Stock Analysis

- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

May 2024 Spotlight On Euronext Amsterdam Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets exhibit mixed responses to recent economic data, the Netherlands market remains a focal point for investors looking for growth opportunities. This May 2024 spotlight on Euronext Amsterdam highlights companies with high insider ownership, a trait often associated with strong governance and aligned interests between shareholders and management, which can be particularly appealing in the current economic climate.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 15.1% | 67.8% |

| Ebusco Holding (ENXTAM:EBUS) | 31.4% | 115.2% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

| PostNL (ENXTAM:PNL) | 30.8% | 24.3% |

Underneath we present a selection of stocks filtered out by our screen.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers, primarily serving markets in the Netherlands, North America, and Europe with a market capitalization of approximately €369.22 million.

Operations: The company generates its revenue by designing, developing, manufacturing, and either selling or leasing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 15.1%

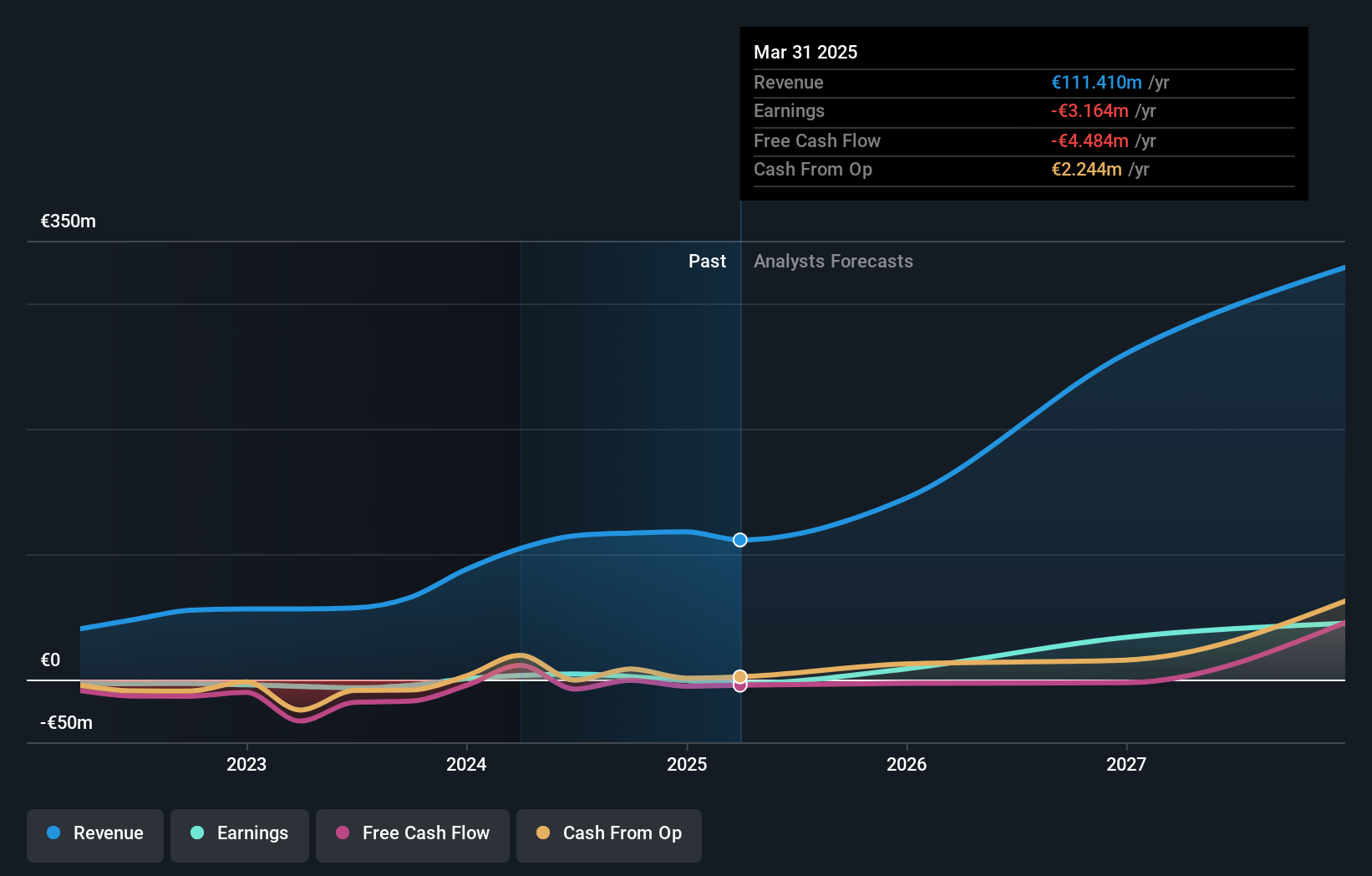

Envipco Holding N.V. has shown a strong recovery with its latest financial results, reporting significant increases in sales and transitioning from a net loss to profitability within the last fiscal year. Despite experiencing shareholder dilution over the past year, the company's earnings are expected to grow by 67.79% annually, outpacing the Dutch market significantly. However, it is trading at 74.9% below its estimated fair value and has a highly volatile share price, which might concern potential investors looking for stability in high insider ownership growth companies.

- Click here to discover the nuances of Envipco Holding with our detailed analytical future growth report.

- Our valuation report here indicates Envipco Holding may be overvalued.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a provider of software-as-a-service solutions tailored for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €270.34 million.

Operations: The company generates revenue primarily through its software and programming segment, which amounted to €42.94 million.

Insider Ownership: 35.8%

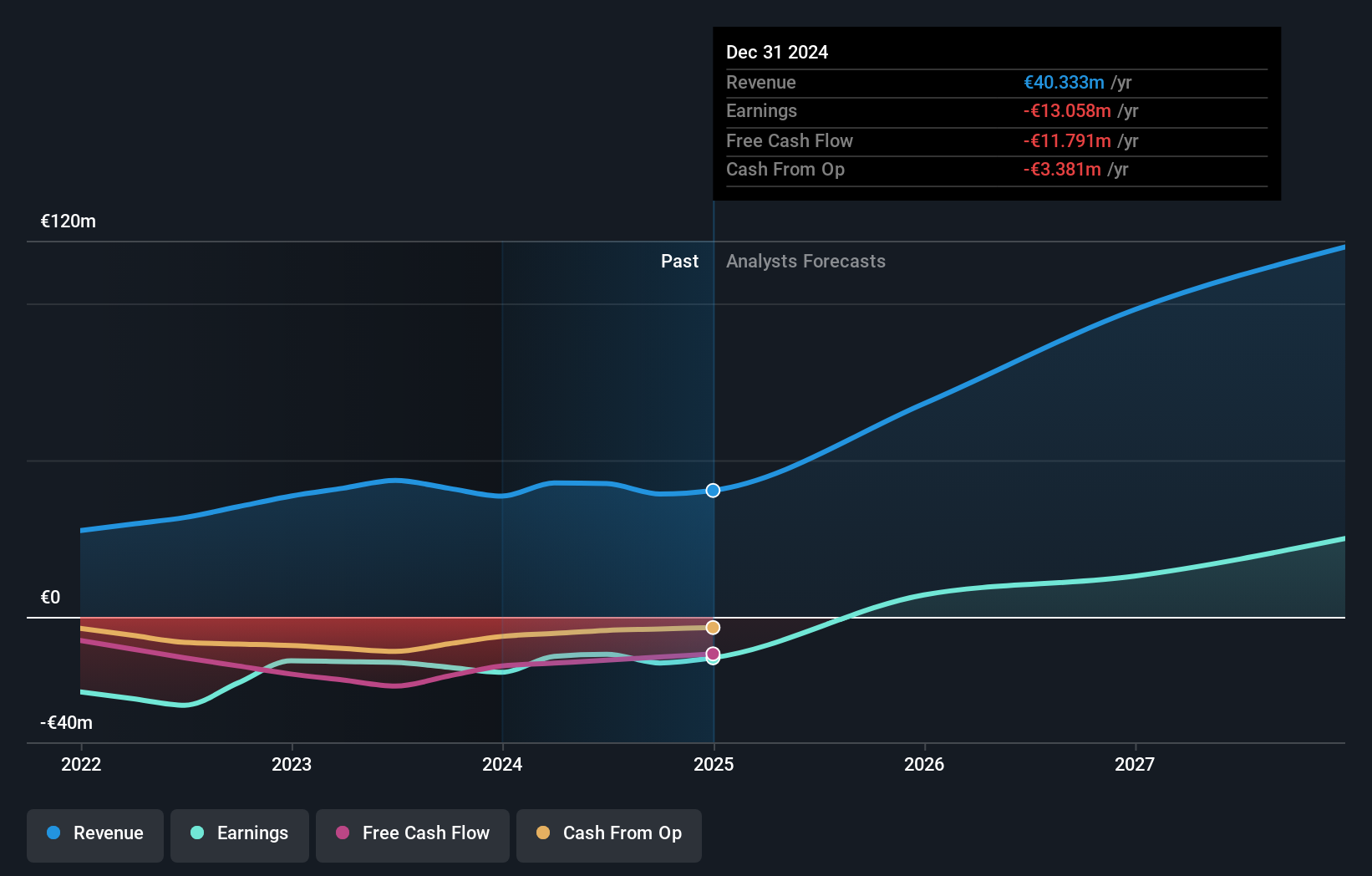

MotorK, a Dutch growth company with high insider ownership, is navigating a challenging phase with its recent financial performance showing a slight decline in quarterly revenue to €11.25 million from €11.43 million year-over-year. Despite this, annual sales increased to €42.94 million from €38.55 million, though the net loss widened to €13.25 million from €7.28 million previously. The company anticipates significant growth with expected Committed Annual Recurring Revenues reaching €50 million for fiscal 2024 and forecasts suggest robust revenue growth of 24% per year and profitability within three years, outpacing average market projections significantly.

- Take a closer look at MotorK's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that MotorK is priced higher than what may be justified by its financials.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.63 billion.

Operations: The company generates revenue primarily through two segments: Packages (€2.25 billion) and Mail in The Netherlands (€1.35 billion).

Insider Ownership: 30.8%

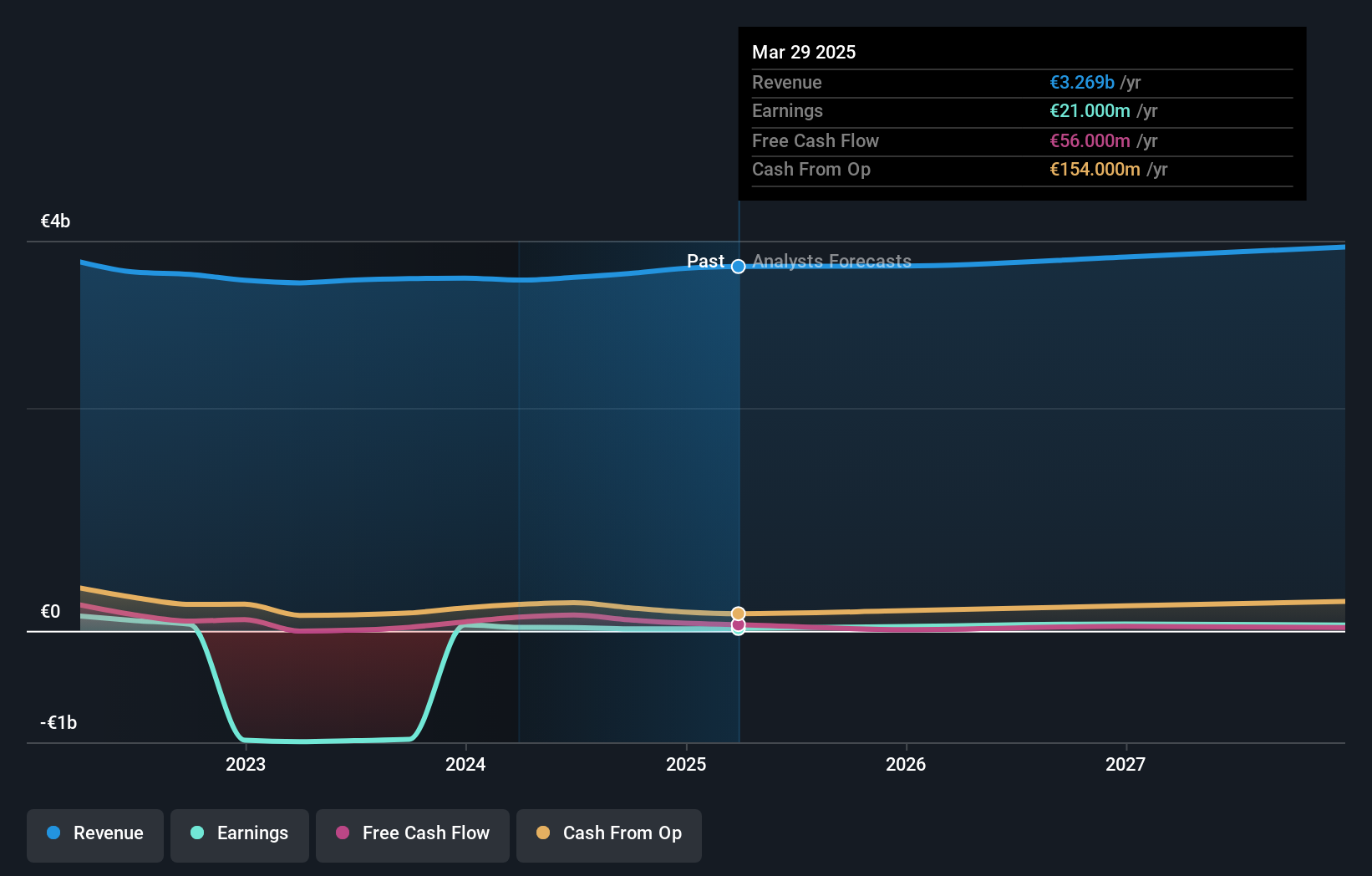

PostNL, a Dutch company with substantial growth in earnings forecasted at 24.3% annually, is set to outpace the local market's average. Despite this promising outlook, it faces challenges like high debt levels and a history of shareholder dilution. Recently, PostNL projected its full-year normalized EBIT between €80 million and €110 million but reported a net loss of €20 million in Q1 2024, indicating volatility in its financial performance. The firm also remains committed to returning value to shareholders with a proposed dividend despite recent losses.

- Unlock comprehensive insights into our analysis of PostNL stock in this growth report.

- Our valuation report unveils the possibility PostNL's shares may be trading at a discount.

Key Takeaways

- Take a closer look at our Fast Growing Euronext Amsterdam Companies With High Insider Ownership list of 5 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Envipco Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, and sells or leases reverse vending machines (RVM) for the collection and processing of used beverage containers primarily in the Netherlands, North America, and Europe.

High growth potential with excellent balance sheet.