- France

- /

- Oil and Gas

- /

- ENXTPA:GTT

European Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As European markets face challenges from renewed tariff uncertainties and political instability, the pan-European STOXX Europe 600 Index has experienced a decline, reflecting broader concerns about economic resilience. In this context, dividend stocks can offer a degree of stability and income potential for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.25% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.93% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.49% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.00% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.58% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.68% | ★★★★★★ |

| Afry (OM:AFRY) | 4.02% | ★★★★★☆ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

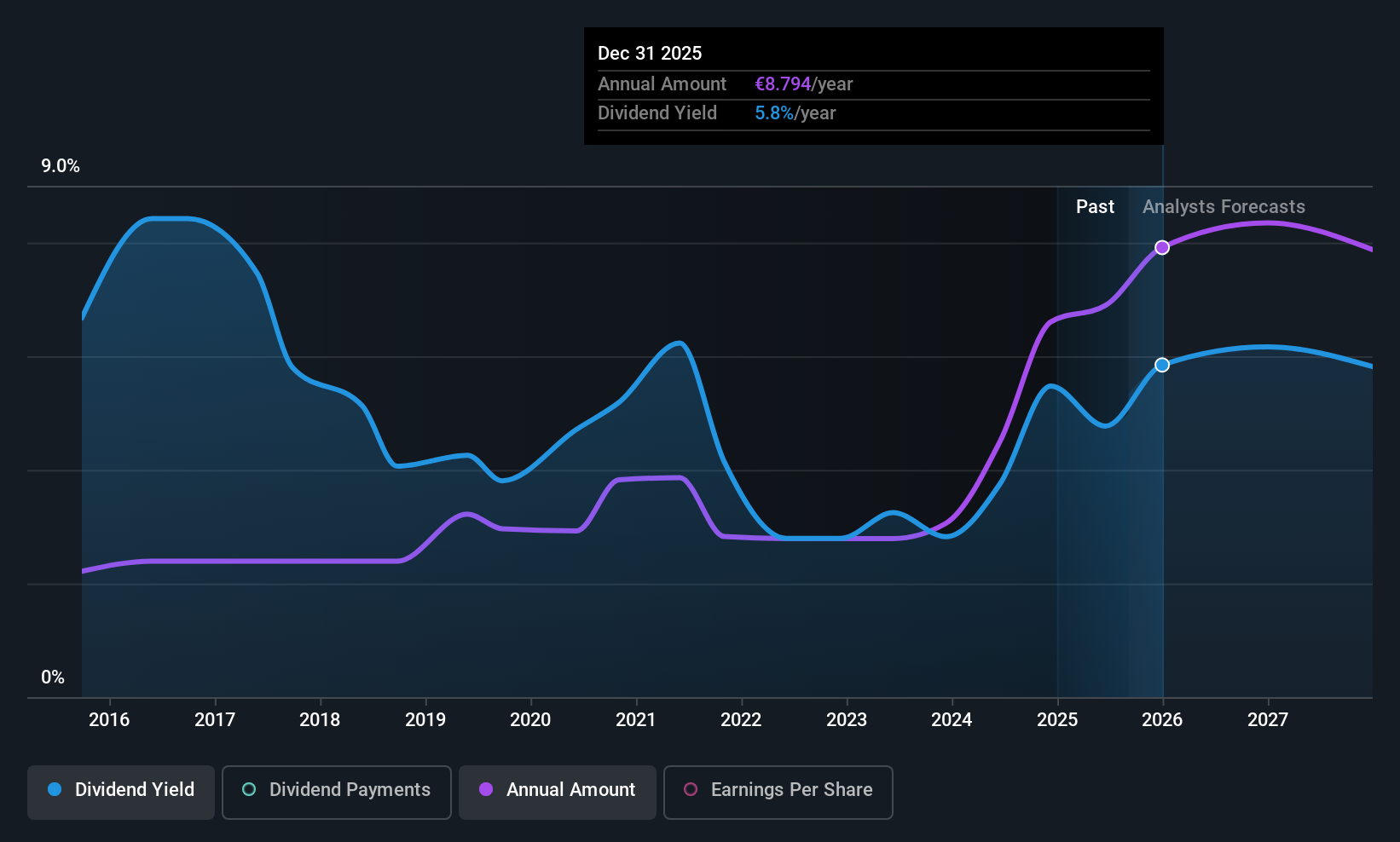

Gaztransport & Technigaz (ENXTPA:GTT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gaztransport & Technigaz SA is a technology and engineering company that specializes in providing cryogenic membrane containment systems for the maritime transportation and storage of liquefied gases globally, with a market cap of approximately €5.91 billion.

Operations: Gaztransport & Technigaz SA generates revenue primarily from its core business, including services, amounting to €727.52 million, and from hydrogen-related activities totaling €7.78 million.

Dividend Yield: 5%

Gaztransport & Technigaz (GTT) offers a mixed dividend profile. Despite a volatile dividend history, recent increases and coverage by earnings (81.1% payout ratio) and cash flows (87.8% cash payout ratio) suggest stability. However, its 5.02% yield is below the French market's top tier of 5.37%. GTT's earnings rose significantly in the past year, with H1 2025 revenue reaching €388.81 million from €295.25 million previously, supporting ongoing dividend payments amidst executive changes and affirmed guidance for 2025 revenue between €750 million to €800 million.

- Delve into the full analysis dividend report here for a deeper understanding of Gaztransport & Technigaz.

- Our valuation report here indicates Gaztransport & Technigaz may be overvalued.

Sparebanken Møre (OB:MORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Møre, along with its subsidiaries, offers banking services to retail and corporate clients in Norway and has a market cap of NOK5.25 billion.

Operations: Sparebanken Møre generates revenue primarily from its Retail segment with NOK1.03 billion, followed by the Corporate segment at NOK855 million, and Real Estate Brokerage contributing NOK55 million.

Dividend Yield: 5.9%

Sparebanken Møre's dividend profile shows mixed reliability, with payments increasing over the past decade but remaining volatile. The current payout ratio of 67.3% indicates dividends are covered by earnings, though future coverage is forecasted at 83.1%. Despite trading below fair value, its dividend yield of 5.91% lags behind Norway's top payers. Recent earnings results reveal a decline in net income and EPS compared to last year, potentially impacting future dividend stability.

- Unlock comprehensive insights into our analysis of Sparebanken Møre stock in this dividend report.

- The valuation report we've compiled suggests that Sparebanken Møre's current price could be inflated.

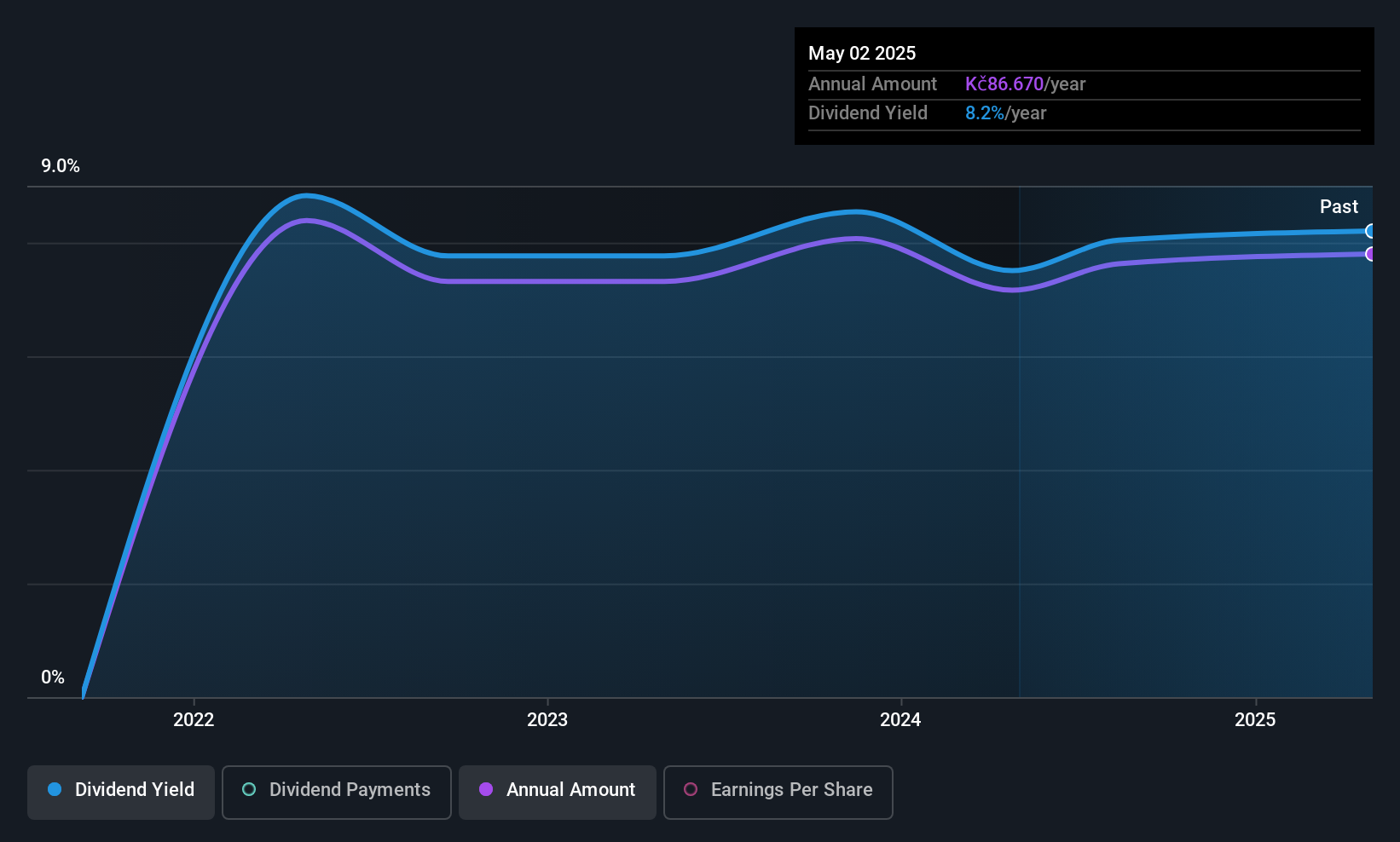

SAB Finance (SEP:SABFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAB Finance a.s. offers a range of foreign exchange services in the Czech Republic and has a market cap of CZK3.26 billion.

Operations: SAB Finance a.s. generates revenue of CZK400.73 million from its foreign exchange services in the Czech Republic.

Dividend Yield: 8.1%

SAB Finance's dividend yield stands strong in the top 25% of the Czech market, supported by a low cash payout ratio of 5.9%, ensuring coverage by cash flows. However, its dividend history is brief and marked by volatility, with payments dropping over 20% annually at times. Despite this instability, dividends are covered by earnings with a payout ratio of 60.7%. The price-to-earnings ratio of 14.6x suggests good value compared to the market average.

- Navigate through the intricacies of SAB Finance with our comprehensive dividend report here.

- According our valuation report, there's an indication that SAB Finance's share price might be on the expensive side.

Summing It All Up

- Click here to access our complete index of 216 Top European Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GTT

Gaztransport & Technigaz

A technology and engineering company, provides cryogenic membrane containment systems for the maritime transportation and storage of liquefied gases in South Korea, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives