- Netherlands

- /

- Telecom Services and Carriers

- /

- ENXTAM:KPN

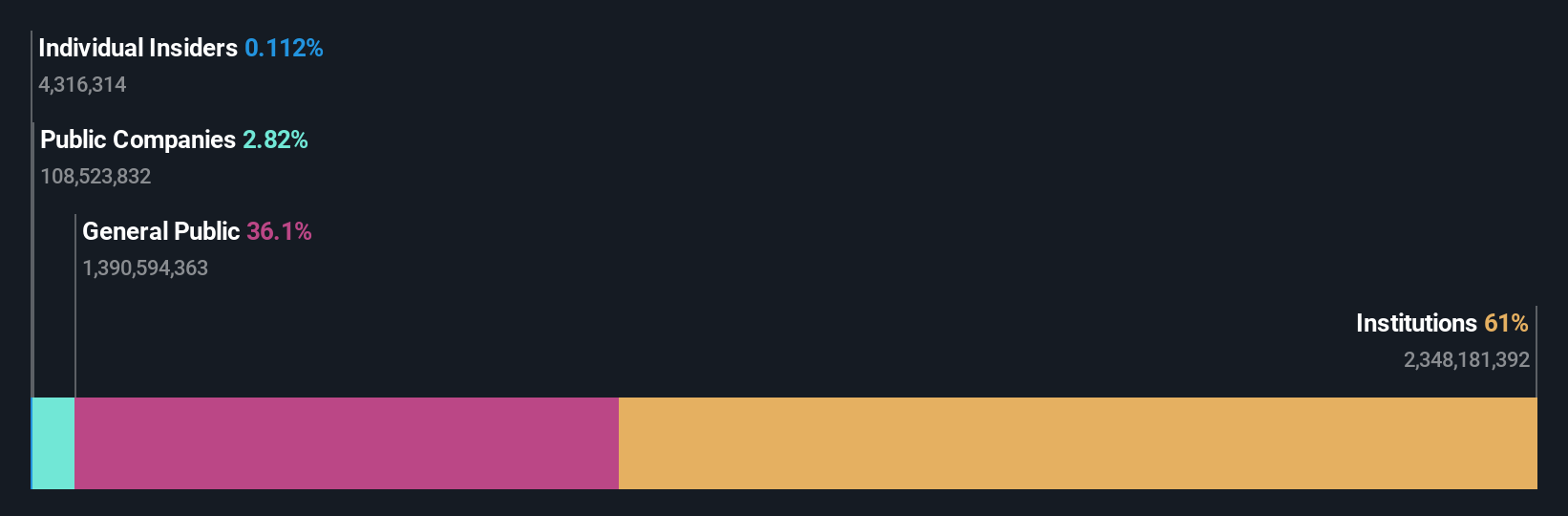

With 61% ownership of the shares, Koninklijke KPN N.V. (AMS:KPN) is heavily dominated by institutional owners

Key Insights

- Institutions' substantial holdings in Koninklijke KPN implies that they have significant influence over the company's share price

- 50% of the business is held by the top 25 shareholders

- Ownership research along with analyst forecasts data help provide a good understanding of opportunities in a stock

Every investor in Koninklijke KPN N.V. (AMS:KPN) should be aware of the most powerful shareholder groups. With 61% stake, institutions possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Given the vast amount of money and research capacities at their disposal, institutional ownership tends to carry a lot of weight, especially with individual investors. Therefore, a good portion of institutional money invested in the company is usually a huge vote of confidence on its future.

In the chart below, we zoom in on the different ownership groups of Koninklijke KPN.

See our latest analysis for Koninklijke KPN

What Does The Institutional Ownership Tell Us About Koninklijke KPN?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

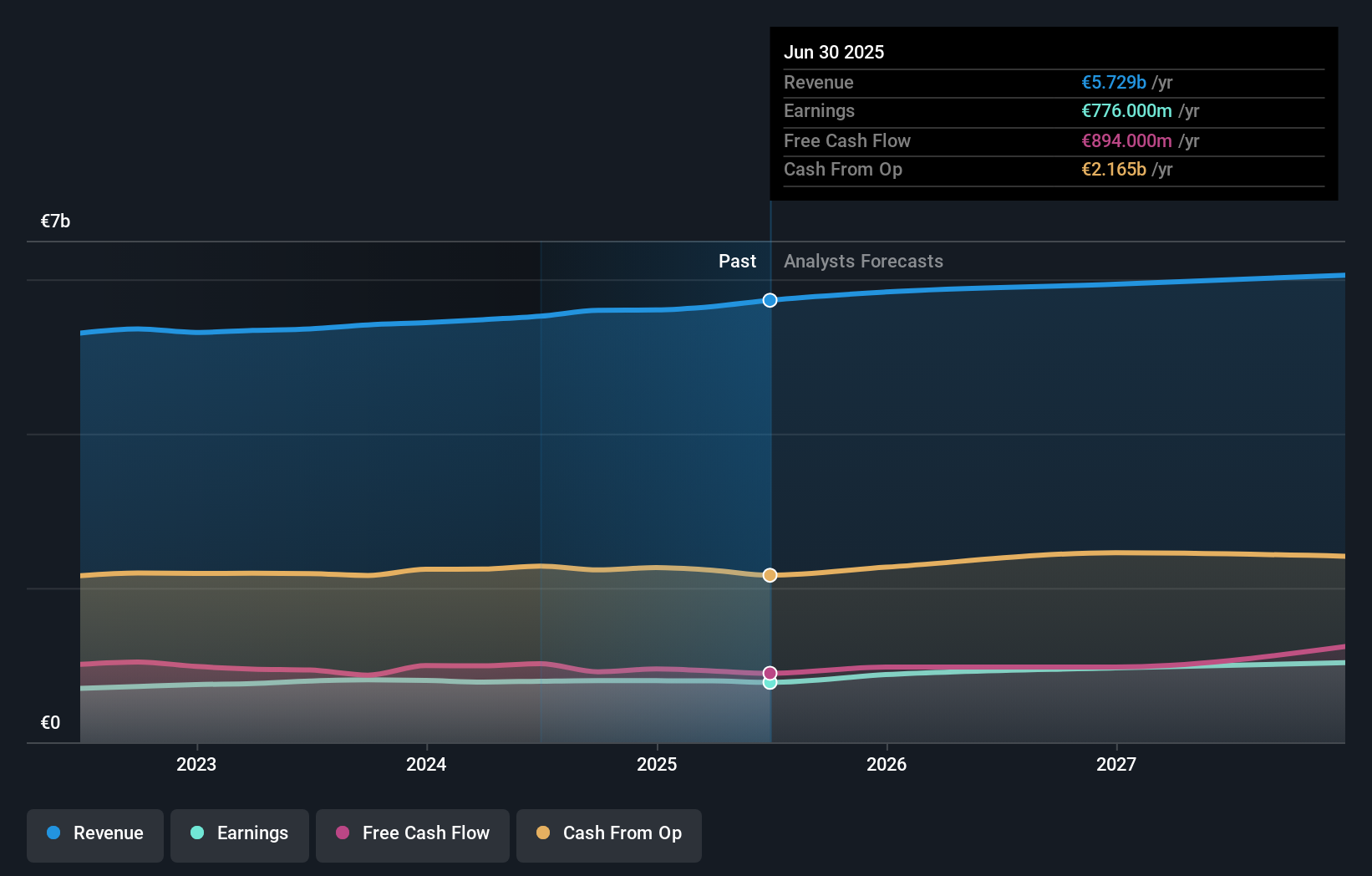

We can see that Koninklijke KPN does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Koninklijke KPN, (below). Of course, keep in mind that there are other factors to consider, too.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. We note that hedge funds don't have a meaningful investment in Koninklijke KPN. The company's largest shareholder is BlackRock, Inc., with ownership of 6.5%. The Vanguard Group, Inc. is the second largest shareholder owning 4.5% of common stock, and Capital Research and Management Company holds about 3.7% of the company stock.

Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Koninklijke KPN

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own less than 1% of Koninklijke KPN N.V.. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own €18m worth of shares (at current prices). Arguably recent buying and selling is just as important to consider. You can click here to see if insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 36% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Koninklijke KPN , and understanding them should be part of your investment process.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke KPN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:KPN

Koninklijke KPN

Provides telecommunications and information technology (IT) services in the Netherlands.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives