Stock Analysis

- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Exploring Three Growth Companies With High Insider Ownership On Euronext Amsterdam

Reviewed by Simply Wall St

Amid fluctuating global markets, the Netherlands continues to present intriguing investment opportunities. As we explore three growth companies with high insider ownership on Euronext Amsterdam, it's essential to consider how such characteristics can contribute to a company's resilience and potential for innovation in today’s economic landscape.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 15.1% | 67.8% |

| Ebusco Holding (ENXTAM:EBUS) | 31.4% | 115.2% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

| PostNL (ENXTAM:PNL) | 30.8% | 24.3% |

Let's uncover some gems from our specialized screener.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines (RVM) for recycling used beverage containers mainly in the Netherlands, North America, and Europe, with a market capitalization of approximately €360.56 million.

Operations: The company primarily generates revenue through the design, development, manufacture, and sale or lease of reverse vending machines in key markets including the Netherlands, North America, and Europe.

Insider Ownership: 15.1%

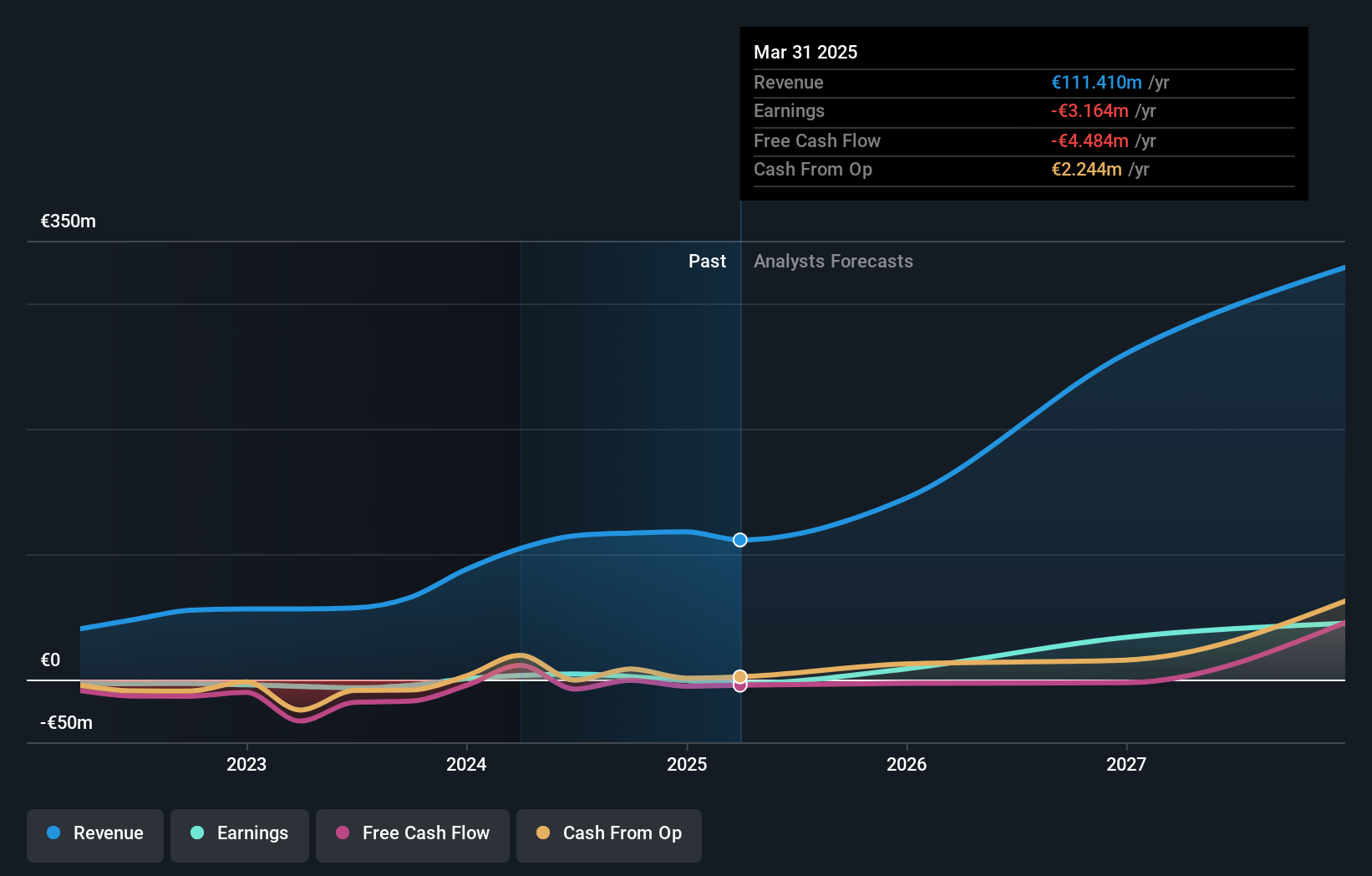

Envipco Holding N.V. has recently transitioned to profitability, with significant revenue and earnings growth outpacing the Dutch market. Despite a highly volatile share price and shareholder dilution over the past year, the company's financial performance is robust, with revenues increasing from €56.37 million to €87.58 million and turning a previous net loss into a profit of €1.42 million annually. However, there's no recent insider buying activity, which might concern investors looking for alignment with management interests.

- Click here and access our complete growth analysis report to understand the dynamics of Envipco Holding.

- In light of our recent valuation report, it seems possible that Envipco Holding is trading beyond its estimated value.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a provider of software-as-a-service solutions tailored for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €270.34 million.

Operations: The company generates €42.94 million from its software and programming segment.

Insider Ownership: 35.8%

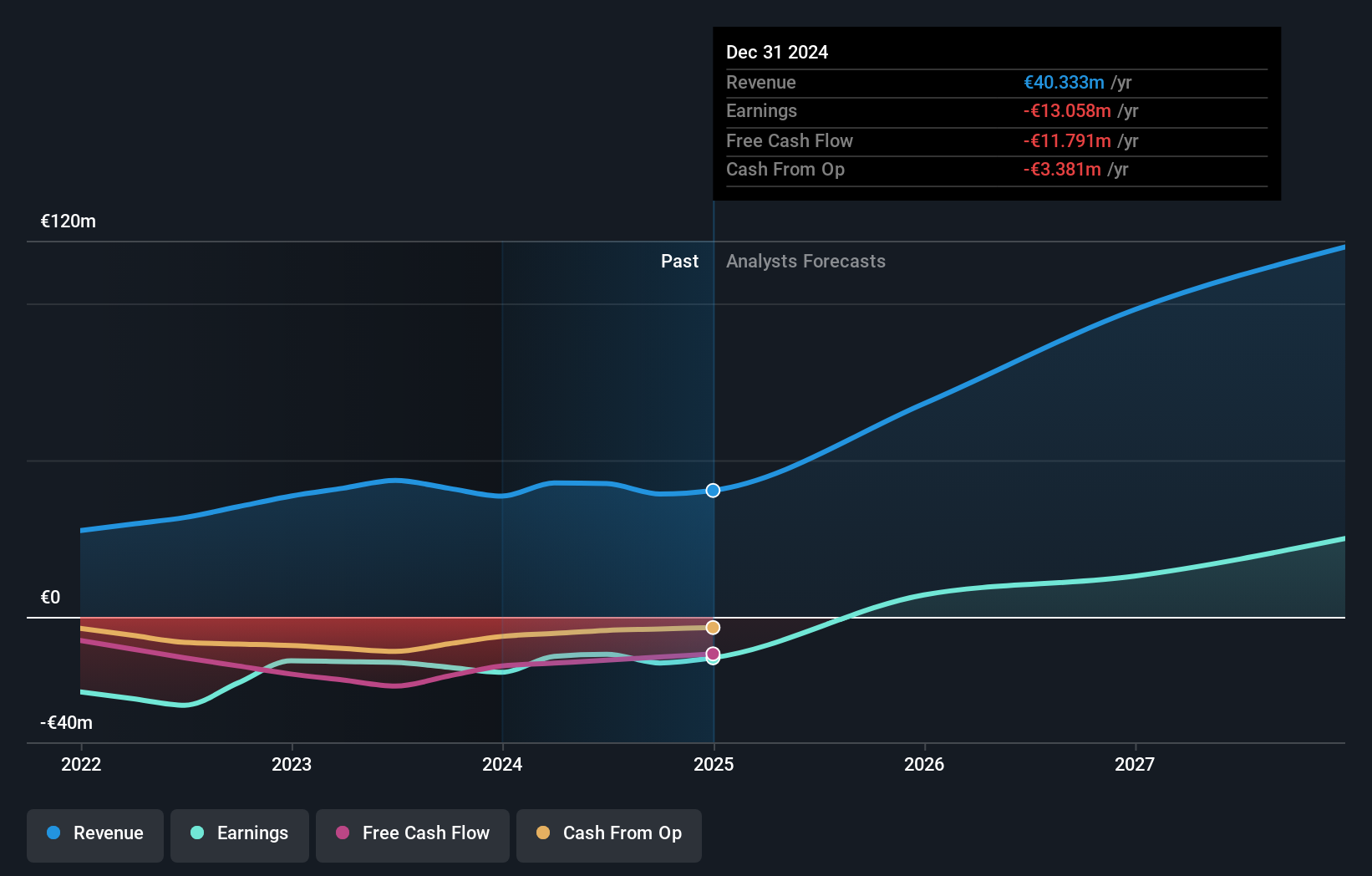

MotorK, a growth-oriented company in the Netherlands, has shown promising trends with its revenue forecast to grow faster than the Dutch market average. Despite a recent dip in quarterly sales from EUR 11.43 million to EUR 11.25 million and an increase in net loss year-over-year from EUR 7.28 million to EUR 13.25 million, MotorK is expected to reach profitability within three years with substantial annual profit growth anticipated. However, investor caution may be advised due to recent executive changes and shareholder dilution over the past year.

- Click to explore a detailed breakdown of our findings in MotorK's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of MotorK shares in the market.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.63 billion.

Operations: The company's revenue is primarily derived from its Packages and Mail in The Netherlands segments, generating €2.25 billion and €1.35 billion respectively.

Insider Ownership: 30.8%

PostNL, a Dutch postal service, faces challenges with a recent net loss of €20 million in Q1 2024 and declining sales from €780 million to €763 million year-over-year. Despite these setbacks, PostNL has shown recovery signs with an annual profit growth forecast of 24.3% and high expected return on equity in three years. The company maintains an unstable dividend record but has committed to a dividend per share of €0.09 for the year, reflecting confidence in future performance despite its high debt levels.

- Unlock comprehensive insights into our analysis of PostNL stock in this growth report.

- Our valuation report here indicates PostNL may be undervalued.

Where To Now?

- Unlock our comprehensive list of 5 Fast Growing Euronext Amsterdam Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Envipco Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, and sells or leases reverse vending machines (RVM) for the collection and processing of used beverage containers primarily in the Netherlands, North America, and Europe.

High growth potential with excellent balance sheet.