As European markets experience a notable upswing, with the STOXX Europe 600 Index climbing 1.68% and major indices across Germany, Italy, France, and the UK showing positive momentum, investors are increasingly focused on growth opportunities within this vibrant economic landscape. In such an environment, companies that exhibit strong insider ownership often stand out as attractive prospects due to their potential for aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's explore several standout options from the results in the screener.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, with a market cap of €227.87 million, offers software-as-a-service solutions to the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company generates €40.62 million in revenue from its Software & Programming segment, serving the automotive retail industry across several European countries.

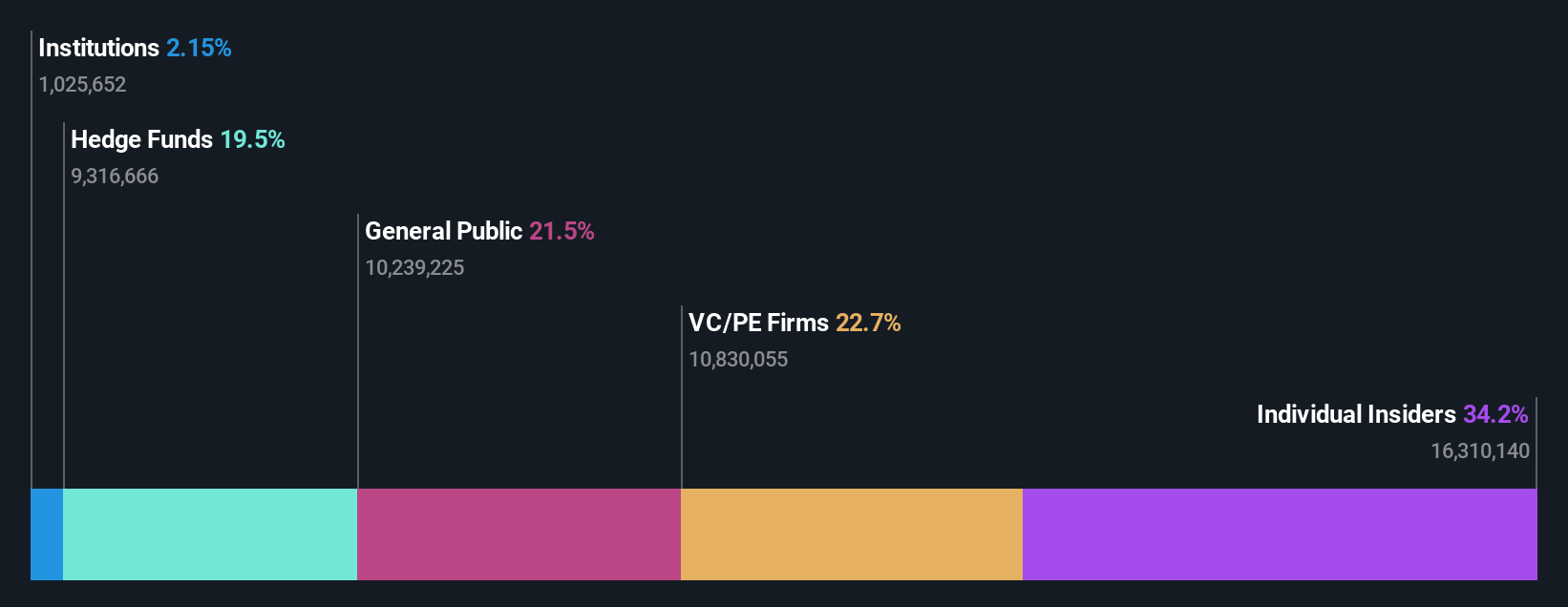

Insider Ownership: 33.4%

MotorK is positioned as a growth company with high insider ownership, reflected in its forecasted revenue growth of 37% annually, outpacing the Dutch market's 7.8%. Despite a volatile share price recently and limited cash runway, MotorK is expected to become profitable within three years with earnings projected to grow by 91.27% annually. Recent corporate guidance confirms commitment to achieving low single-digit revenue growth for fiscal year 2025.

- Navigate through the intricacies of MotorK with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility MotorK's shares may be trading at a premium.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★★

Overview: MedinCell S.A. is a pharmaceutical company in France that develops long-acting injectables across various therapeutic areas, with a market cap of €1.21 billion.

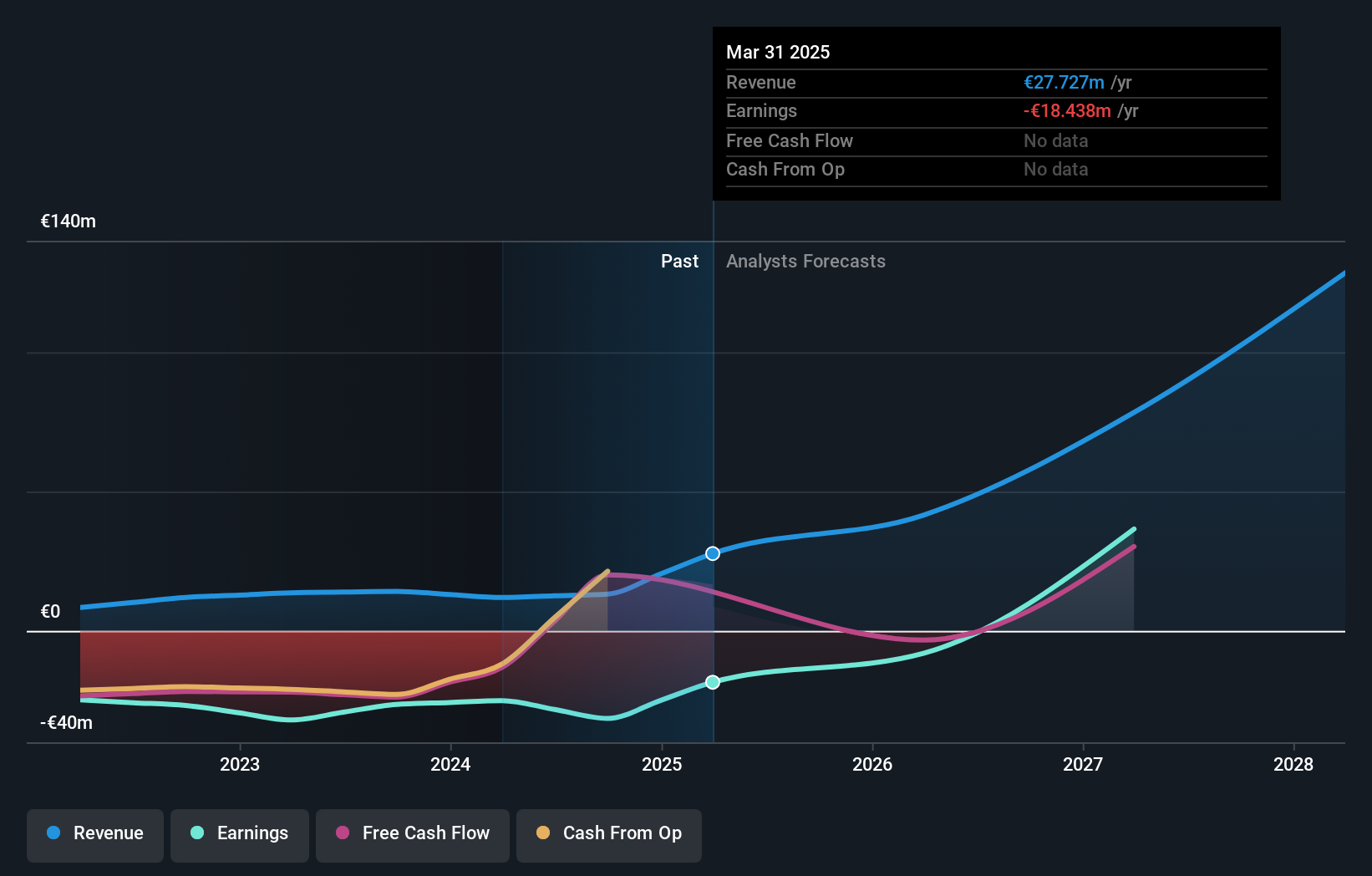

Operations: MedinCell generates revenue primarily from conducting research and development on biodegradable polymer-based processes, amounting to €27.73 million.

Insider Ownership: 12.5%

MedinCell exhibits characteristics of a growth company with significant insider ownership, highlighted by its forecasted revenue growth of 35.1% annually, surpassing the French market's average. The company's recent FDA approval for UZEDY® for bipolar I disorder and schizophrenia enhances its commercial prospects. Despite negative shareholders' equity, MedinCell is expected to achieve profitability within three years, supported by innovative drug delivery technologies and strategic partnerships with Teva Pharmaceuticals.

- Click here to discover the nuances of MedinCell with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that MedinCell is trading beyond its estimated value.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atea ASA delivers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK16.84 billion.

Operations: Atea's revenue is primarily derived from its operations in Sweden (NOK13.73 billion), Norway (NOK9.27 billion), Denmark (NOK8.56 billion), Finland (NOK3.48 billion), and the Baltics (NOK1.90 billion).

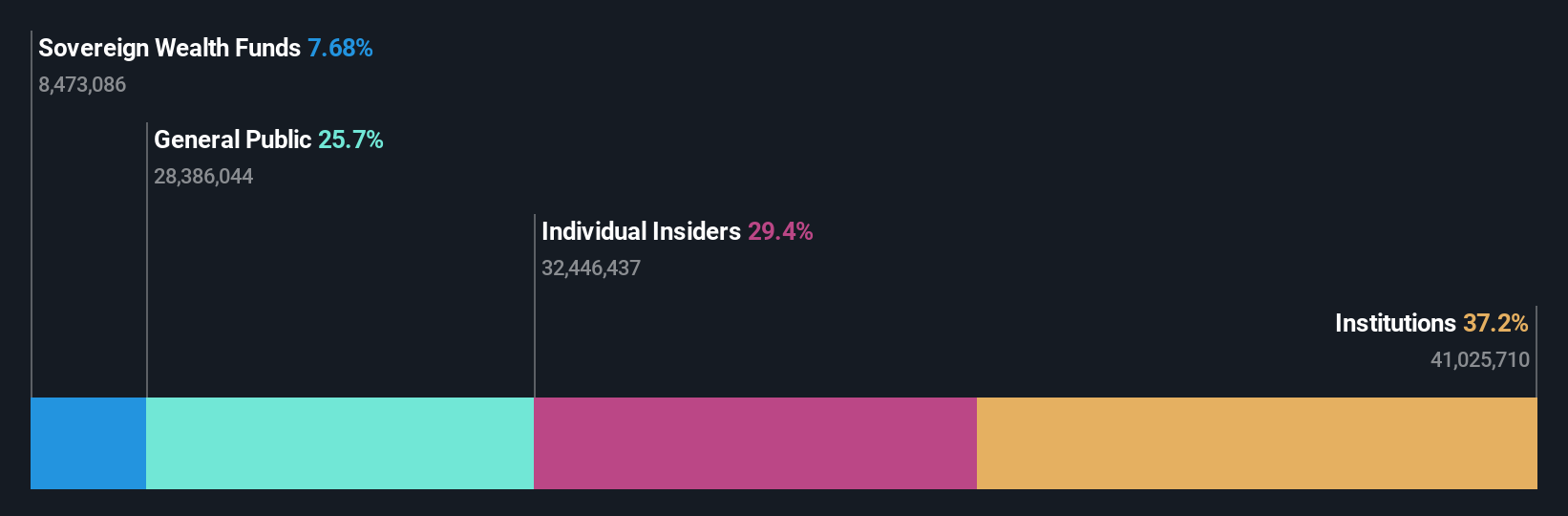

Insider Ownership: 29.1%

Atea ASA demonstrates growth potential with its forecasted earnings growth of 23.4% annually, outpacing the Norwegian market average. The company reaffirmed its 2025 guidance, projecting gross sales at the high end of NOK 57 billion to NOK 60 billion and EBIT in the middle range of NOK 1.33 billion to NOK 1.45 billion. Despite a dividend yield not fully covered by earnings, Atea's share repurchase program indicates confidence in its valuation and future prospects.

- Click to explore a detailed breakdown of our findings in Atea's earnings growth report.

- Our valuation report unveils the possibility Atea's shares may be trading at a discount.

Taking Advantage

- Explore the 192 names from our Fast Growing European Companies With High Insider Ownership screener here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives