitability.

PLAID Inc. has emerged as a notable player, recently achieving profitability which sets it apart in the software industry. Despite its volatile share price over the last three months, this company boasts high-quality earnings and trades at an attractive P/E ratio of 0.1x, significantly below Japan's market average of 13.3x. The firm's debt management is commendable, with a reduction in its debt-to-equity ratio from 46.9% to 31.9% over five years and sufficient EBIT coverage for interest payments at 300x. However, future earnings are anticipated to decline by an average of 119% annually over the next three years, suggesting potential challenges ahead despite current strengths.

- Click here to discover the nuances of PLAIDInc with our detailed analytical health report.

Gain insights into PLAIDInc's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4711 more companies for you to explore.Click here to unveil our expertly curated list of 4714 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4165

PLAIDInc

Develops and operates KARTE, a customer experience SaaS platform in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives