SpareBank 1 SMN (OB:MING) Margins Edge Higher, Underscoring Profit Consistency Against Slower Growth Narratives

Reviewed by Simply Wall St

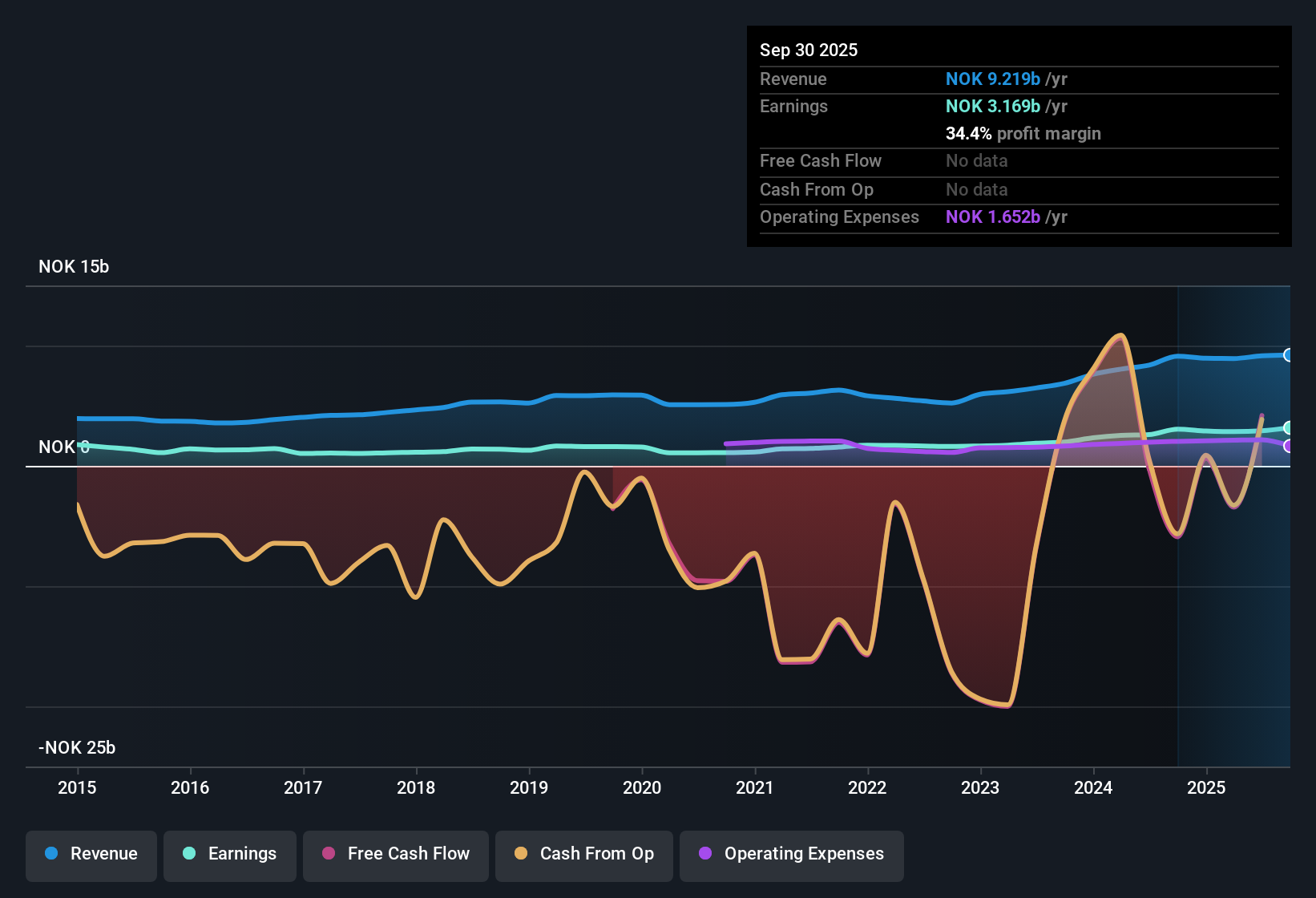

SpareBank 1 SMN (OB:MING) posted robust results for the period, with net profit margins edging up to 34.4% from 33.5% a year ago. Over the past five years, earnings have grown at a healthy 19.8% per year, though most recent annual earnings growth eased to 3.9%. Investors will find it notable that the shares are priced attractively, with a PE ratio of 8.6x, which is well below both the sector average and the company is trading under its estimated fair value at NOK 188.76. Looking ahead, forecasts point to earnings growth of 6.7% per year and revenue growth of 0.7% per year. Both figures trail the broader Norwegian market, but the company’s reputation for high-quality, consistent profits keeps sentiment positive.

See our full analysis for SpareBank 1 SMN.The next section sets these results against the widely held narratives for SpareBank 1 SMN and highlights where the numbers support market sentiment and where the story could shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stay Elevated Despite Slowing Growth

- Net profit margins came in at 34.4%, just ahead of last year’s 33.5%, which confirms profitability has held firm even as annual earnings growth slowed to 3.9% from the five-year annualized 19.8% pace.

- Strong margins support the idea that SpareBank 1 SMN’s business model is resilient and continues to generate dependable profits, even when overall growth cools.

- The period’s margin improvement, although modest, strongly reinforces optimism about management’s ability to maintain efficiency and pricing power in a slower market.

- Bulls highlight that consistent profit margins make the company more dependable compared to rivals that might be more sensitive to economic swings.

Peer-Relative Valuation Points to Upside

- The price-to-earnings ratio of 8.6x is noticeably below both the industry’s 10.7x and peer group’s 9.8x, while the share price of NOK 188.76 sits well beneath the DCF fair value estimate of NOK 297.77.

- The valuation gap stands out as a key reason some investors consider SpareBank 1 SMN undervalued, even with growth expected to trail the broader Norwegian market.

- With the bank trading at these lower multiples, market participants may see both a margin of safety and room for re-rating if fundamentals remain stable.

- However, since top-line growth is only forecast at 0.7% per year, bulls are careful to ground their optimism in the quality and consistency of underlying earnings rather than betting on a big step-up in revenue.

Consistent Profitability Supports Dividend and Value Strength

- Reported earnings have grown by an average of 19.8% per year over the past five years, coupled with several confirmed rewards in quality and dividend reliability according to company risk/reward data.

- The prevailing narrative centers on SpareBank 1 SMN’s reputation for delivering steady profits and rewarding income-focused investors, which is reinforced by the lack of flagged risks.

- Many observers see the track record for durable growth and stable payouts as a powerful reason for continued confidence at current price levels.

- The absence of major risks in recent filings, when considered alongside robust historical earnings, makes the overall investment case stronger, though investors will still watch for any signs of a shift in operating conditions.

To see deeper analysis and insights on SpareBank 1 SMN, check out the full balanced narrative for more context on these numbers. 📊 Read the full SpareBank 1 SMN Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SpareBank 1 SMN's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With revenue and earnings growth projected to lag behind the wider Norwegian market, SpareBank 1 SMN’s upside may appear limited for aggressive growth seekers.

If you want to focus on businesses forecast for stronger financial acceleration, our high growth potential stocks screener (62 results) can help you discover established names targeting higher growth over the next few years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MING

SpareBank 1 SMN

Provides various banking, accounting, and real estate products and services to private individuals and companies in Norway and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives