- Japan

- /

- Energy Services

- /

- TSE:6369

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by a mix of domestic policy shifts and geopolitical developments, investors are keeping a close eye on dividend stocks as a potential source of steady income. In this dynamic environment, selecting stocks with strong fundamentals and reliable dividend histories can be an effective strategy for those looking to navigate market volatility while seeking consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

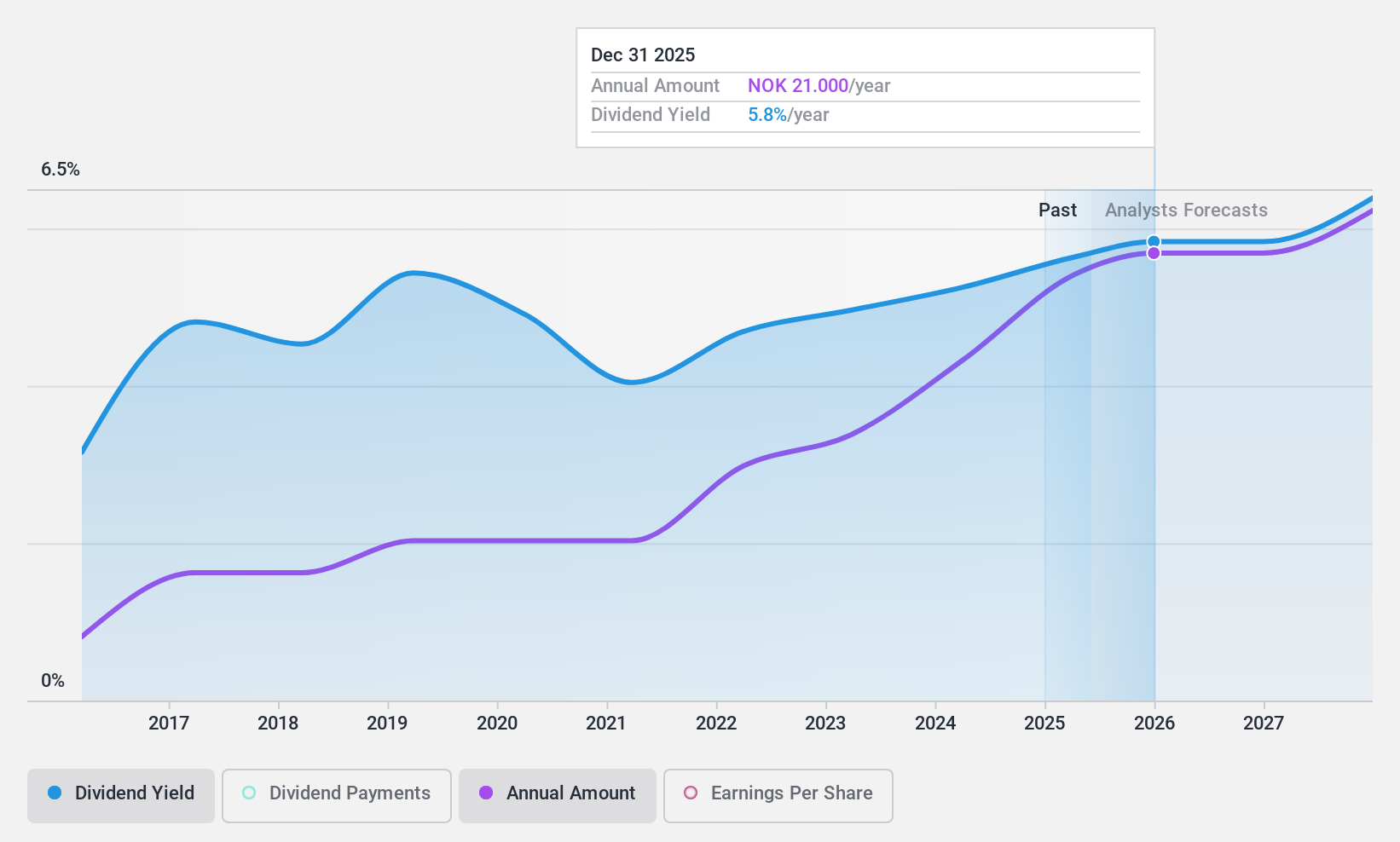

Jæren Sparebank (OB:JAREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jæren Sparebank offers a range of financial products and services to individuals and businesses in Norway, with a market cap of NOK1.57 billion.

Operations: Jæren Sparebank generates revenue from its Retail Market segment with NOK266.70 million and Corporate Market segment with NOK166.69 million.

Dividend Yield: 4.9%

Jæren Sparebank's dividend payments have been volatile over the past decade, with a payout ratio currently at 58.9% and forecasted to be 62.7% in three years, indicating coverage by earnings. Despite an unstable dividend track record, recent earnings growth—19.8% last year—supports future payouts. The bank trades at 49.5% below estimated fair value, but its dividend yield of 4.94% remains low compared to top-tier Norwegian dividend payers (7.68%). Recent reports show improved net income and earnings per share for Q3 and nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Jæren Sparebank.

- The analysis detailed in our Jæren Sparebank valuation report hints at an inflated share price compared to its estimated value.

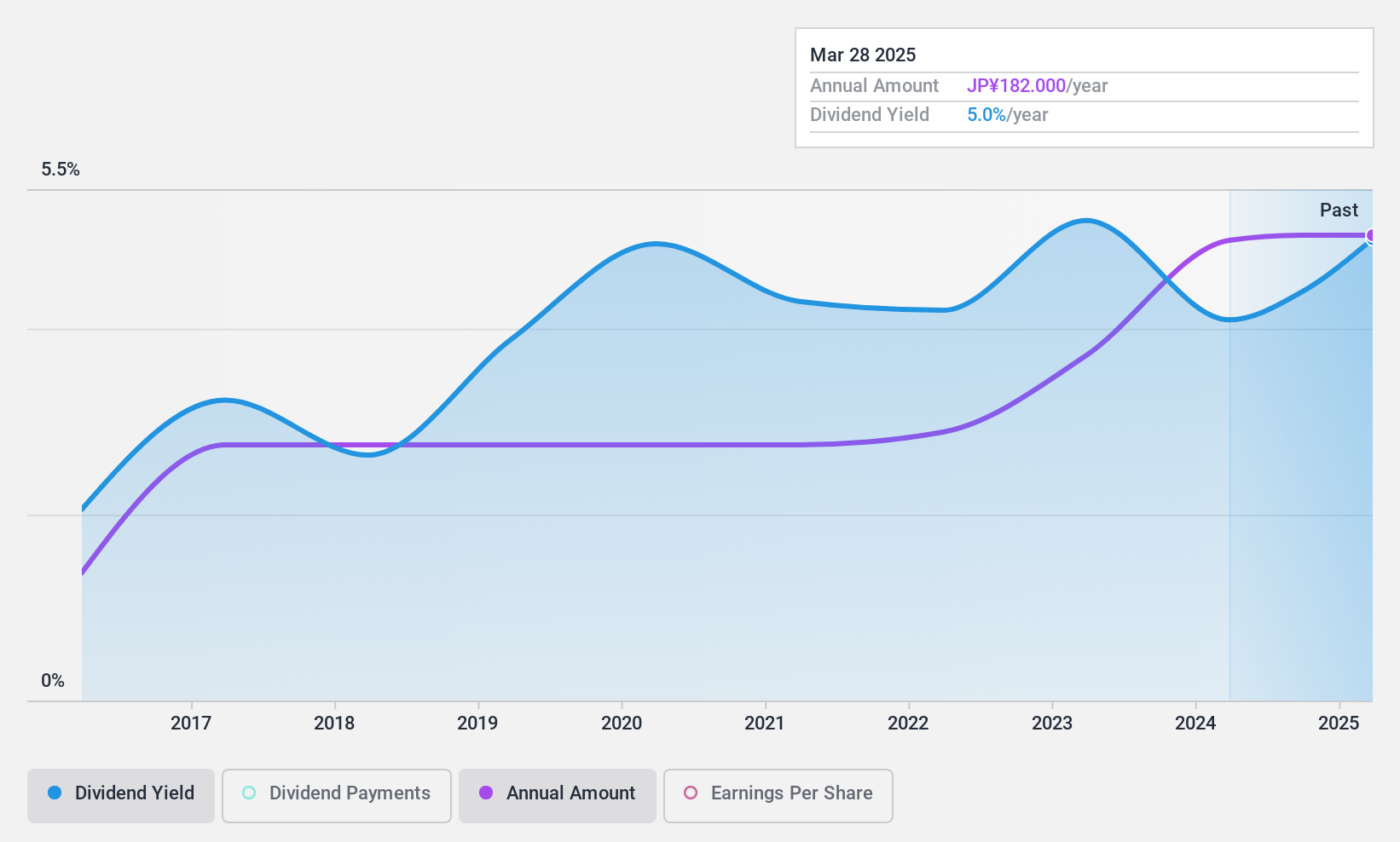

Toyo Kanetsu K.K (TSE:6369)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Kanetsu K.K. operates in the plant and machinery sector, material handling systems, and other businesses across Japan, Southeast Asia, and internationally with a market cap of ¥32.09 billion.

Operations: Toyo Kanetsu K.K. generates revenue through its operations in the plant and machinery sector, as well as material handling systems, serving markets in Japan, Southeast Asia, and internationally.

Dividend Yield: 4.4%

Toyo Kanetsu K.K.'s dividend payments have been inconsistent over the past decade, despite a 10-year growth trend. The dividends are well covered by earnings and cash flows, with payout ratios of 37.1% and 42.4%, respectively. Trading at 53.6% below estimated fair value, its dividend yield of 4.38% ranks in the top quarter of Japanese market payers (3.84%). However, large one-off items have impacted its financial results recently, affecting earnings quality.

- Get an in-depth perspective on Toyo Kanetsu K.K's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Toyo Kanetsu K.K's share price might be too pessimistic.

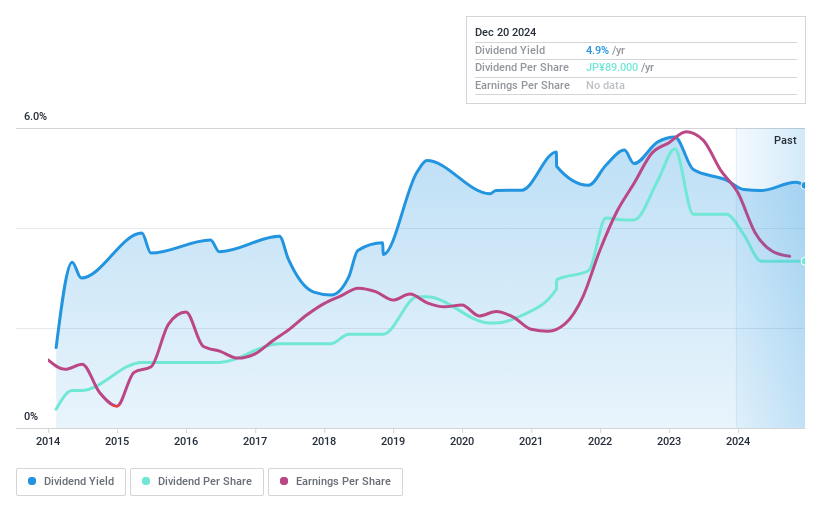

Suzuden (TSE:7480)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Suzuden Corporation operates in Japan, focusing on the purchasing and selling of electrical and electronic components, with a market cap of ¥25.77 billion.

Operations: Suzuden Corporation's revenue is primarily derived from its Electrical and Electronic Components Sales segment, which generated ¥45.70 billion, complemented by its Manufacturing Business segment with ¥255.66 million.

Dividend Yield: 4.8%

Suzuden's dividend yield of 4.84% ranks in the top 25% of Japanese market payers, supported by an earnings payout ratio of 82.3% and a low cash payout ratio of 28.6%, indicating robust coverage. Despite this, Suzuden has a volatile and unreliable dividend history over the past decade, with significant fluctuations exceeding 20%. The stock trades at a substantial discount to its estimated fair value, potentially offering value for investors seeking dividends.

- Click here to discover the nuances of Suzuden with our detailed analytical dividend report.

- According our valuation report, there's an indication that Suzuden's share price might be on the expensive side.

Summing It All Up

- Explore the 1962 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Kanetsu K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6369

Toyo Kanetsu K.K

Engages in plant and machinery, material handling systems, and other businesses in Japan, Southeast Asia, and internationally.

Excellent balance sheet established dividend payer.