- Netherlands

- /

- Specialty Stores

- /

- ENXTAM:FAST

Reflecting on Fastned B.V's (AMS:FAST) Share Price Returns Over The Last Year

While not a mind-blowing move, it is good to see that the Fastned B.V. (AMS:FAST) share price has gained 29% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 25% in one year, under-performing the market.

View our latest analysis for Fastned B.V

Fastned B.V wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Fastned B.V saw its revenue grow by 291%. That's a strong result which is better than most other loss making companies. The share price drop of 25% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

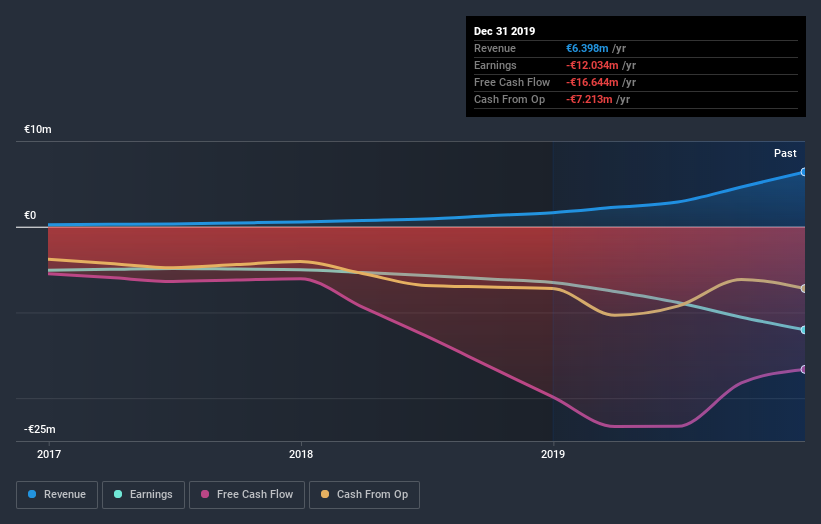

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Fastned B.V shareholders are down 25% for the year, even worse than the market loss of 8.0%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 29% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Fastned B.V (2 are potentially serious) that you should be aware of.

Of course Fastned B.V may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

If you decide to trade Fastned B.V, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTAM:FAST

Fastned B.V

Engages in the construction and operation of charging stations for fully electric and hybrid cars.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives