- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

Does Surging Demand for High NA EUV Machines Reinforce the ASML (ENXTAM:ASML) Bull Case?

Reviewed by Sasha Jovanovic

- In November 2025, ASML Holding made presentations at key technology conferences in Barcelona and Hong Kong, highlighting advances in its High NA EUV lithography platforms, which underpin leading-edge semiconductor manufacturing for AI chips.

- This reinforced ASML's position as the sole global provider of advanced EUV technology, a major driver behind recent increases in analyst confidence and interest from institutional investors.

- Now, we'll explore how the rising demand for High NA EUV machines strengthens ASML's long-term investment story and growth outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ASML Holding Investment Narrative Recap

To be a shareholder in ASML today, you need confidence that the company’s leading-edge EUV and High NA lithography systems will remain indispensable in advanced chip manufacturing, securing sustained demand amid evolving technology cycles and competition. The recent technology conference presentations reaffirm ASML’s technological leadership but are not likely to materially alter the short-term catalyst, broad AI-driven demand for High NA EUV systems, or reduce exposure to geopolitical and tariff risks, which remain the biggest overhangs.

Among recent announcements, ASML’s Q3 2025 earnings report stands out, showing rising revenue and net income. This performance gives context to the company’s conference messaging about High NA EUV advances; robust financial momentum and strong customer adoption could reinforce ASML’s growth outlook, powering expectations for continued earnings and margin expansion as it ramps up production and delivery of new systems.

However, investors should also consider that, despite solid operational momentum, ongoing concerns about export controls and China’s access to ASML’s technology remain an ever-present risk...

Read the full narrative on ASML Holding (it's free!)

ASML Holding's outlook points to €39.6 billion in revenue and €12.1 billion in earnings by 2028. This implies annual revenue growth of 7.2% and an earnings increase of €2.7 billion from current earnings of €9.4 billion.

Uncover how ASML Holding's forecasts yield a €941.90 fair value, a 6% upside to its current price.

Exploring Other Perspectives

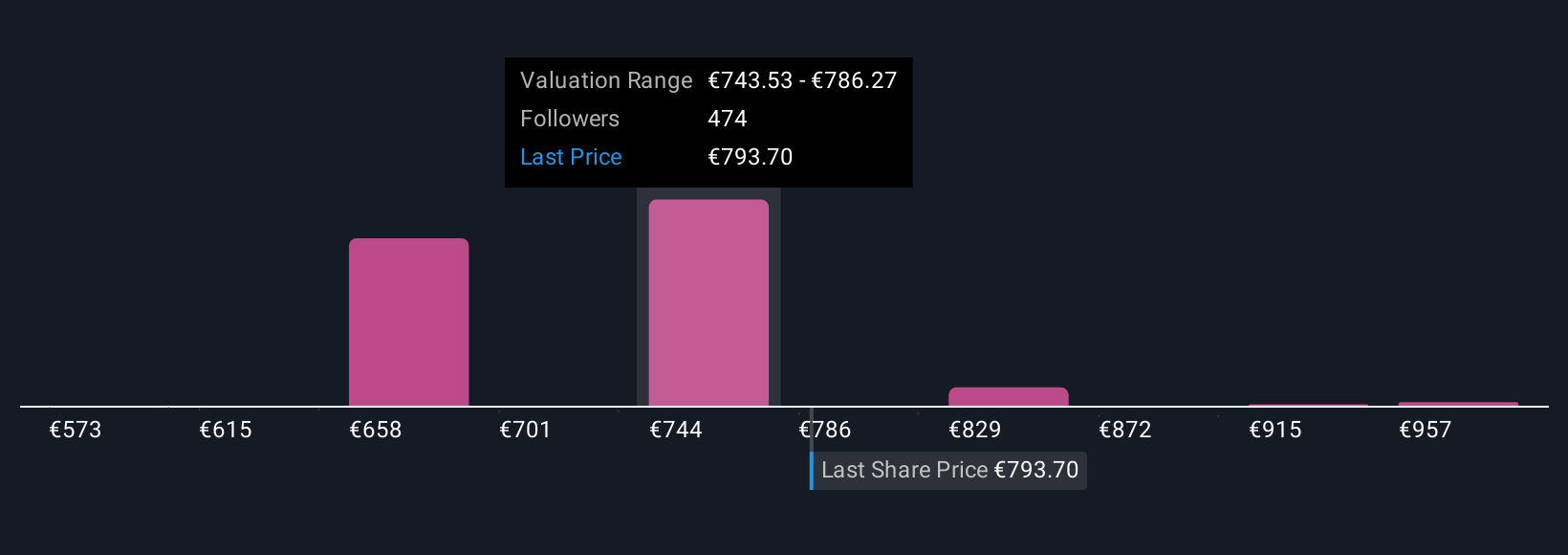

Eighty-three individual fair value estimates from the Simply Wall St Community span €572.55 to €1,000, with viewpoints at both extremes. While community perspectives vary, persistent geopolitical risk highlights how external factors could influence ASML’s performance, explore the full range of opinions and analysis.

Explore 83 other fair value estimates on ASML Holding - why the stock might be worth 36% less than the current price!

Build Your Own ASML Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASML Holding research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ASML Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASML Holding's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives