Exploring 3 Undervalued European Small Caps With Insider Activity

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.68%, supported by strong business activity and consumer confidence in the eurozone. Amid this positive backdrop, small-cap stocks in Europe are attracting attention due to their potential for growth and insider activity, which can be indicative of confidence from those closest to the companies.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 30.48% | ★★★★★★ |

| Bytes Technology Group | 16.3x | 4.0x | 21.90% | ★★★★★☆ |

| Boozt | 18.0x | 0.8x | 48.66% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 30.31% | ★★★★★☆ |

| BEWI | NA | 0.5x | 39.92% | ★★★★★☆ |

| Eastnine | 12.4x | 7.8x | 48.37% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.93% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 35.82% | ★★★★☆☆ |

| Nyab | 21.8x | 1.0x | 35.71% | ★★★☆☆☆ |

| Pexip Holding | 36.7x | 5.4x | 39.79% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

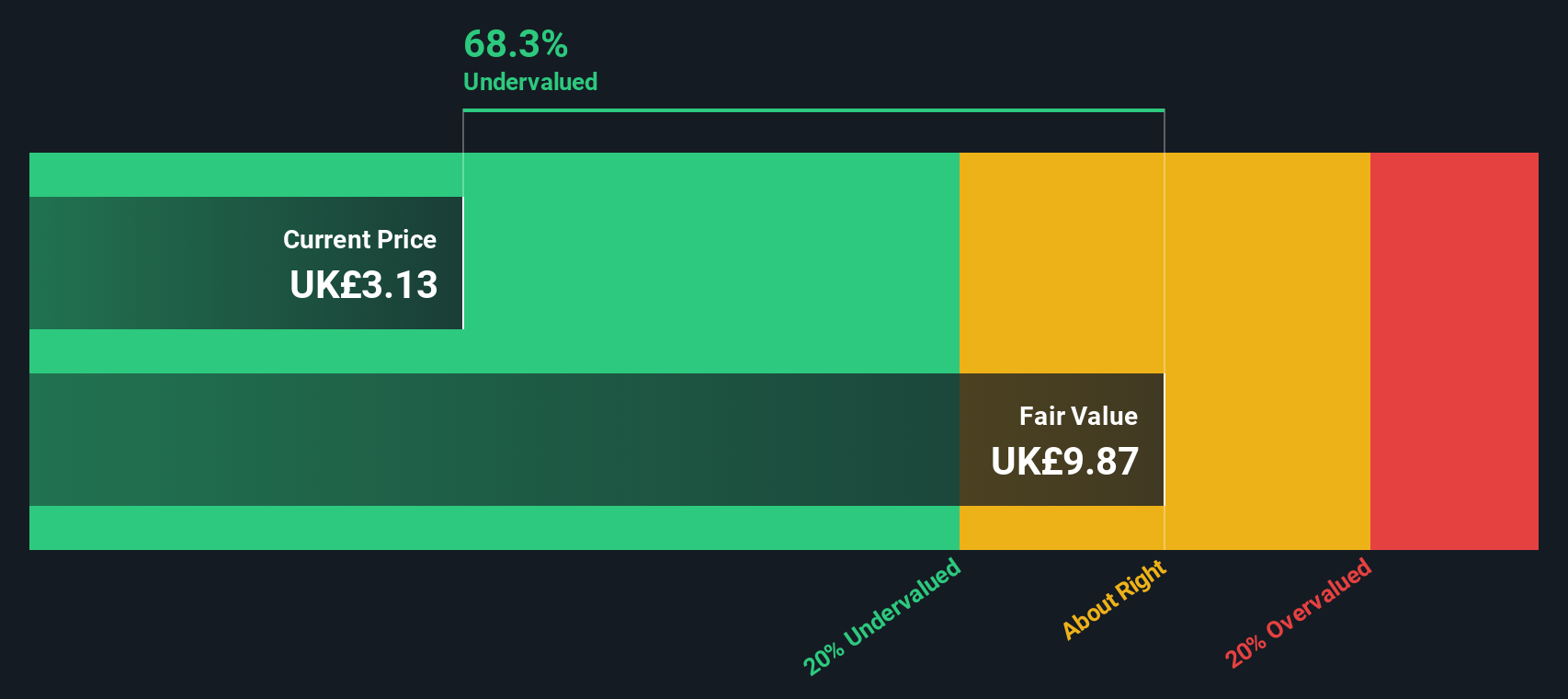

Capita (LSE:CPI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Capita is a business process outsourcing and professional services company, providing a range of services including public service management, contact center solutions, pension administration, and regulated services.

Operations: Capita generates revenue primarily from its Public Service and Experience segments, with notable contributions from Contact Centre, Pension Solutions, and Regulated Services. The company's gross profit margin has shown fluctuations over time, reaching 20.97% in the most recent period. Operating expenses have been a significant component of costs, influencing overall profitability trends.

PE: 22.7x

Capita, a smaller European player, is gaining attention with its AI Catalyst Stack launch, aiming to transform BPO through AI integration. This innovation promises faster service delivery and enhanced customer satisfaction. Despite this progress, Capita reported a net loss of £7.5 million for the first half of 2025 against last year's profit of £53 million. Insider confidence remains high with recent share purchases in September 2025, signaling belief in future growth prospects despite current financial challenges.

- Navigate through the intricacies of Capita with our comprehensive valuation report here.

Gain insights into Capita's past trends and performance with our Past report.

Sparebanken Norge (OB:SBNOR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sparebanken Norge is a financial institution primarily engaged in providing banking services, including retail and corporate banking, with a market capitalization of NOK 1.91 billion.

Operations: The company's revenue streams are primarily derived from its Banking Operations in the Retail Market and Corporate Market, contributing significantly to its overall financial performance. Operating expenses have shown a tendency to increase alongside revenue growth, with General & Administrative Expenses being a notable component. The net income margin has experienced fluctuations, reaching as high as 24.52% in recent periods, indicating variability in profitability over time.

PE: 9.2x

Sparebanken Norge, a smaller player in the European market, has demonstrated insider confidence with recent share purchases. The bank's second-quarter net income rose to NOK 1.7 billion from NOK 1.1 billion year-on-year, indicating strong financial performance. Recent debt financing activities include issuing NOK 2.7 billion in Senior Preferred Bonds and SEK 500 million in non-preferred bonds, showcasing strategic capital management despite reliance on external borrowing for funding. Earnings are projected to grow significantly at an annual rate of 31%.

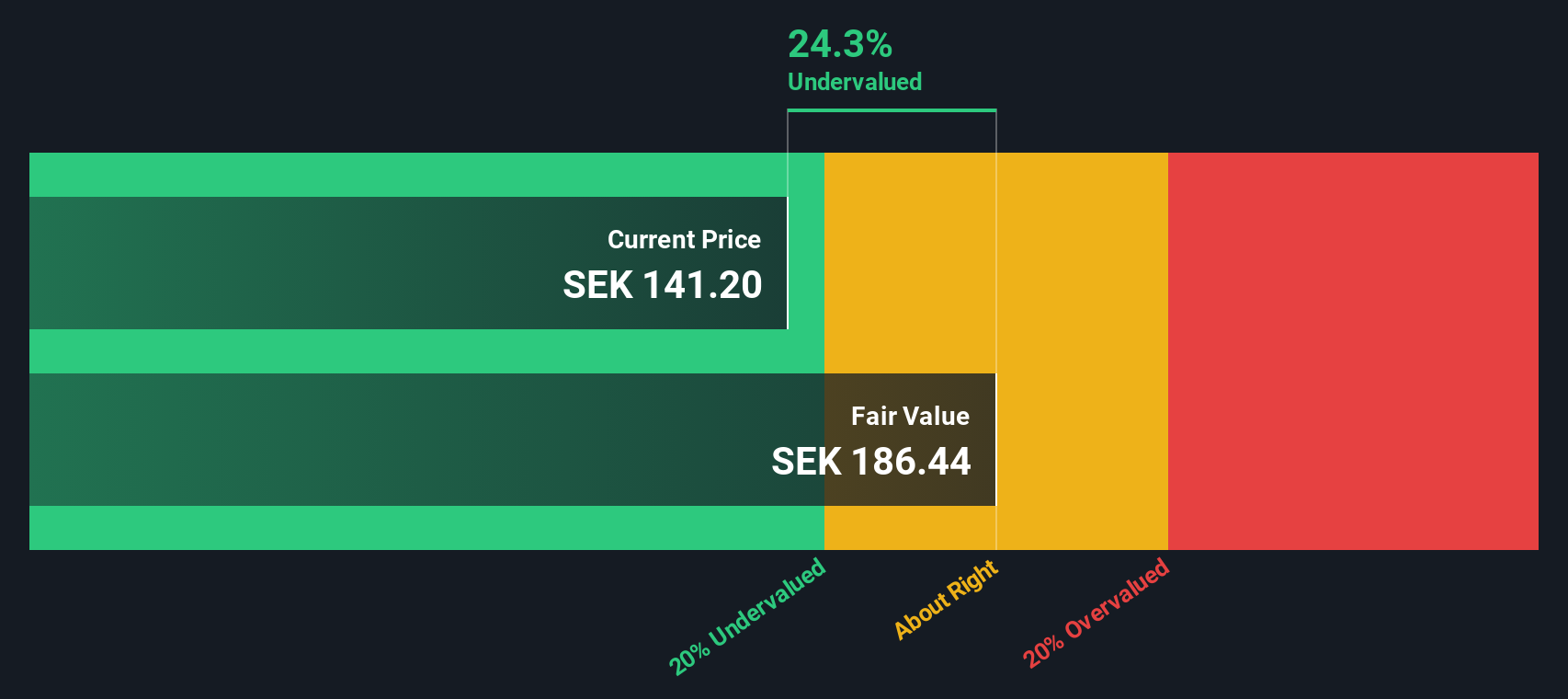

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alimak Group specializes in providing vertical access solutions for various industries, including construction and industrial sectors, with a market capitalization of approximately SEK 5.14 billion.

Operations: The Facade Access segment generates the highest revenue at SEK 1.997 billion, followed by Construction and Industrial segments at SEK 1.553 billion and SEK 1.551 billion respectively. The company's gross profit margin has fluctuated over time, reaching a recent high of 40.81% in June 2025, indicating variations in cost management efficiency across periods.

PE: 21.7x

Alimak Group, a European company with a focus on industrial equipment, has seen insider confidence with recent share purchases in 2025. Despite lower third-quarter sales of SEK 1,658 million compared to the previous year's SEK 1,742 million, net income for the nine months increased to SEK 501 million from SEK 429 million. While their funding relies solely on external borrowing—considered higher risk—their earnings are projected to grow annually by over 13%.

- Take a closer look at Alimak Group's potential here in our valuation report.

Review our historical performance report to gain insights into Alimak Group's's past performance.

Make It Happen

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 59 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALIG

Alimak Group

Alimak Group AB (publ) desigs and manufactures vertical access solutions in Europe, Asia, Australia, South and North America, and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives