- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

ASML (ENXTAM:ASML): How the New South Korea R&D Campus Shapes the Valuation of This Semiconductor Linchpin

Reviewed by Simply Wall St

ASML Holding (ENXTAM:ASML) has just opened a massive R&D campus in South Korea, designed to boost collaboration with Samsung and SK hynix. This strategic initiative aims to accelerate advanced lithography, especially High-NA EUV tools.

See our latest analysis for ASML Holding.

ASML’s R&D push in South Korea adds momentum to a year already marked by robust performance and rapid innovation. Despite some choppiness this week, the stock’s 38% share price return over the past 90 days reflects building optimism about demand for its EUV tools. One-year total shareholder return has outpaced most of the sector. Ongoing export restrictions may temper bullishness, but long-term investors have enjoyed a remarkable 160% five-year total return as ASML cements its position at the heart of next-gen chipmaking.

If the excitement around ASML’s growth has you thinking bigger, it could be the right time to discover See the full list for free.

With elevated expectations already reflected in ASML's soaring valuation, investors must now weigh whether all that future innovation is already priced in or if there is still a genuine buying opportunity left on the table.

Most Popular Narrative: 11.8% Undervalued

At a last close of €881.50, the leading narrative by Investingwilly argues that ASML’s fair value should be much higher, setting the stage for a potentially sizable upside in the months ahead. The valuation suggests the market may not fully appreciate ASML’s long-term growth engine.

ASML Holding N.V. is a Dutch company and the world’s only supplier of extreme ultraviolet (EUV) lithography machines, a critical technology used to produce the world’s most advanced computer chips. These machines are essential for manufacturing cutting-edge semiconductors found in everything from AI chips and smartphones to data centers and advanced computing systems. ASML’s customers include industry giants like TSMC, Intel, and Samsung.

Want a look under the hood of this bullish price target? The narrative hinges on ambitious expansion and persistent leadership in a technology only one company on Earth can offer. There is a bold profit outlook, aggressive reinvestment, and a long runway in next-gen chip manufacturing. Ready to discover what really drives that fair value?

Result: Fair Value of €1000 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions and the possibility of stalled sales growth in 2026 could quickly challenge this optimism about ASML’s outlook.

Find out about the key risks to this ASML Holding narrative.

Another View: What Does the SWS DCF Model Say?

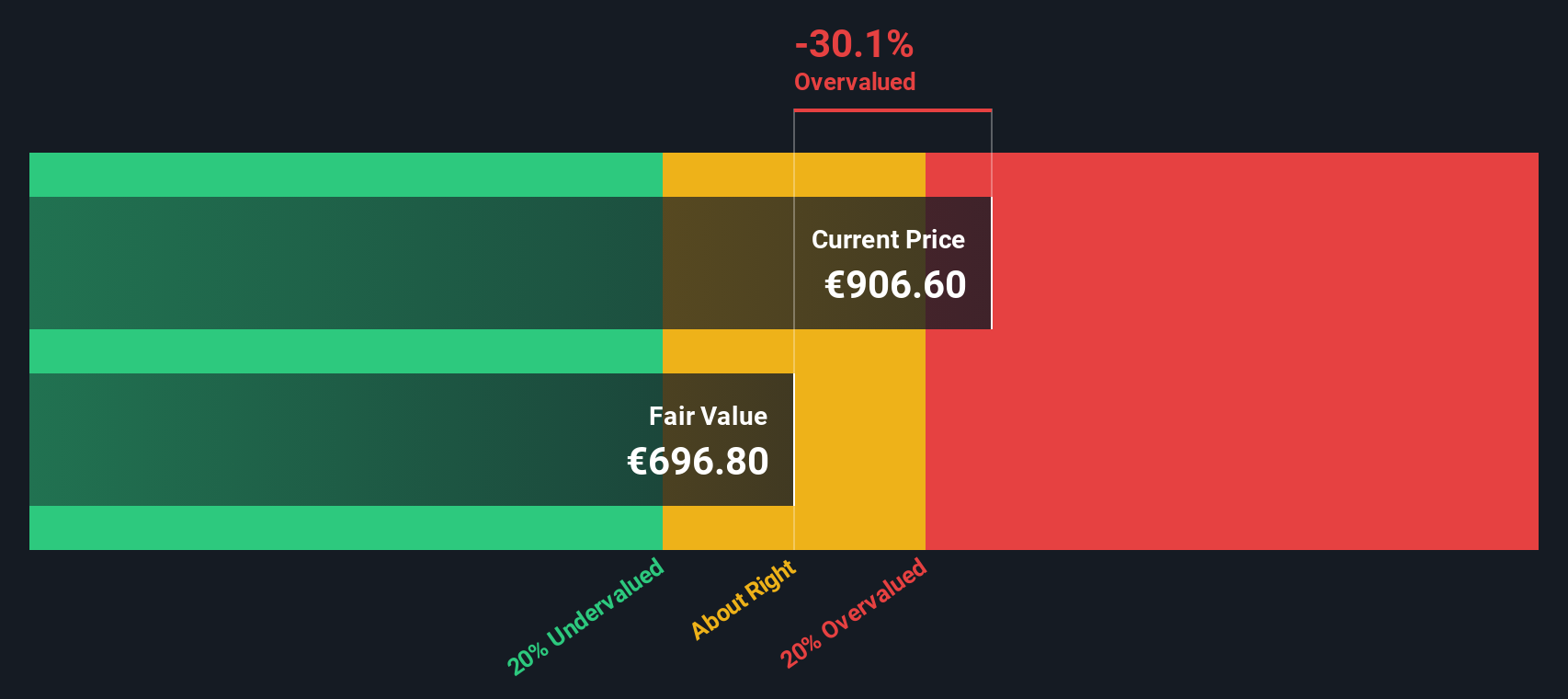

While some investors see ASML as undervalued, our DCF model draws a more cautious picture. Based on projected future cash flows, ASML’s estimated fair value is €685, which is below the current price of €881.50. Could the market be factoring in even more ambitious growth? Or is there risk in these lofty expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASML Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASML Holding Narrative

Not convinced by these forecasts, or want to put your own spin on ASML's story? Dive into the data, draw your own insights, and see how quickly you can create your unique perspective: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ASML Holding.

Looking for More Standout Investment Opportunities?

The best investors never wait for the next big idea to reach them. Stay ahead of the curve by checking out these smartly-curated stock lists, all handpicked to help you spot fresh opportunities and maximize your portfolio’s potential.

- Fuel your growth strategy when you tap into these 870 undervalued stocks based on cash flows, which are poised for a breakout as market attention catches up with their true worth.

- Lock in regular income and benefit from compounding returns with these 15 dividend stocks with yields > 3%, which boast consistent yields and financial strength.

- Get a jump on the next wave of AI disruption by scanning these 27 AI penny stocks, which are at the forefront of artificial intelligence innovation and adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives