- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

3 Euronext Amsterdam Growth Stocks With High Insider Ownership And Up To 108% Earnings Growth

Reviewed by Simply Wall St

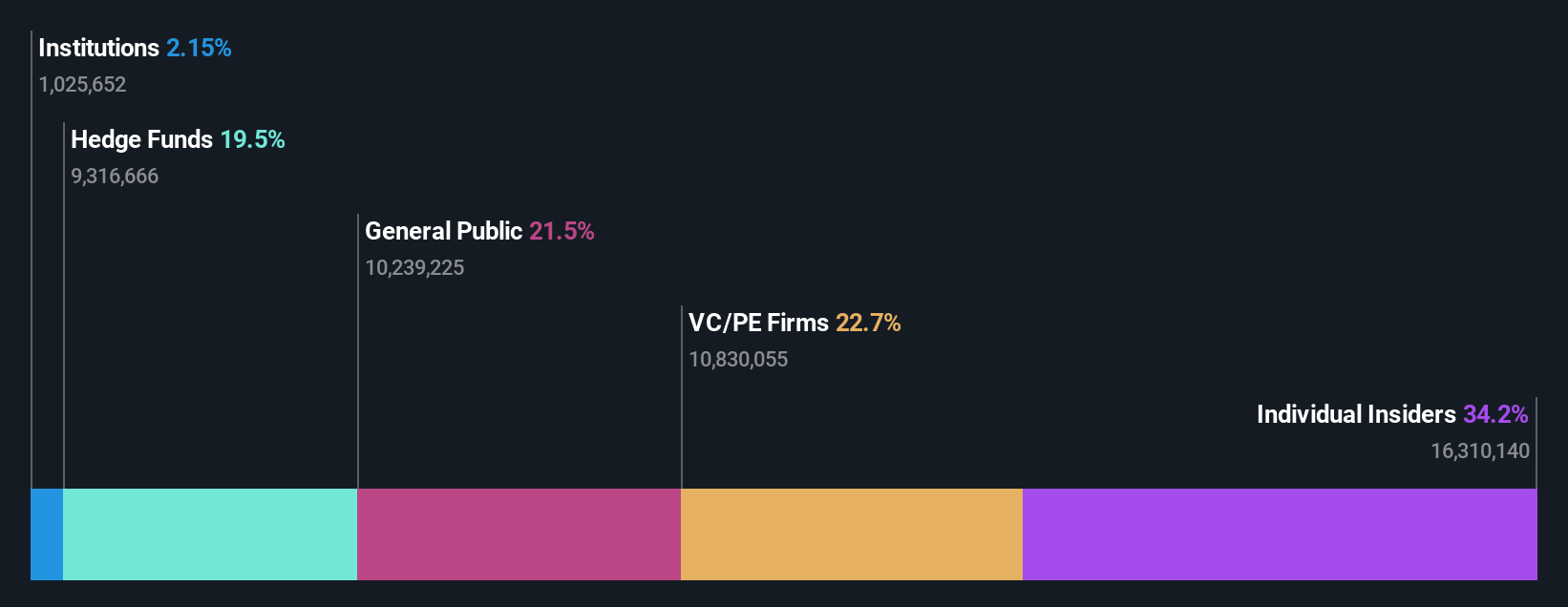

The Euronext Amsterdam market has been navigating a complex landscape marked by economic uncertainties and fluctuating consumer demand, reflective of broader trends in Europe. Despite these challenges, certain growth companies with high insider ownership have demonstrated resilience and potential for significant earnings growth. In this environment, stocks with strong internal commitment often stand out as promising opportunities. High insider ownership can signal confidence from those closest to the company's operations and strategy, making them particularly noteworthy amid current market conditions.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 69.8% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 107.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 78.3% |

| MotorK (ENXTAM:MTRK) | 35.8% | 108.4% |

| PostNL (ENXTAM:PNL) | 35.8% | 36.4% |

We're going to check out a few of the best picks from our screener tool.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

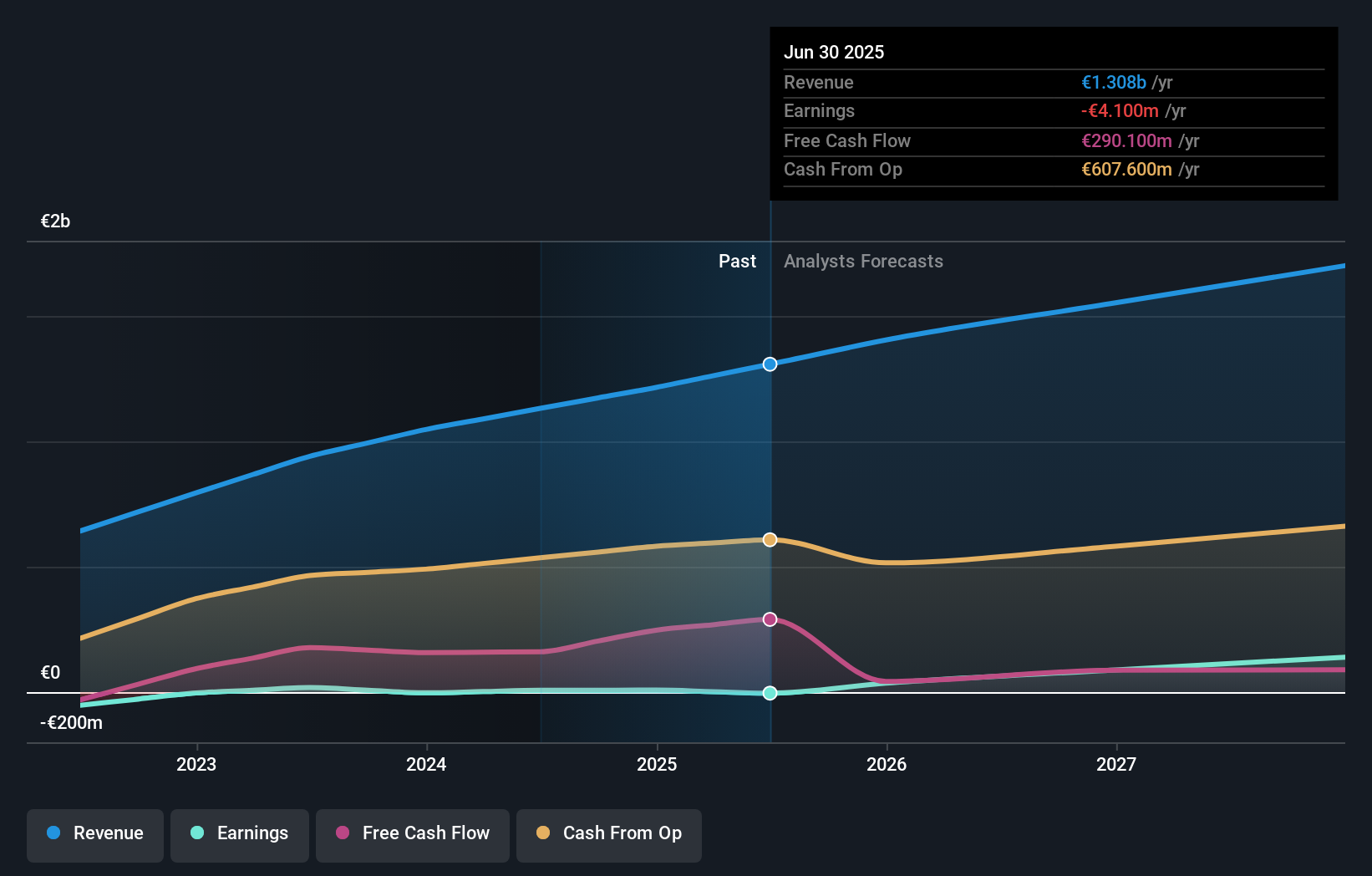

Overview: Basic-Fit N.V., with a market cap of €1.50 billion, operates fitness clubs through its subsidiaries.

Operations: The company's revenue segments are comprised of €505.17 million from Benelux and €626.41 million from France, Spain, and Germany.

Insider Ownership: 12%

Earnings Growth Forecast: 78.3% p.a.

Basic-Fit N.V. has shown promising growth with recent half-year earnings reporting sales of €584.76 million, up from €500.42 million a year ago, and net income of €4.18 million compared to a net loss previously. Insider transactions have seen more buying than selling in the past three months, albeit in modest volumes. Despite lower profit margins and high share price volatility, analysts forecast significant annual earnings growth of 78.3%, outpacing the Dutch market's 19.5%.

- Click here to discover the nuances of Basic-Fit with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Basic-Fit is priced higher than what may be justified by its financials.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines for collecting and processing used beverage containers primarily in the Netherlands, North America, and Europe with a market cap of €320.18 million.

Operations: Envipco Holding generates revenue from the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers in the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Earnings Growth Forecast: 69.8% p.a.

Envipco Holding has demonstrated significant growth potential, with earnings forecasted to grow at 69.83% annually, outpacing the Dutch market's 19.5%. Recent earnings reports show a substantial increase in sales to €54.01 million for the first half of 2024, reducing net losses significantly from €4.37 million to €0.406 million year-over-year. Insider transactions have seen more buying than selling recently, indicating confidence in future performance despite high share price volatility and past shareholder dilution.

- Delve into the full analysis future growth report here for a deeper understanding of Envipco Holding.

- Upon reviewing our latest valuation report, Envipco Holding's share price might be too optimistic.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

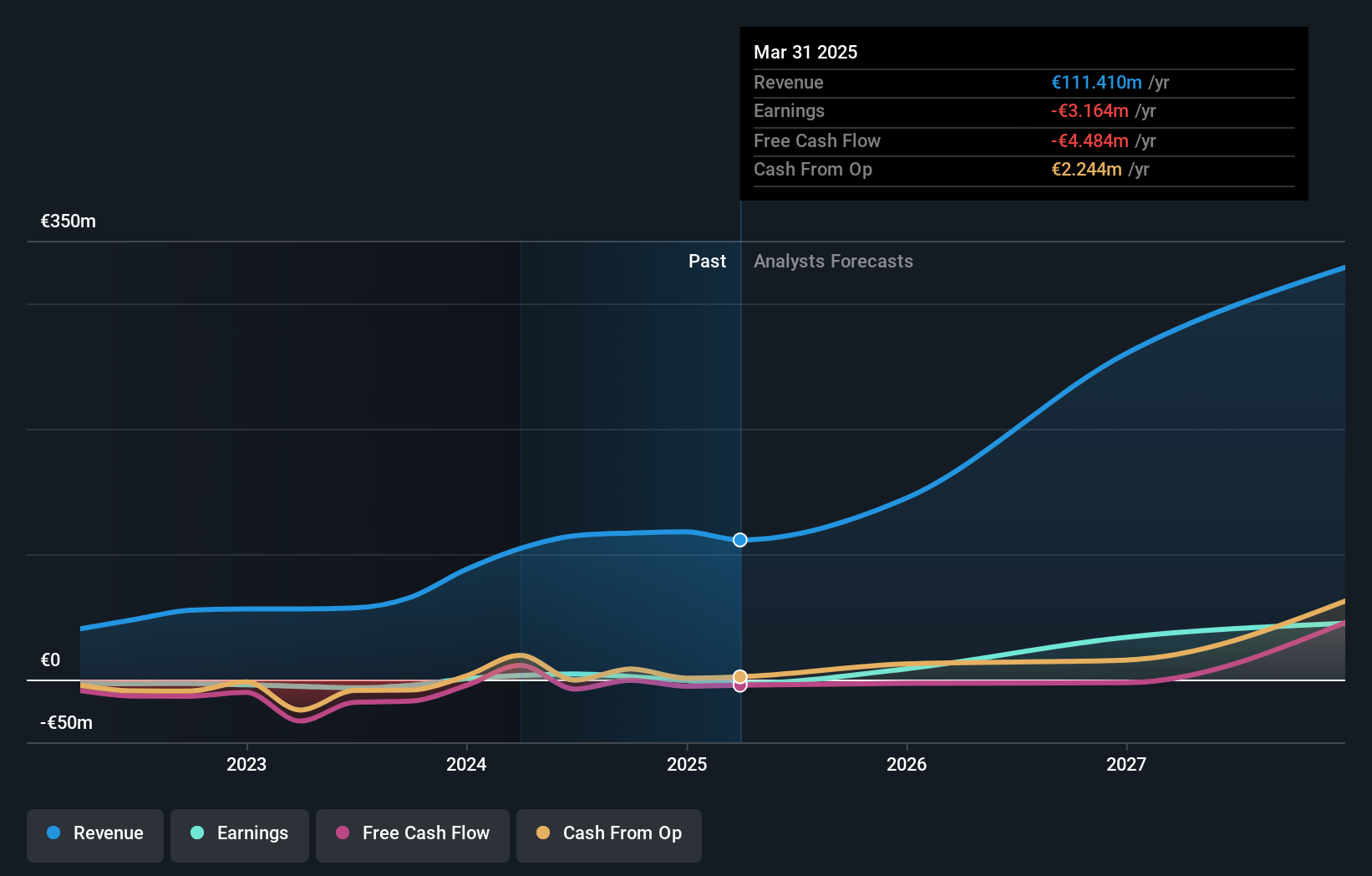

Overview: MotorK plc, with a market cap of €268.97 million, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company's revenue segment is primarily derived from Software & Programming, amounting to €42.50 million.

Insider Ownership: 35.8%

Earnings Growth Forecast: 108.4% p.a.

MotorK is forecast to grow revenue at 22.1% per year, outpacing the Dutch market's 9.8%. Despite current unprofitability, it is expected to become profitable within three years with earnings growth projected at 108.44% annually. Recent financial results show a slight sales decline to €21.46 million and a reduced net loss of €6.48 million for H1 2024. Insider ownership remains high, though there has been shareholder dilution in the past year and limited cash runway under one year.

- Unlock comprehensive insights into our analysis of MotorK stock in this growth report.

- According our valuation report, there's an indication that MotorK's share price might be on the expensive side.

Taking Advantage

- Embark on your investment journey to our 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential slight.