As Europe navigates a landscape marked by tentative optimism surrounding an EU-U.S. trade deal and the European Central Bank's steady interest rates, the pan-European STOXX Europe 600 Index has seen modest gains, reflecting a cautious yet resilient market sentiment. In this environment, high-growth tech stocks in Europe can be particularly appealing to investors looking for innovation-driven opportunities that align with broader economic trends and technological advancements.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Shoper | 14.28% | 23.79% | ★★★★★☆ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Lipigon Pharmaceuticals | 104.89% | 93.94% | ★★★★★☆ |

| Yubico | 16.27% | 23.90% | ★★★★★☆ |

| ContextVision | 5.83% | 39.78% | ★★★★★☆ |

| Aelis Farma | 79.30% | 106.93% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| CD Projekt | 33.57% | 40.19% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharming Group N.V. is a biopharmaceutical company that focuses on developing and commercializing protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and other international markets, with a market cap of €596.08 million.

Operations: Pharming Group generates revenue primarily through its Recombinant Human C1 Esterase Inhibitor business, which accounts for $320.71 million. The company's focus is on providing treatments for rare diseases in various international markets.

Pharming Group N.V. is navigating a complex landscape with an 8.3% expected annual revenue growth, which, although modest compared to some high-growth sectors, outpaces the Dutch market's 7.3%. The company's commitment to innovation is underscored by its significant R&D efforts aimed at tackling rare diseases like APDS; this focus not only differentiates it within the biotech industry but also enhances its potential in a niche market. Recent announcements include the hosting of a webcast to discuss groundbreaking findings in immune disorders and an upgrade in revenue guidance for 2025 to USD 325-340 million, reflecting positive business momentum. These developments suggest Pharming is strategically poised to leverage scientific advances into commercial success, despite current unprofitability and market challenges.

- Dive into the specifics of Pharming Group here with our thorough health report.

Assess Pharming Group's past performance with our detailed historical performance reports.

BioInvent International (OM:BINV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BioInvent International AB (publ) is a clinical-stage company focused on discovering and developing immuno-modulatory antibodies for cancer treatment, with a market cap of approximately SEK2.64 billion.

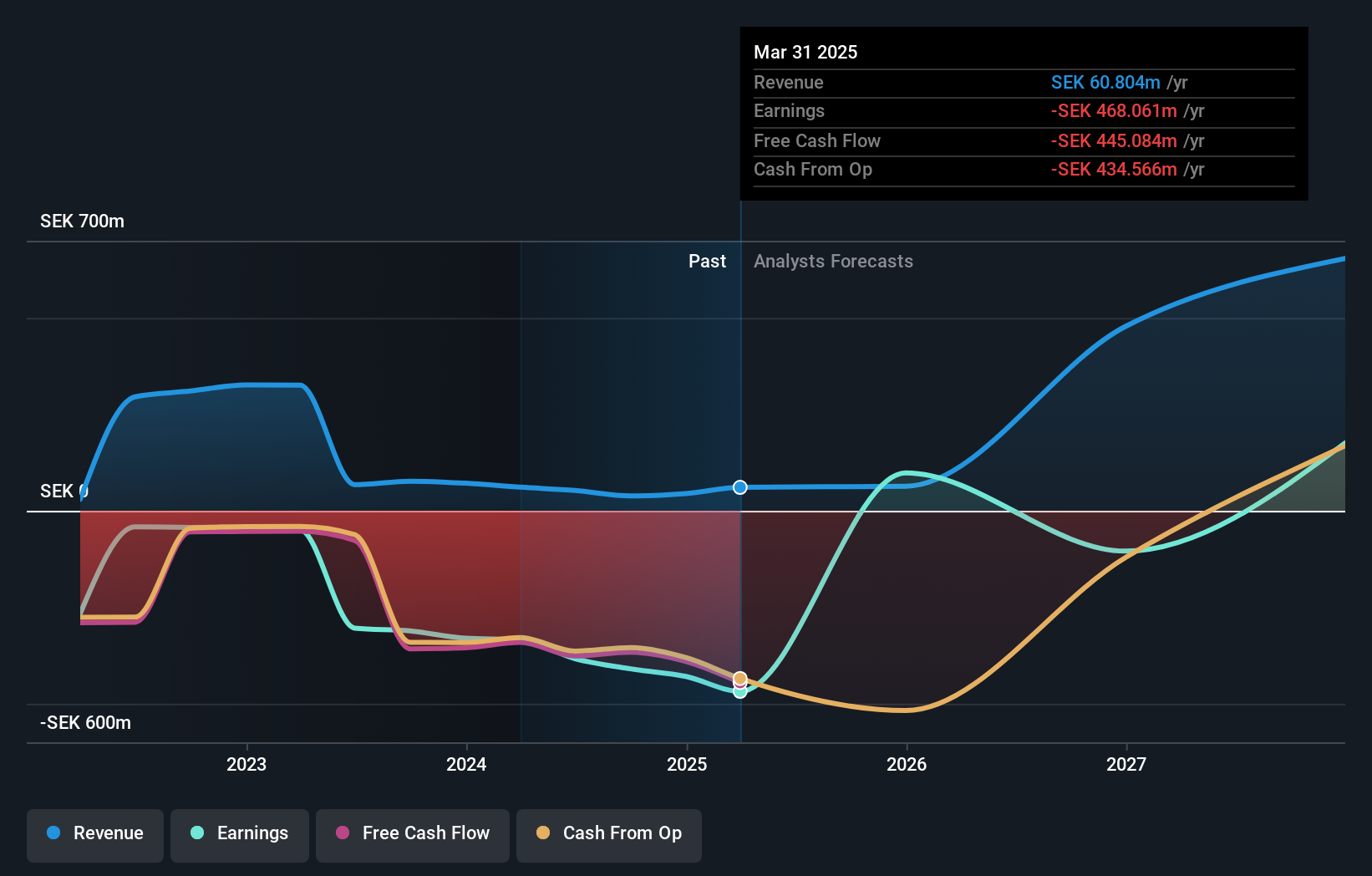

Operations: The company generates revenue primarily from developing antibody-based drugs, amounting to SEK60.80 million.

BioInvent International is making significant strides in the biotech sector, particularly with its innovative BI-1808 treatment for cutaneous T-cell lymphoma (CTCL), demonstrating a 100% disease control rate in recent trials. This promising performance is underpinned by a robust annual revenue growth forecast of 76.6% and an earnings growth projection of 91.77%. With R&D expenses aligned to propel future innovations, BioInvent not only surpasses the Swedish market's growth rate of 5.2% but also outpaces biotech industry norms, positioning it well for upcoming profitability within three years.

- Click here and access our complete health analysis report to understand the dynamics of BioInvent International.

Gain insights into BioInvent International's past trends and performance with our Past report.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that specializes in developing and selling injectable bio-ceramic bone graft substitutes across Europe, North America, and other international markets, with a market cap of SEK21.76 billion.

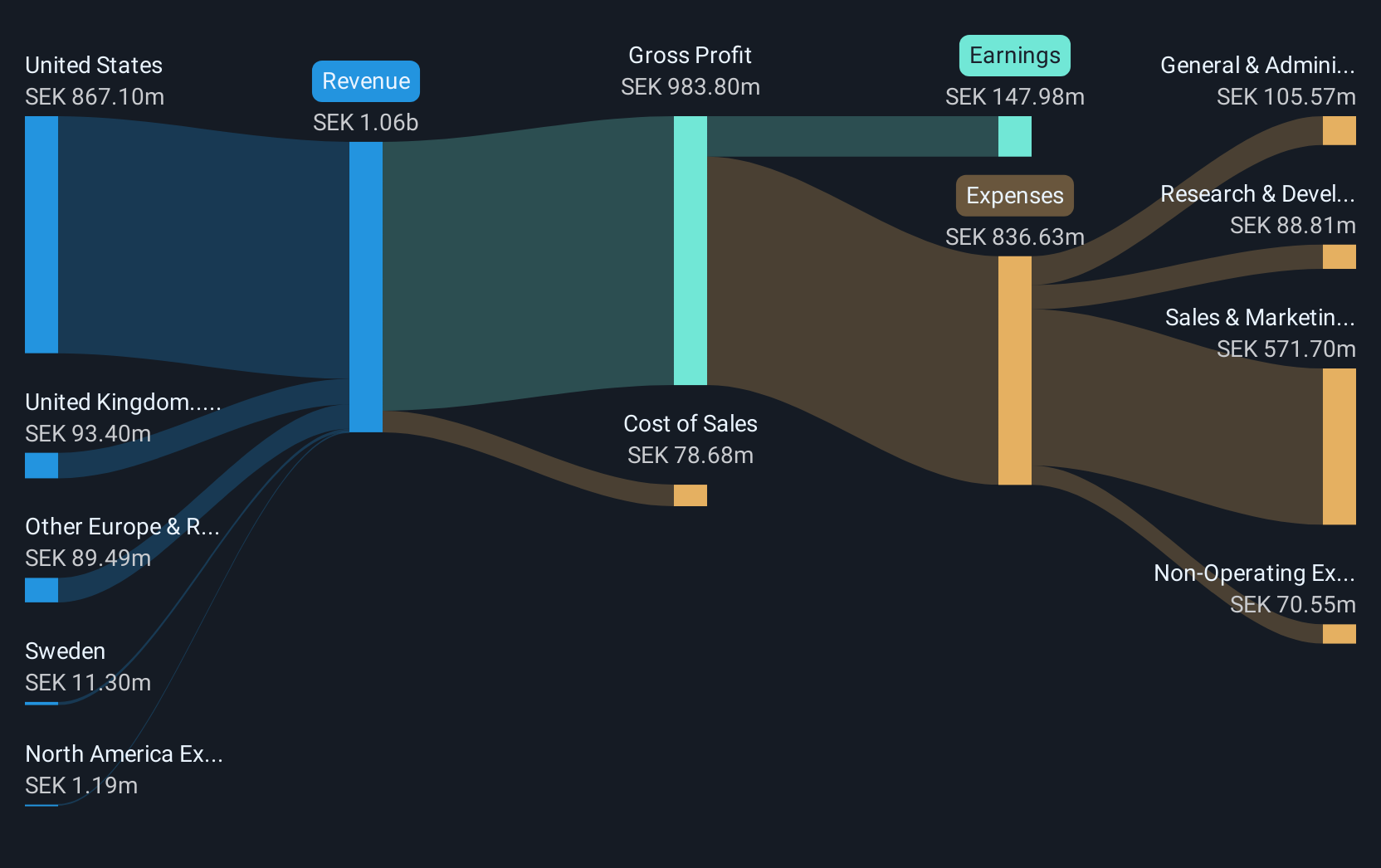

Operations: Bonesupport Holding AB generates revenue primarily from its pharmaceuticals segment, amounting to SEK1.06 billion. The company focuses on the development and sale of injectable bio-ceramic bone graft substitutes across various regions, including Europe and North America.

Bonesupport Holding's recent financial performance underscores its potential within the European tech landscape, with a notable increase in Q2 sales to SEK 284.43 million from SEK 219.8 million the previous year, and net income more than doubling to SEK 53.07 million. This growth trajectory is complemented by an ambitious R&D strategy, critical for maintaining technological leadership and competitiveness. The company's robust revenue growth rate of 24% annually outpaces the broader Swedish market's growth of 5.2%, positioning it well for sustained advancements in its sector. Additionally, with earnings expected to surge by 62.3% annually, Bonesupport is poised to capitalize on expanding market opportunities while enhancing shareholder value through strategic reinvestments in innovation and market expansion initiatives.

Seize The Opportunity

- Dive into all 52 of the European High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioInvent International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BINV

BioInvent International

A clinical-stage company, discovers and develops immuno-modulatory antibodies for the treatment of cancer in Sweden, Europe, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives