- Netherlands

- /

- Real Estate

- /

- ENXTAM:CTPNV

CTP's Strong Nine-Month Revenue and Earnings Could Be a Game Changer for CTP (ENXTAM:CTPNV)

Reviewed by Sasha Jovanovic

- CTP N.V. recently announced its earnings for the nine months ended September 30, 2025, reporting sales of €562 million and revenue of €693.5 million, both higher than the previous year.

- This performance also saw net income and basic earnings per share rise, reflecting improved operations across the business.

- We’ll explore how sustained growth in sales and net income could impact CTP’s broader investment narrative and future outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is CTP's Investment Narrative?

To see CTP as a compelling investment, you’d need to believe the company can keep converting its strong revenue momentum and net income growth into durable value, especially with its business steadily expanding across Central and Eastern Europe’s logistics sector. The latest financials, delivering higher sales and income, help reinforce the bull case, hinting at management’s ability to capitalize on market demand and execute strategic client wins. However, this robust showing does make you pause on a couple of key risks. With recent large one-off gains distorting some growth figures, and interest expenses still not fully covered by earnings, these financial quality signals can leave the risk profile in a more complex light. Overall, while the recent update offers validation for near-term optimism, it may not meaningfully change the biggest risks or short-term catalysts; the sustainability of high profit margins and the impact of future refinancing costs remain center stage.

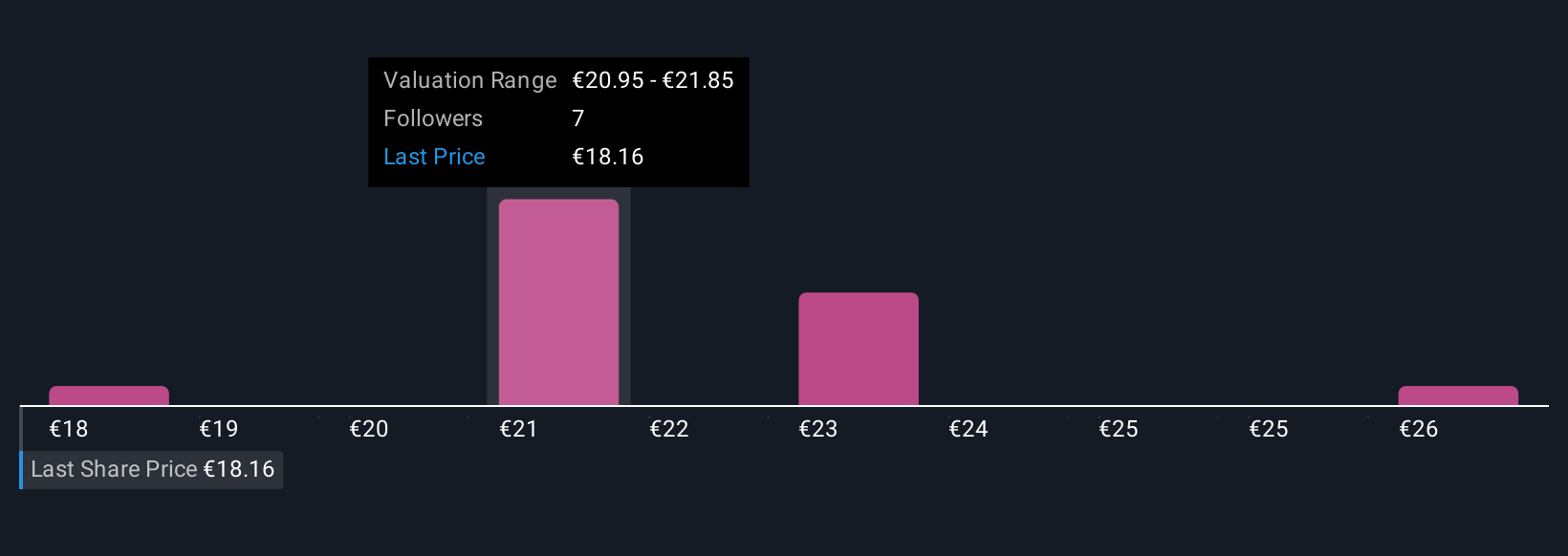

But despite solid earnings, the question of recurring profitability is still unresolved for investors. Despite retreating, CTP's shares might still be trading 23% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on CTP - why the stock might be worth as much as 52% more than the current price!

Build Your Own CTP Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTP research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CTP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTP's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CTPNV

CTP

Develops, owns, operates, and leases commercial real estate properties in Western Europe and Central and Eastern Europe.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives