Sparebanken Norge (OB:SBNOR): Assessing Valuation Following Profit Growth and Euronext 150 Index Inclusion

Reviewed by Simply Wall St

Sparebanken Norge (OB:SBNOR) reported higher net income for both the third quarter and the year-to-date period, emphasizing year-over-year profitability gains. Its recent addition to the Euronext 150 Index may further boost market attention.

See our latest analysis for Sparebanken Norge.

Steady earnings growth and Sparebanken Norge's recent addition to the Euronext 150 Index have helped keep momentum strong. The share price is up 21.8% year-to-date and has delivered an impressive 35.3% total shareholder return over the last twelve months, reflecting growing investor confidence in its long-term prospects.

If you're watching financial names gain recognition, it’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

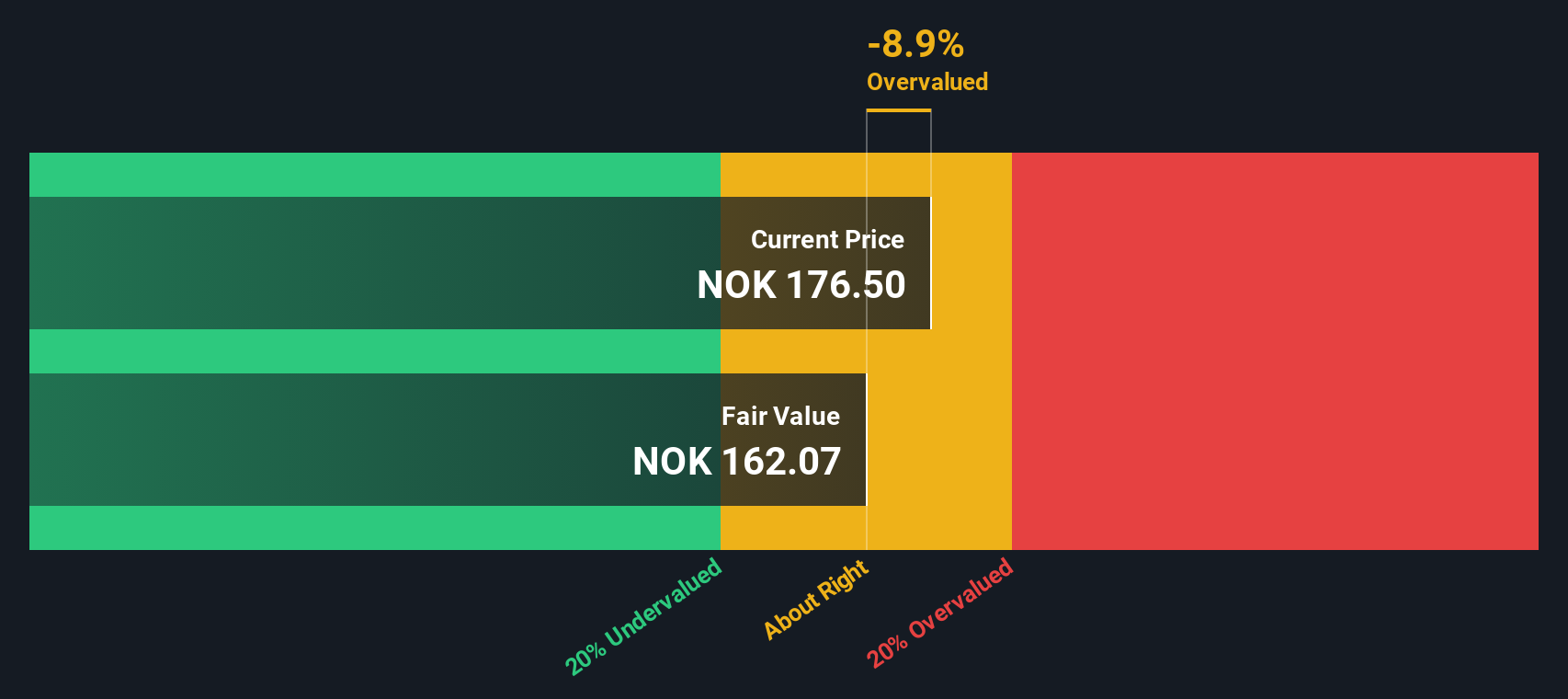

But with the share price surging and strong earnings driving optimism, the key question now is whether Sparebanken Norge remains undervalued or if the current market enthusiasm already reflects its future growth potential.

Price-to-Earnings of 3.8x: Is it justified?

With a price-to-earnings ratio of just 3.8x, Sparebanken Norge looks attractively valued compared to both industry peers and historical averages. The last close price stands at NOK172.46, which is well below both the bank sector average and the estimated fair P/E ratio.

The price-to-earnings ratio measures how much investors are willing to pay today for a company's earnings. It is a widely used metric for banks because it directly ties share price to profitability, highlighting market sentiment about future growth and risk.

At 3.8x, the current multiple is a substantial discount compared to the Norwegian banks industry average of 10.2x and the peer average of 10.3x. The estimated fair price-to-earnings ratio is even higher at 11.2x. This pricing gap indicates the market may be undervaluing Sparebanken Norge’s strong profit growth and solid fundamentals, which could provide opportunity for share price appreciation if the market reassesses the stock.

Explore the SWS fair ratio for Sparebanken Norge

Result: Price-to-Earnings of 3.8x (UNDERVALUED)

However, slower revenue growth or unexpected market volatility could challenge the current upbeat outlook and may impact investor sentiment in the months ahead.

Find out about the key risks to this Sparebanken Norge narrative.

Another View: Discounted Cash Flow Perspective

Taking a different angle, our SWS DCF model estimates Sparebanken Norge’s fair value at NOK301.67, significantly higher than its current price of NOK172.46. This model suggests the shares are trading well below their underlying worth, indicating notable upside potential. However, how much should investors rely on these longer-term forecasts versus market sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sparebanken Norge for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sparebanken Norge Narrative

If you’d rather draw your own conclusions or want to see what the numbers reveal firsthand, you can easily craft your personal take on Sparebanken Norge in just a few minutes. Do it your way

A great starting point for your Sparebanken Norge research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to spot the next big winner. The market is full of untapped opportunities waiting for investors who look beyond the obvious.

- Uncover steady income streams and lock in strong yields by checking out these 16 dividend stocks with yields > 3% with payouts above 3%.

- Tap into rising healthcare innovations by reviewing these 31 healthcare AI stocks positioned at the forefront of AI-driven medical technology.

- Stay ahead as finance reshapes with these 82 cryptocurrency and blockchain stocks driving growth in the new world of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SBNOR

Sparebanken Norge

Sparebanken Vest, a financial services company, provides banking and financing services in the counties of Vestland and Rogaland, Norway.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives