- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6951

Exploring High Growth Tech Stocks December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the Russell 2000 Index hitting new peaks and the S&P 500 maintaining a robust upward trajectory, investor sentiment remains buoyed by domestic policy developments and geopolitical resolutions. In this context of heightened market activity, identifying high growth tech stocks involves assessing companies that not only demonstrate innovation and adaptability but also possess the potential to thrive amidst evolving economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 21.20% | 28.62% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genew Technologies Co., Ltd. focuses on the research, development, production, and sale of communication and network products globally with a market capitalization of CN¥6.37 billion.

Operations: Genew Technologies Co., Ltd. generates revenue through the global sale of its communication and network products. The company's operations are centered around research, development, and production in this sector.

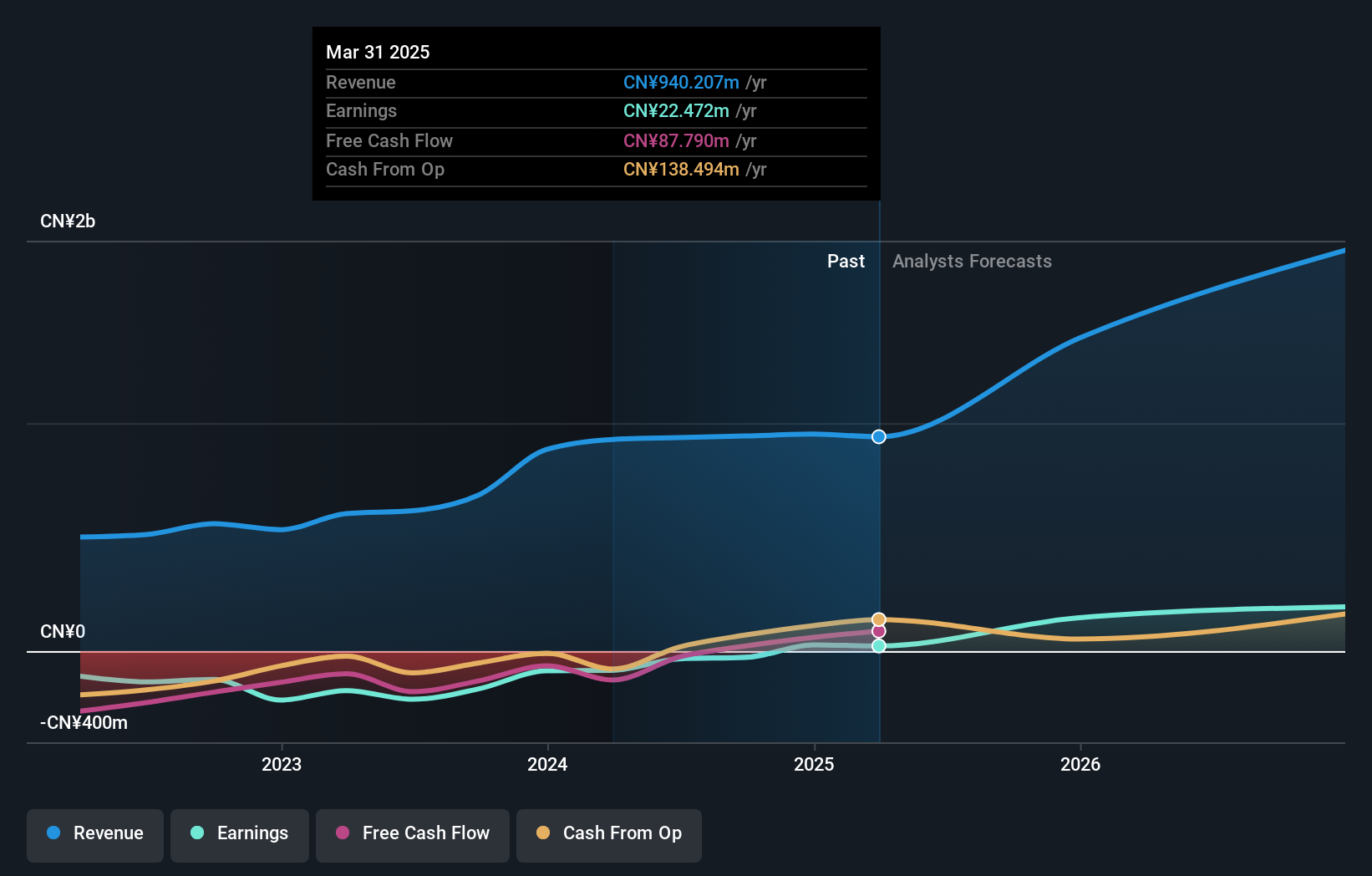

Genew Technologies has shown a robust turnaround with its recent earnings report, highlighting a net income of CNY 16.61 million from a net loss just the previous year, underscoring significant operational improvements. With an impressive revenue growth forecast at 32.4% annually, the company is outpacing the CN market's average of 13.8%. This surge is backed by substantial R&D investments that fuel innovation and future capabilities in high-tech sectors. Moreover, earnings are expected to skyrocket by approximately 94.3% per year over the next three years, positioning Genew well within a competitive landscape that demands constant evolution and technological advancement.

Runa Smart Equipment (SZSE:301129)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Runa Smart Equipment Co., Ltd. offers urban smart heating solutions in China and has a market capitalization of CN¥3.57 billion.

Operations: Runa Smart Equipment focuses on urban smart heating solutions in China, leveraging advanced technology to enhance energy efficiency. The company generates revenue primarily through the sale and installation of its heating systems.

Runa Smart Equipment's recent financial performance highlights significant challenges, with a reported net loss of CNY 39.15 million for the nine months ending September 2024, a stark reversal from the net income of CNY 8.03 million in the previous year. Despite these setbacks, the company is poised for potential recovery, underscored by its aggressive R&D spending aimed at driving innovation and future growth in smart equipment technology. This focus on development is critical as it aligns with industry trends towards more automated and intelligent manufacturing solutions. Moreover, Runa's commitment to reinvesting in its core capabilities is evident from its R&D expenditure which consistently accounts for a substantial portion of its revenue, positioning it to capitalize on evolving market demands effectively.

- Unlock comprehensive insights into our analysis of Runa Smart Equipment stock in this health report.

JEOL (TSE:6951)

Simply Wall St Growth Rating: ★★★★☆☆

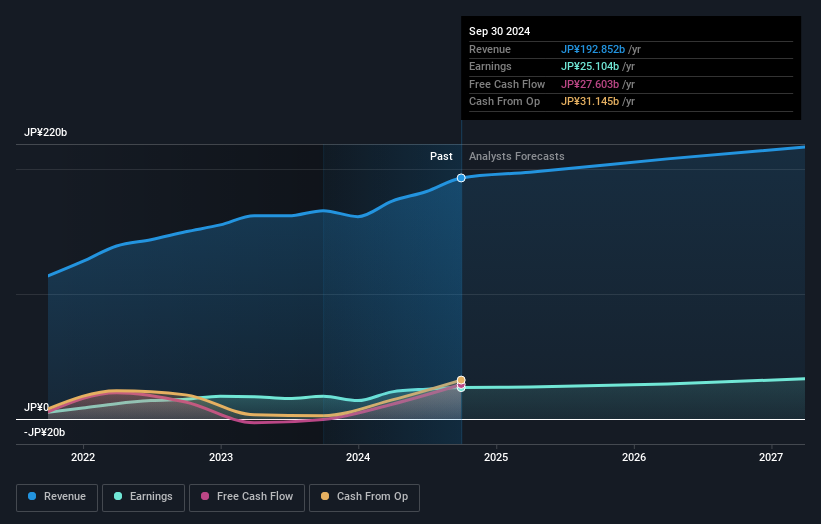

Overview: JEOL Ltd. is a global company involved in the research, development, manufacture, and marketing of scientific and metrology instruments, semiconductor and industrial equipment, and medical equipment with a market capitalization of ¥266.69 billion.

Operations: JEOL Ltd. generates revenue primarily from three segments: Science and Measurement Equipment, Industrial Equipment, and Medical Equipment, with the Science and Measurement segment contributing ¥128.06 billion. The company's focus on these diverse sectors underscores its role in providing specialized instruments and equipment across various industries globally.

JEOL's recent engagement in multiple international conferences, including SEMICON EUROPA and MEDICA 2024, underscores its proactive stance in showcasing its technological advancements across various sectors. This strategic visibility is complemented by the company's solid R&D commitment, which is evident from its latest product releases like the CROSS SECTION POLISHER IB-19540CP. These efforts are part of JEOL’s strategy to enhance product functionality and user experience, leveraging IoT for better operational efficiency. Financially, JEOL has demonstrated robust growth with a notable 38.6% increase in earnings over the past year and forecasts suggest a continued upward trajectory with expected annual profit growth of 10%. Furthermore, this growth rate surpasses the broader Japanese market's forecast of 7.9%, positioning JEOL favorably within its industry context.

- Delve into the full analysis health report here for a deeper understanding of JEOL.

Explore historical data to track JEOL's performance over time in our Past section.

Turning Ideas Into Actions

- Explore the 1288 names from our High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6951

JEOL

Engages in the research, development, manufacture, and marketing of scientific and metrology instruments, semiconductor and industrial equipment, and medical equipment worldwide.

Flawless balance sheet, undervalued and pays a dividend.