- Netherlands

- /

- Software

- /

- ENXTAM:TOM2

Why Investors Shouldn't Be Surprised By TomTom N.V.'s (AMS:TOM2) Low P/S

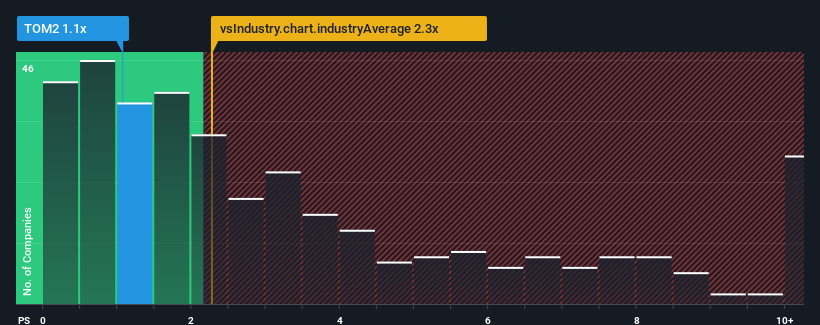

TomTom N.V.'s (AMS:TOM2) price-to-sales (or "P/S") ratio of 1.1x might make it look like a buy right now compared to the Software industry in the Netherlands, where around half of the companies have P/S ratios above 2.3x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for TomTom

What Does TomTom's Recent Performance Look Like?

TomTom hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TomTom.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as TomTom's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 3.5% over the next year. That's not great when the rest of the industry is expected to grow by 11%.

With this in consideration, we find it intriguing that TomTom's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does TomTom's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of TomTom's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, TomTom's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for TomTom that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TomTom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:TOM2

TomTom

Develops and sells navigation and location-based products and services in Europe, the Americas, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives