DNB Bank (OB:DNB) Valuation in Focus After Announcing Share Buy-back and Plans for Capital Return

Reviewed by Simply Wall St

DNB Bank (OB:DNB) has announced a share buy-back programme. The bank aims to repurchase up to 1% of its outstanding shares by next February. The plan also includes a proposal to cancel these shares at the upcoming annual meeting.

See our latest analysis for DNB Bank.

DNB Bank’s buy-back programme follows several notable events, including a NOK 250 million bond listing and its role in a high-profile credit facility for AutoStore. These moves have helped underpin solid momentum, with a year-to-date share price return of nearly 17% and an impressive 1-year total shareholder return of 26.7%. This reflects both the bank's resilience and value-creation efforts.

If you’re curious what other companies are riding similar waves of momentum and insider confidence, now’s the perfect moment to discover fast growing stocks with high insider ownership

Despite these strong returns and shareholder-friendly moves, investors are left to ponder whether DNB Bank’s current valuation leaves room for further gains. There is also the question of whether renewed optimism around the stock has already been fully reflected in the price.

Most Popular Narrative: 2.5% Undervalued

The current narrative places DNB Bank's fair value just above its last close price, suggesting a modest gap in favor of the stock. With the market already pricing in much of the good news, the following quote shares what may be driving this slight optimism.

Strong asset quality, diversified growth, resilient revenue streams, solid capital, and strategic digital investments position DNB for stable earnings, operational efficiency, and long-term market strength.

Curious what numbers underpin this small margin of undervaluation? The story hinges on future profit margins, stable revenue growth, and surprisingly optimistic market assumptions. Want to see which key forecasts tip the scales? Uncover the full breakdown within the narrative.

Result: Fair Value of $275.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing digital disruption and new ESG regulations could quickly challenge the current outlook. This may make future profit margins less predictable for DNB Bank.

Find out about the key risks to this DNB Bank narrative.

Another View: What Do the Multiples Say?

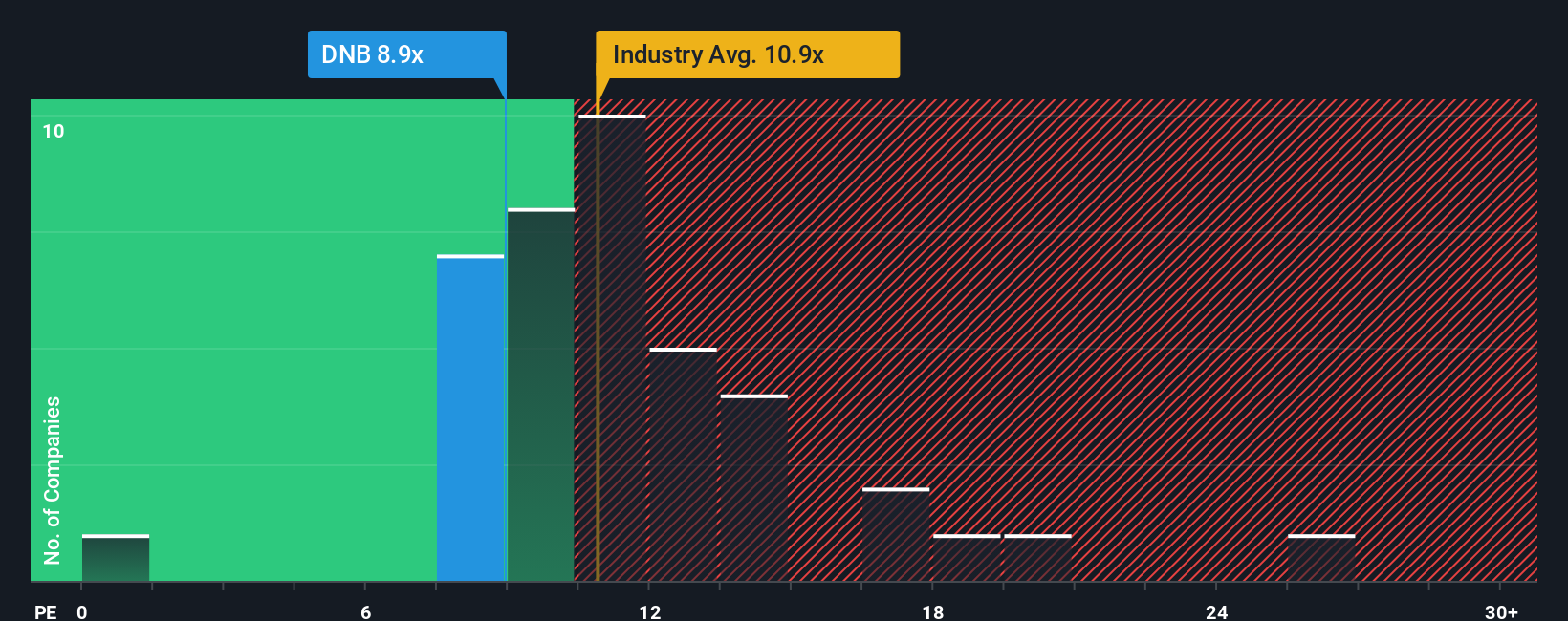

Shifting gears from fair value, DNB's current price-to-earnings ratio stands at 9.2x, higher than peer banks averaging 8.1x in this metric. However, it is still below both the Norwegian industry average of 10.4x and the fair ratio of 10.3x. This gap highlights a valuation puzzle: while DNB trades above its closest rivals, the broader market suggests there could still be upside if sentiment shifts. Does this mean there is hidden value yet to be unlocked, or is the stock’s premium justified by its strengths?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DNB Bank Narrative

If you see things differently, or want to dig into the data first-hand, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your DNB Bank research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Top investors always keep their eyes open for overlooked opportunities. Don’t let the next standout performer slip by. See what else could boost your returns.

- Unlock potential from stocks trading below their worth by reviewing these 881 undervalued stocks based on cash flows that could be right for a value-driven strategy.

- Tap into growth prospects by reviewing these 32 healthcare AI stocks powering advances in medicine and reshaping the future of healthcare.

- Boost your passive income by targeting these 14 dividend stocks with yields > 3% sporting reliable yields and robust financials for lasting financial security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNB

DNB Bank

Provides financial services to individuals and businesses in Norway and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives