As European markets remain relatively stable, with the pan-European STOXX Europe 600 Index ending roughly flat amid ongoing trade discussions, investors are keenly observing opportunities within smaller market segments. Penny stocks, often associated with smaller or newer companies, continue to capture attention due to their potential for growth and affordability. Despite being considered a somewhat outdated term, these stocks can still present viable investment options when supported by strong financial health.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.43 | €45.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.87 | €60.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.99 | €18.66M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.40 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.24 | SEK3.1B | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.91M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 335 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hove (CPSE:HOVE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hove A/S develops, produces, and supplies advanced lubrication solutions for heavy machinery both in Denmark and internationally, with a market cap of DKK90.79 million.

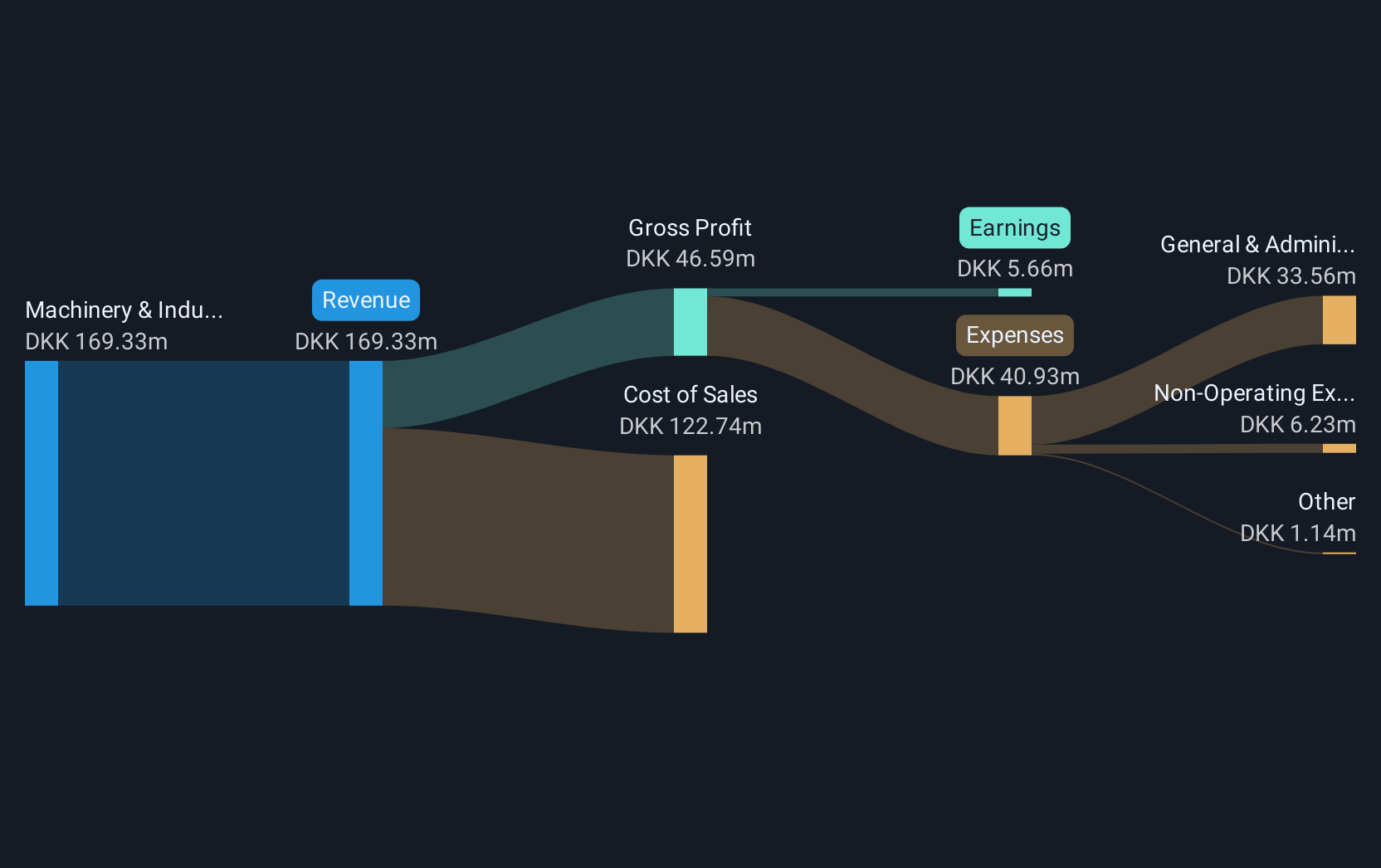

Operations: The company's revenue is derived entirely from its Machinery & Industrial Equipment segment, amounting to DKK169.33 million.

Market Cap: DKK90.79M

Hove A/S, with a market cap of DKK90.79 million, has shown significant order activity in recent months, securing multiple large orders from global wind OEMs and other clients. Despite its relatively low return on equity at 7.1%, the company has demonstrated strong earnings growth of 58.4% over the past year, surpassing industry averages. However, Hove faces challenges such as high share price volatility and negative operating cash flow impacting debt coverage. The company's strategic focus on the wind energy sector is underscored by successful deployments of its IoT solution, Hove Smart Lube, enhancing operational efficiency in renewable energy markets.

- Navigate through the intricacies of Hove with our comprehensive balance sheet health report here.

- Assess Hove's previous results with our detailed historical performance reports.

MKB Nedsense (ENXTAM:NEDSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MKB Nedsense N.V. operates in the financing and lending sector, providing funds to individuals and legal entities, with a market cap of €9.50 million.

Operations: The company's revenue segment includes CAD/CAM Software, which generated -€0.022 million.

Market Cap: €9.5M

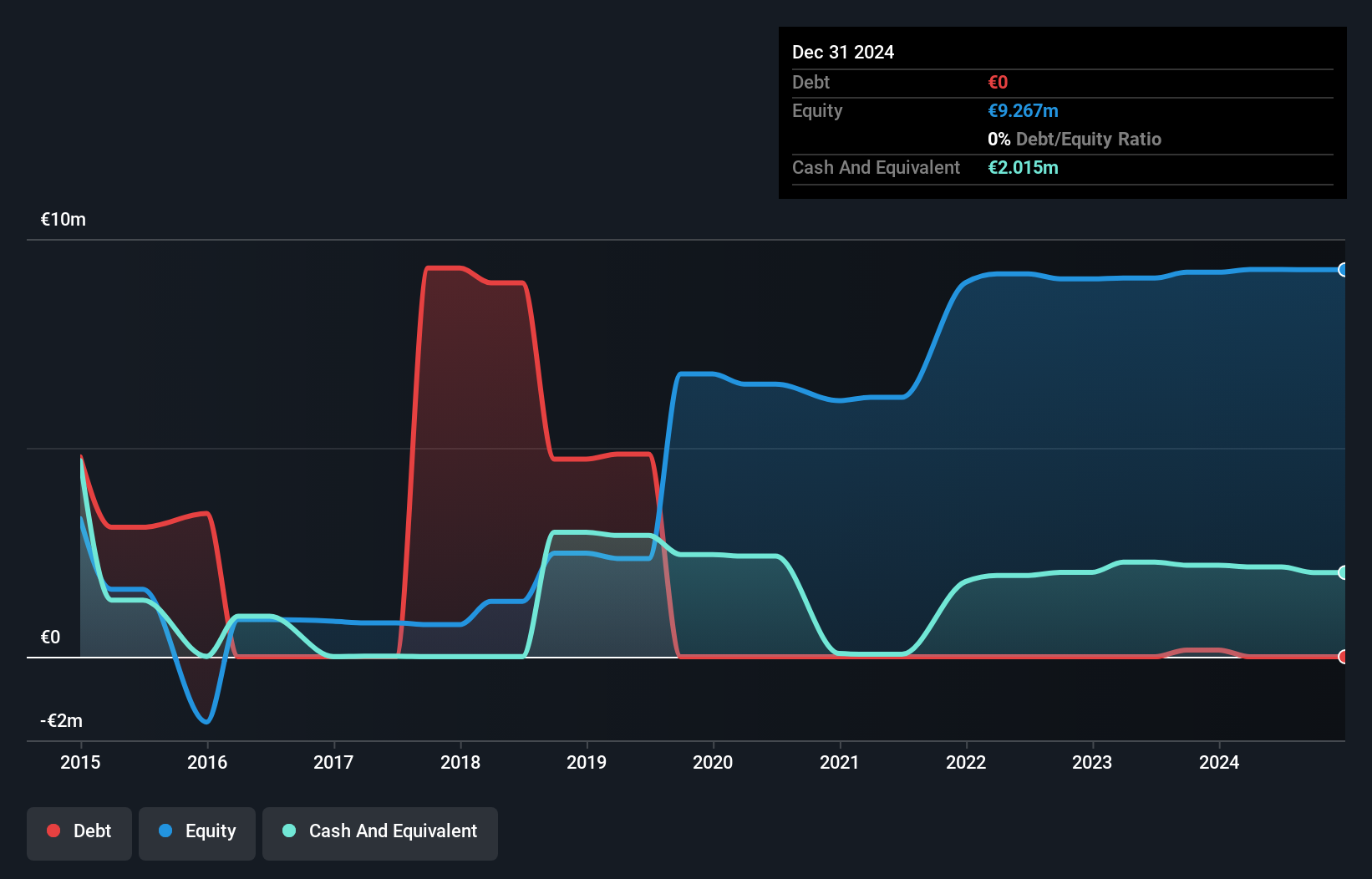

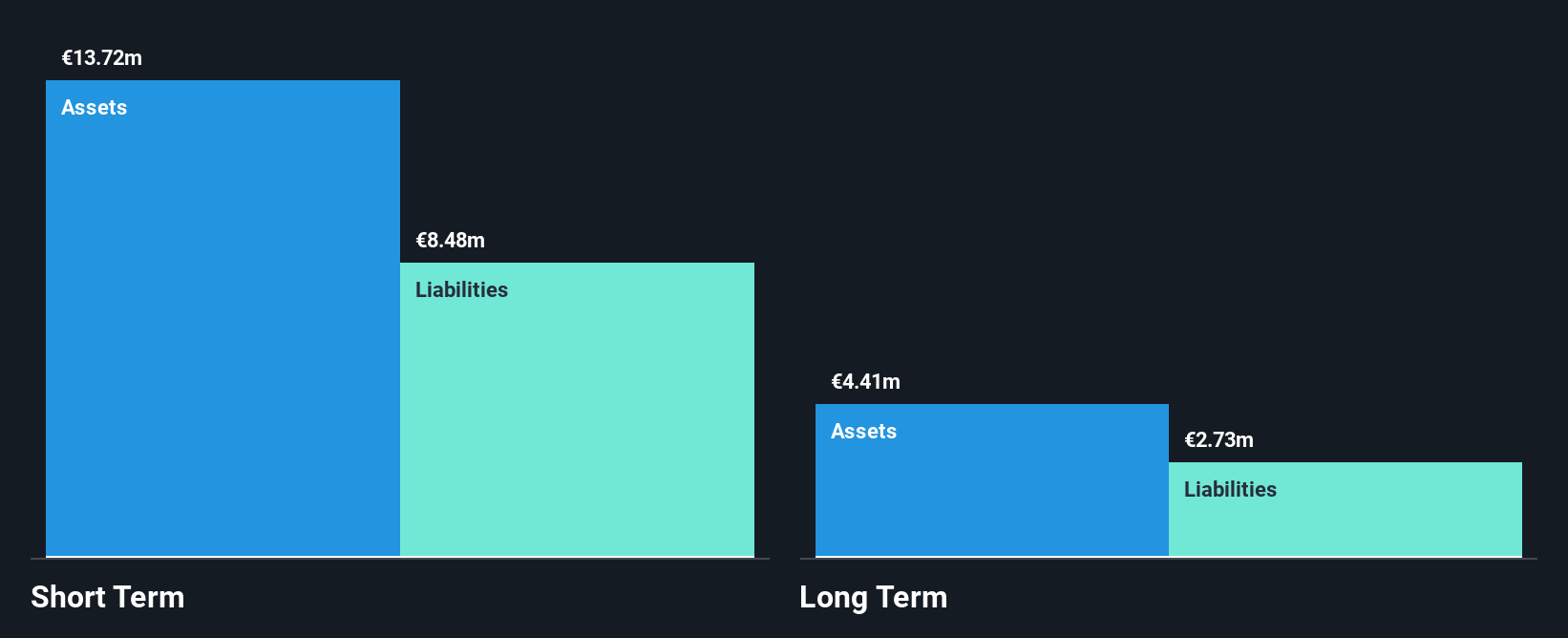

MKB Nedsense N.V., with a market cap of €9.50 million, operates debt-free and has short-term assets (€4.4M) comfortably covering its liabilities (€379K). However, it is pre-revenue with negative revenue of -€0.022 million for 2024 and declining net income from €0.158 million to €0.064 million year-on-year, reflecting challenges in achieving profitability. The company's return on equity is low at 0.7%, and profit margins have deteriorated significantly to -290.9%. Despite high-quality earnings reported over the past five years, recent volatility in share price remains a concern for investors considering penny stocks like MKB Nedsense.

- Click to explore a detailed breakdown of our findings in MKB Nedsense's financial health report.

- Evaluate MKB Nedsense's historical performance by accessing our past performance report.

Miliboo Société anonyme (ENXTPA:ALMLB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Miliboo Société anonyme designs and sells modular and customizable furniture in Paris and internationally, with a market cap of €10.24 million.

Operations: The company generates revenue of €40.55 million from its online retail operations.

Market Cap: €10.24M

Miliboo Société anonyme, with a market cap of €10.24 million, generates €40.55 million in revenue through its online retail operations. Despite negative earnings growth recently and a decline in net profit margins from 4% to 3.2%, the company has become profitable over the past five years with earnings growing by 33.3% annually. The board is experienced, and short-term assets exceed both short-term and long-term liabilities, indicating solid financial management. With more cash than debt and interest payments well covered by EBIT, Miliboo's financial stability is noteworthy for investors exploring penny stocks despite its high volatility.

- Take a closer look at Miliboo Société anonyme's potential here in our financial health report.

- Review our growth performance report to gain insights into Miliboo Société anonyme's future.

Turning Ideas Into Actions

- Click this link to deep-dive into the 335 companies within our European Penny Stocks screener.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hove might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:HOVE

Hove

Develops, produces, and supplies advanced lubrication solutions for heavy machinery in Denmark and inetrnationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion