The European stock market has been buoyed by expectations of a U.S. Federal Reserve rate cut, with major indices like the STOXX Europe 600 Index seeing gains. In this context, penny stocks—typically smaller or newer companies—remain an intriguing investment area for those looking to explore growth opportunities beyond mainstream options. Though often considered niche, these stocks can offer a blend of affordability and potential when backed by strong financials, making them worth considering for investors seeking long-term success in under-the-radar companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.268 | €1.48B | ✅ 4 ⚠️ 2 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €233.95M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN2.91 | PLN102.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.97 | €40.3M | ✅ 3 ⚠️ 3 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.23 | €373.87M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.06 | €284.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.92 | €31.03M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 329 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kamux Oyj (HLSE:KAMUX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kamux Oyj, with a market cap of €82.74 million, operates in the wholesale and retail sectors for used cars across Finland, Sweden, and Germany.

Operations: The company's revenue is derived from its operations as a gasoline and auto dealer, generating €954.9 million.

Market Cap: €82.74M

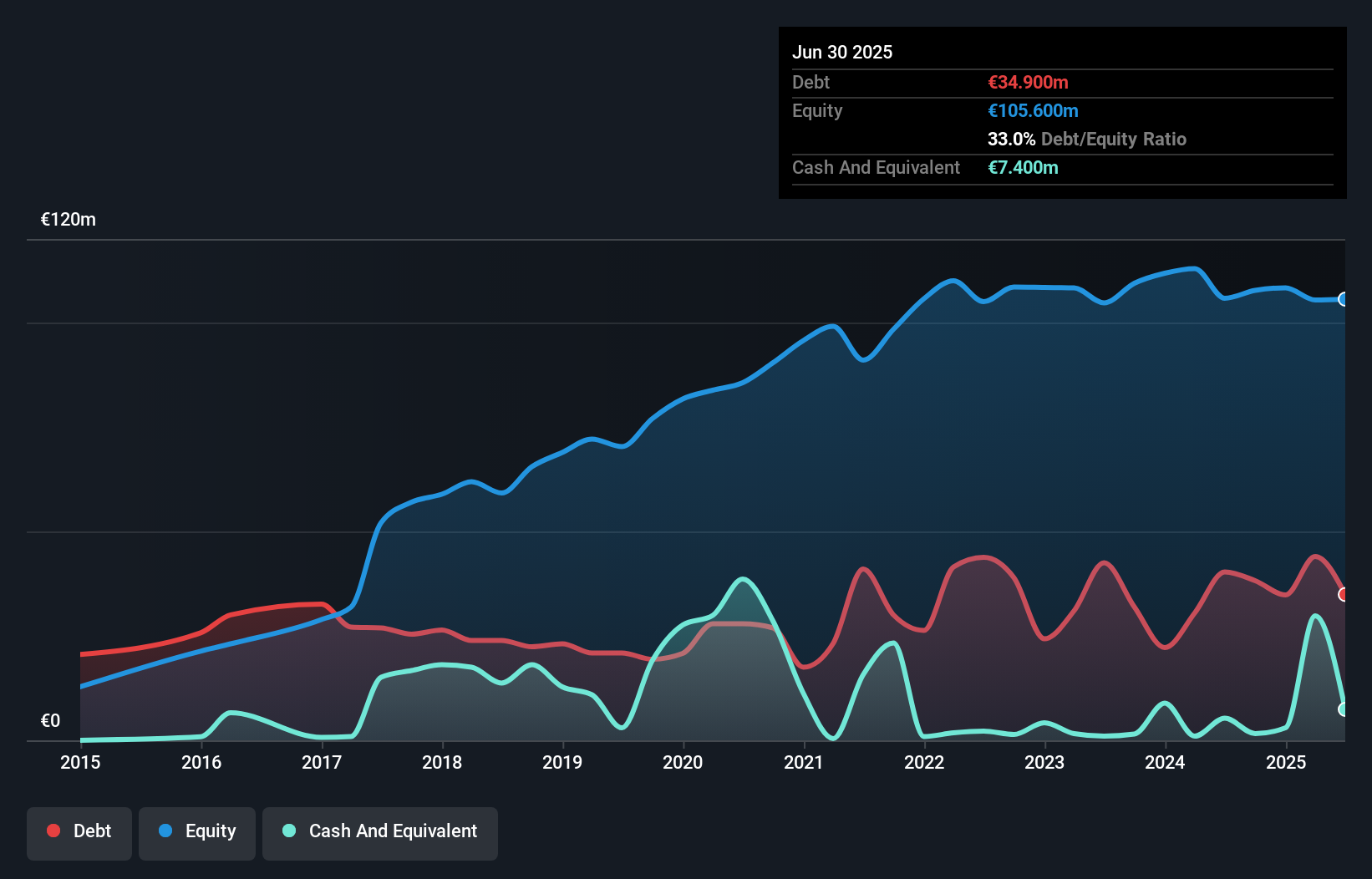

Kamux Oyj, with a market cap of €82.74 million, operates in the used car sector across Finland, Sweden, and Germany. Despite generating significant revenue (€954.9 million), it remains unprofitable with a recent net loss of €3.9 million for the first half of 2025. The company faces challenges such as increased debt levels and insufficient interest coverage by EBIT (0.7x). However, it trades at a good value compared to peers and has strong asset coverage over liabilities (€156M in short-term assets against €112M total liabilities). Recent management changes could influence future strategic direction amidst ongoing insider selling concerns.

- Navigate through the intricacies of Kamux Oyj with our comprehensive balance sheet health report here.

- Understand Kamux Oyj's earnings outlook by examining our growth report.

Instabank (OB:INSTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Instabank ASA offers a range of banking products and services in Norway, with a market cap of NOK1.12 billion.

Operations: Instabank ASA has not reported any specific revenue segments.

Market Cap: NOK1.12B

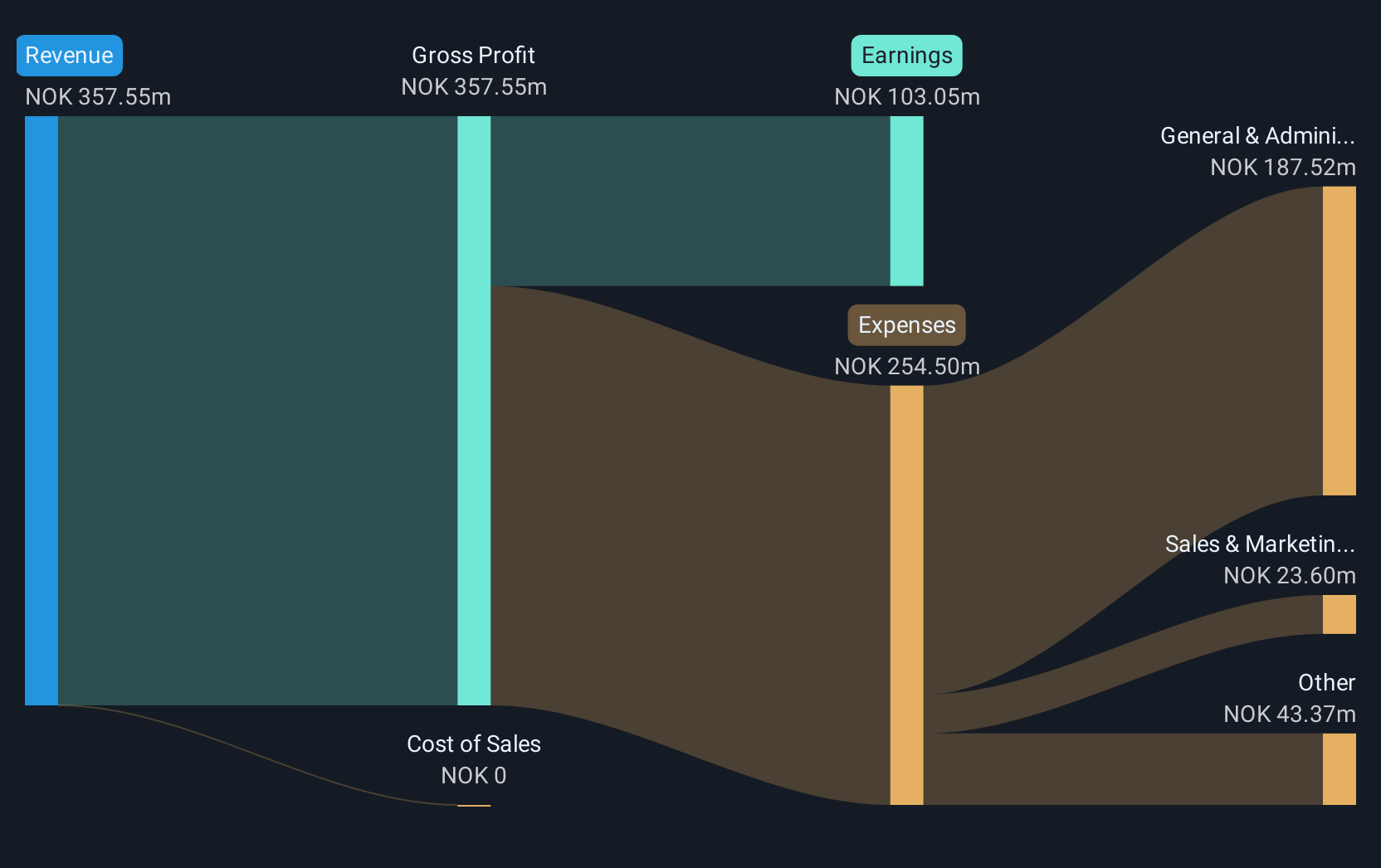

Instabank ASA, with a market cap of NOK1.12 billion, offers banking products in Norway. Despite a seasoned management team and stable weekly volatility, the bank faces challenges such as declining net profit margins (26.5% from 31.8% last year) and negative earnings growth (-0.7%) over the past year compared to industry averages. While trading below its estimated fair value, Instabank's high level of bad loans (8.5%) and low return on equity (8.8%) are concerns for investors in penny stocks seeking stability or rapid growth potential amid its primarily low-risk funding structure and appropriate loan levels.

- Jump into the full analysis health report here for a deeper understanding of Instabank.

- Assess Instabank's future earnings estimates with our detailed growth reports.

Kudelski (SWX:KUD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kudelski SA, with a market cap of CHF75.79 million, offers digital access and security solutions for digital television and interactive applications across Switzerland, the United States, France, Germany, Austria, and other international markets.

Operations: The company's revenue is primarily derived from its Cybersecurity segment, generating $106.04 million, and its Internet of Things segment, contributing $45.13 million.

Market Cap: CHF75.79M

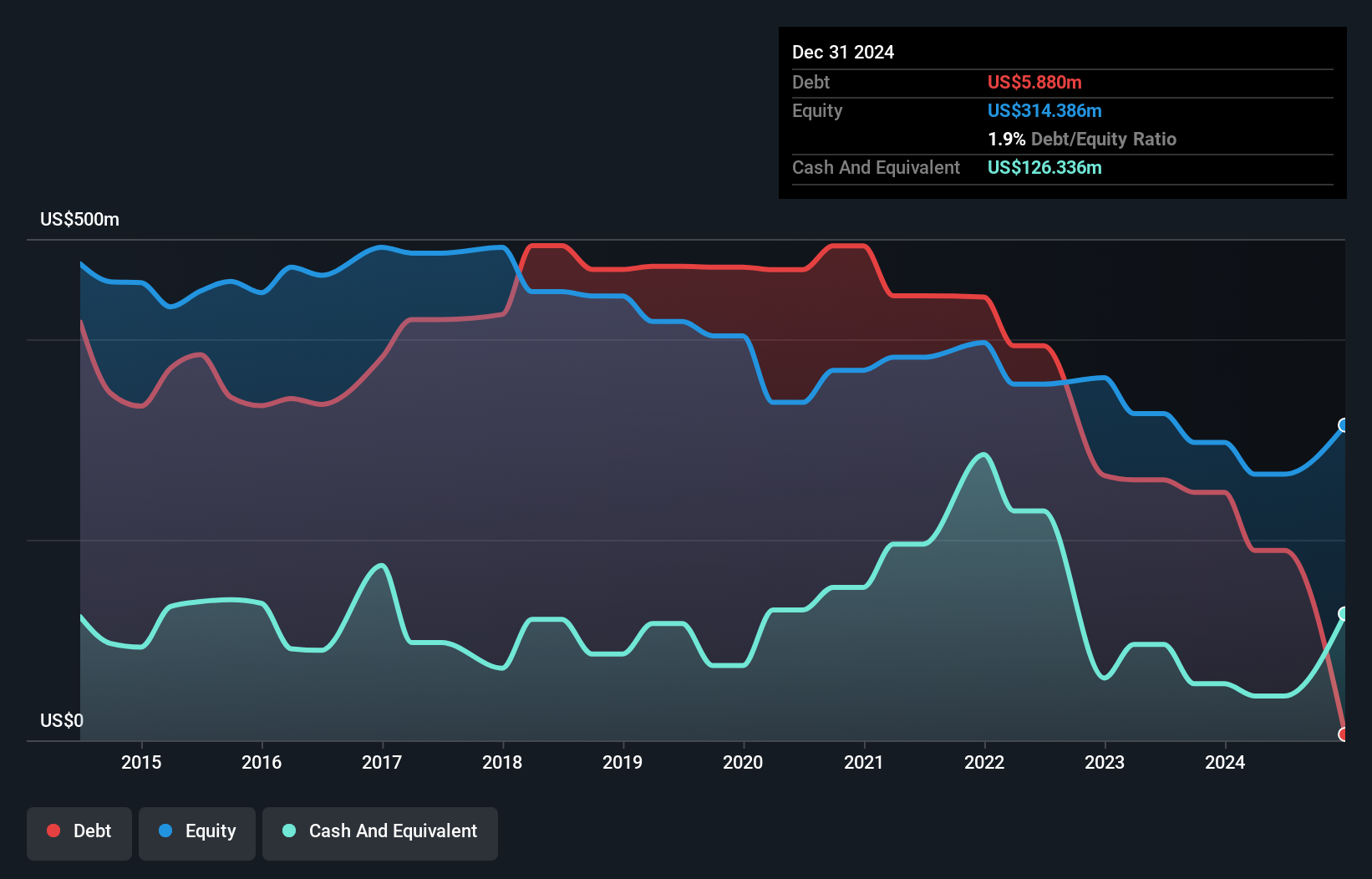

Kudelski SA, with a market cap of CHF75.79 million, has faced challenges in profitability, reporting a net loss of US$34.24 million for the first half of 2025 despite generating significant revenue from its Cybersecurity (US$106.04 million) and IoT segments (US$45.13 million). The company is strategically expanding through partnerships like the one with Broadpeak to enhance streaming security solutions and initiatives such as RecovR ID Check to combat identity fraud in automotive retail. While Kudelski's debt levels have improved significantly over five years, it remains unprofitable with less than a year of cash runway based on current free cash flow trends.

- Click to explore a detailed breakdown of our findings in Kudelski's financial health report.

- Examine Kudelski's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Discover the full array of 329 European Penny Stocks right here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 25 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:INSTA

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives