Prosus (ENXTAM:PRX) Valuation: Are Shares Now Trading Below Fair Value?

Reviewed by Simply Wall St

Prosus (ENXTAM:PRX) shares have seen some movement in recent sessions. Investors may be weighing the company’s performance and valuation, particularly in light of ongoing shifts in the broader digital and e-commerce landscape.

See our latest analysis for Prosus.

After reaching new highs earlier in the year, Prosus shares have pulled back in recent weeks, with a 1-day share price drop of 2.92% and a 30-day decline of 11.75%. Despite short-term volatility, the stock still shows a strong year-to-date share price return of 39.29% and a robust 3-year total shareholder return of 90.85%. This indicates that while momentum has cooled lately, the long-term performance remains notable.

If the recent swings in Prosus have you thinking about new opportunities, now is a perfect time to check out fast growing stocks with high insider ownership.

With share prices recently cooling off after extended gains, investors may be wondering if Prosus is trading at an attractive discount or if the market has already factored in all of its future growth potential.

Most Popular Narrative: 15% Undervalued

With the latest fair value estimate at €63.25 and Prosus closing at €53.78, the most closely watched narrative points to further upside and a persistent value gap that is yet to be closed by the market.

Prosus is focusing on leveraging its ecosystem to improve the performance of its companies by sharing best practices and innovating rapidly. This approach could lead to better revenue and net margins as companies operate more efficiently and effectively. The company is increasingly investing in AI to improve operational efficiencies, reduce customer acquisition costs, and fight fraud. These initiatives may enhance profitability and potentially expand net margins over time.

Want to know the secret behind that valuation? The story depends on bold moves in technology and a forecast of strong operational improvement. Find out which numbers really move the needle, and see what is fueling analysts’ optimism. Only the full narrative reveals the surprising drivers behind this price target.

Result: Fair Value of $63.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, as Prosus's heavy reliance on ecosystem synergies and successful investments may threaten future returns if operational improvements fall short.

Find out about the key risks to this Prosus narrative.

Another View: Is the Discount Real?

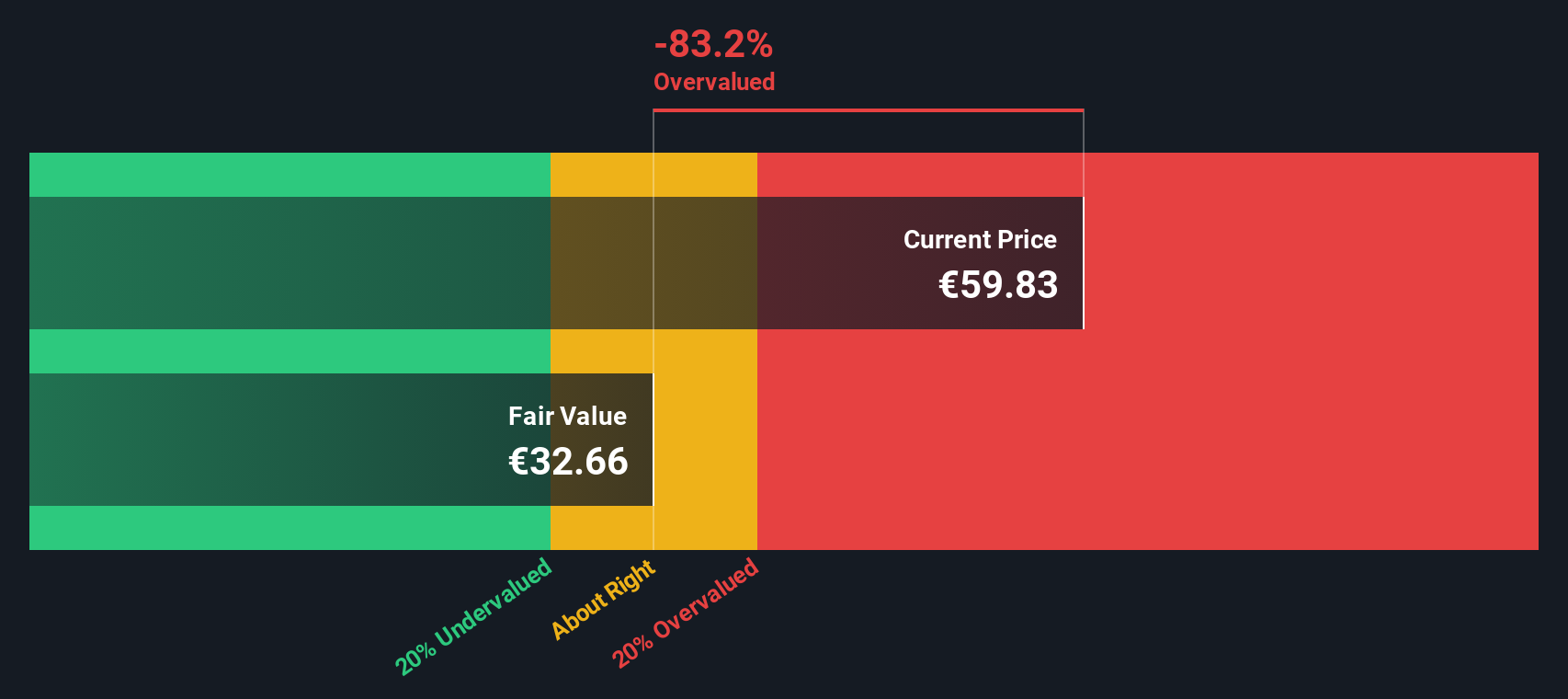

While much attention is on analyst price targets and earnings projections, our SWS DCF model presents a different perspective. It suggests Prosus may actually be trading above its fair value, which raises doubts about the size of the potential upside. Which valuation method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Prosus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Prosus Narrative

If you want to dig deeper into the numbers or see the story from your own perspective, it only takes a few minutes to craft your own interpretation. Do it your way.

A great starting point for your Prosus research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your investment journey stop at Prosus. Take the chance to spot opportunities others might overlook and build a portfolio that stands out.

- Boost your passive income stream by jumping into these 15 dividend stocks with yields > 3% offering high yields and steady returns.

- Ride the AI growth wave and capitalize on innovation with these 25 AI penny stocks that are pioneering breakthroughs in automation and intelligent tech.

- Get ahead of market hype and tap into these 82 cryptocurrency and blockchain stocks shaping the latest trends in blockchain and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PRX

Prosus

Engages in the e-commerce and internet businesses in Asia, Europe, Latin America, North America, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success