Sparebanken Møre (OB:MORG) Profit Margins Drop to 20%, Challenging Bullish Quality Narratives

Reviewed by Simply Wall St

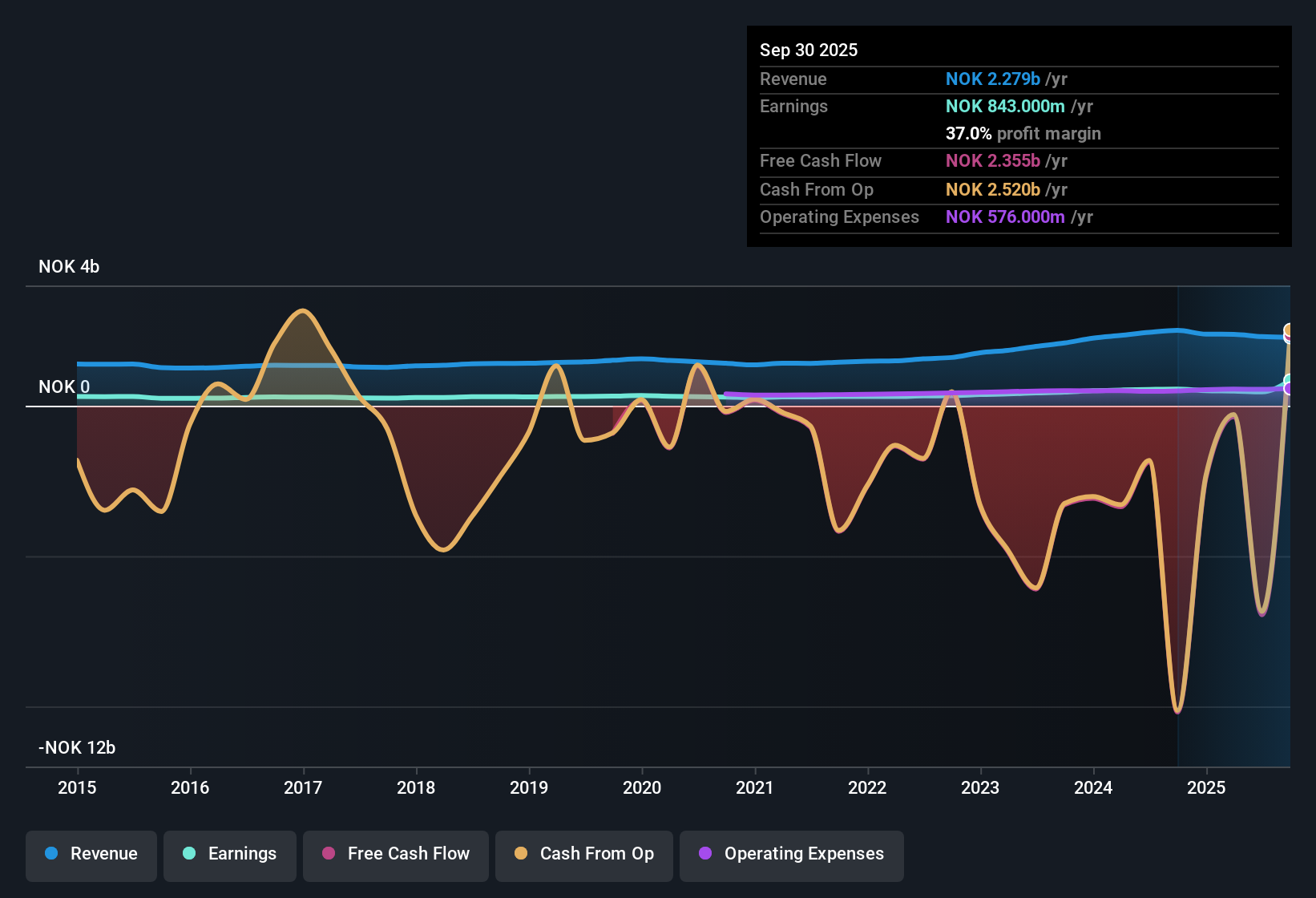

Sparebanken Møre (OB:MORG) has delivered earnings growth of 15.5% per year over the last five years, but in the most recent period, net profit margins slipped to 20% from 22.2% a year ago. Looking ahead, future earnings are forecast to grow at 5.3% per year, notably slower than the broader Norwegian market’s 14% rate. Revenue is expected to rise at 3.7% annually compared to the market’s 3.9% average. While investors may pause at the moderating growth figures and shrinking margins, underlying earnings quality and shares trading at a discount to estimated fair value remain in focus as key upsides.

See our full analysis for Sparebanken Møre.Now let’s see how these latest results stack up against the market’s bigger picture story, including where the leading narratives hold up and where the numbers might flip expectations on their head.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Dip Counters Historic Growth

- Net profit margins have slipped to 20% this period, down from 22.2% a year ago. Five-year annual earnings growth averaged a robust 15.5%, and this change pulls profitability below its long-term trend.

- What is surprising is that despite this recent margin decline, the overall profit quality remains high and operational stability continues to be a strength.

- The consistent pace of five-year earnings growth reinforces management’s reputation for disciplined risk management and supports hopes that the recent margin compression may not signal broader underlying issues.

- Bulls highlight the bank’s steady management, pointing to commitment to prudent lending and established dividend policies as important confidence builders even during periods of softer profits.

Forecasted Growth Lags the Sector

- Annual revenue is projected to grow at 3.7% versus a 3.9% market average, and future earnings are expected to rise at 5.3% per year, which is below both the Norwegian market's 14% forecast and the company’s own historical growth pace.

- Several analysts raise questions about upside, noting that a muted forward growth trajectory could limit re-rating potential.

- The difference between prior outperformance and more modest projections creates tension. While recent history shows strong expansion, market participants appear to be preparing for a slowdown in the coming years.

- Commentary notes that lower forecasts may challenge the idea that the shares can command a premium unless a new catalyst emerges to revive sentiment.

Shares Trade at a Discount to DCF Fair Value

- The current share price of NOK 103.80 sits well below both the DCF fair value estimate of NOK 166.77 and the analyst target price of NOK 113.33. The price-to-earnings ratio of 11.2x carries a slight premium compared to the Norwegian bank average of 10.8x.

- This discount supports prevailing arguments that the shares offer attractive value, despite a minor risk flagged around dividend sustainability.

- Valuation-focused investors may view the significant gap to DCF fair value as a buffer against slower top-line growth, especially with underlying profit quality still described as high.

- Bears, however, might note that a premium to the industry on earnings multiples, together with slowing growth, could justify market skepticism about a rapid rebound.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sparebanken Møre's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sparebanken Møre’s slowing growth outlook and weaker margins highlight concerns about the company’s ability to sustain its past level of performance.

If you want reliable expansion and fewer surprises, focus on companies showing consistent results with stable growth stocks screener (2090 results) for steadier returns across the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MORG

Sparebanken Møre

Provides banking services for retail and corporate customers in Norway.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives