- Romania

- /

- Infrastructure

- /

- BVB:SOCP

European Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index rising for a fourth consecutive week, investors are increasingly optimistic about easing trade tensions between China and the U.S. In such an environment, penny stocks—often representing smaller or newer companies—are gaining attention for their potential to offer growth at lower price points. Despite being a somewhat outdated term, these stocks can still provide hidden opportunities when backed by strong financials and fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.28 | SEK2.18B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.28 | SEK304.11M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.68 | SEK275.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.67 | PLN124.39M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.462 | NOK105.06M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.67 | €56.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.015 | €33.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.03M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

SOCEP (BVB:SOCP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOCEP S.A., along with its subsidiary SOCEFIN S.R.L., offers cargo handling services in the ports of Constanta and Agigea, Romania, with a market cap of RON949.99 million.

Operations: The company generates revenue through its holding activities, contributing RON1.47 million, and port operations, which account for RON237.24 million.

Market Cap: RON950M

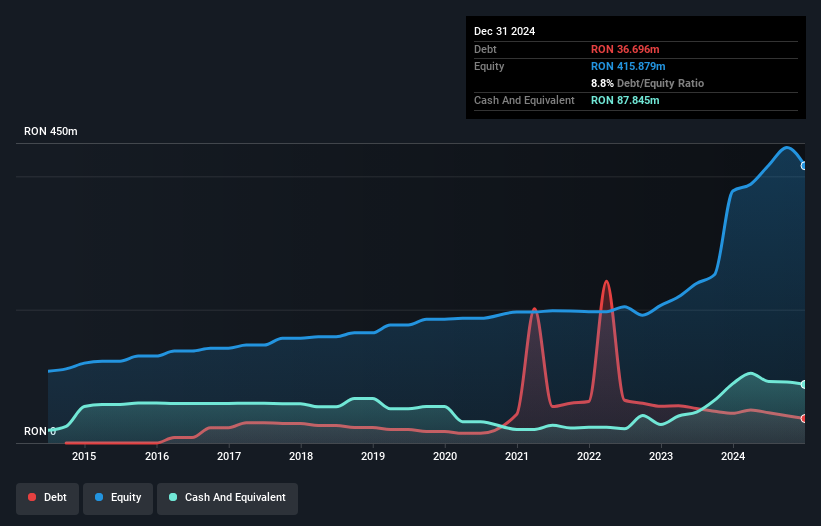

SOCEP S.A. presents a mixed picture for investors interested in penny stocks. The company has strong financial fundamentals, with short-term assets exceeding liabilities and more cash than total debt, ensuring interest payments are covered. However, its net profit margin has decreased from last year and earnings growth was negative over the past year despite significant growth over five years. The dividend yield is high but not well-supported by free cash flows, raising concerns about sustainability. Recent earnings showed slight revenue growth but a decline in net income, highlighting challenges in maintaining profitability amid industry pressures.

- Dive into the specifics of SOCEP here with our thorough balance sheet health report.

- Assess SOCEP's previous results with our detailed historical performance reports.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pharming Group N.V. is a biopharmaceutical company that develops and commercializes protein replacement therapies and precision medicines for rare diseases globally, with a market cap of €596.05 million.

Operations: Pharming Group N.V. has not reported any specific revenue segments.

Market Cap: €596.05M

Pharming Group's recent developments highlight its potential in the penny stock arena, with a market cap of €596.05 million and ongoing strategic shifts. Despite being unprofitable, it has a robust cash position exceeding total debt and a stable cash runway for over three years. The company is trading significantly below estimated fair value, suggesting possible undervaluation. Recent announcements include raised revenue guidance for 2025 to US$325-340 million and positive regulatory endorsements for its drug Joenja® in England and Wales. However, volatility remains high compared to other Dutch stocks, reflecting inherent risks associated with biotech investments.

- Navigate through the intricacies of Pharming Group with our comprehensive balance sheet health report here.

- Learn about Pharming Group's future growth trajectory here.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glenveagh Properties PLC, with a market cap of €921.98 million, constructs and sells houses and apartments for private buyers, local authorities, and the private rental sector in Ireland.

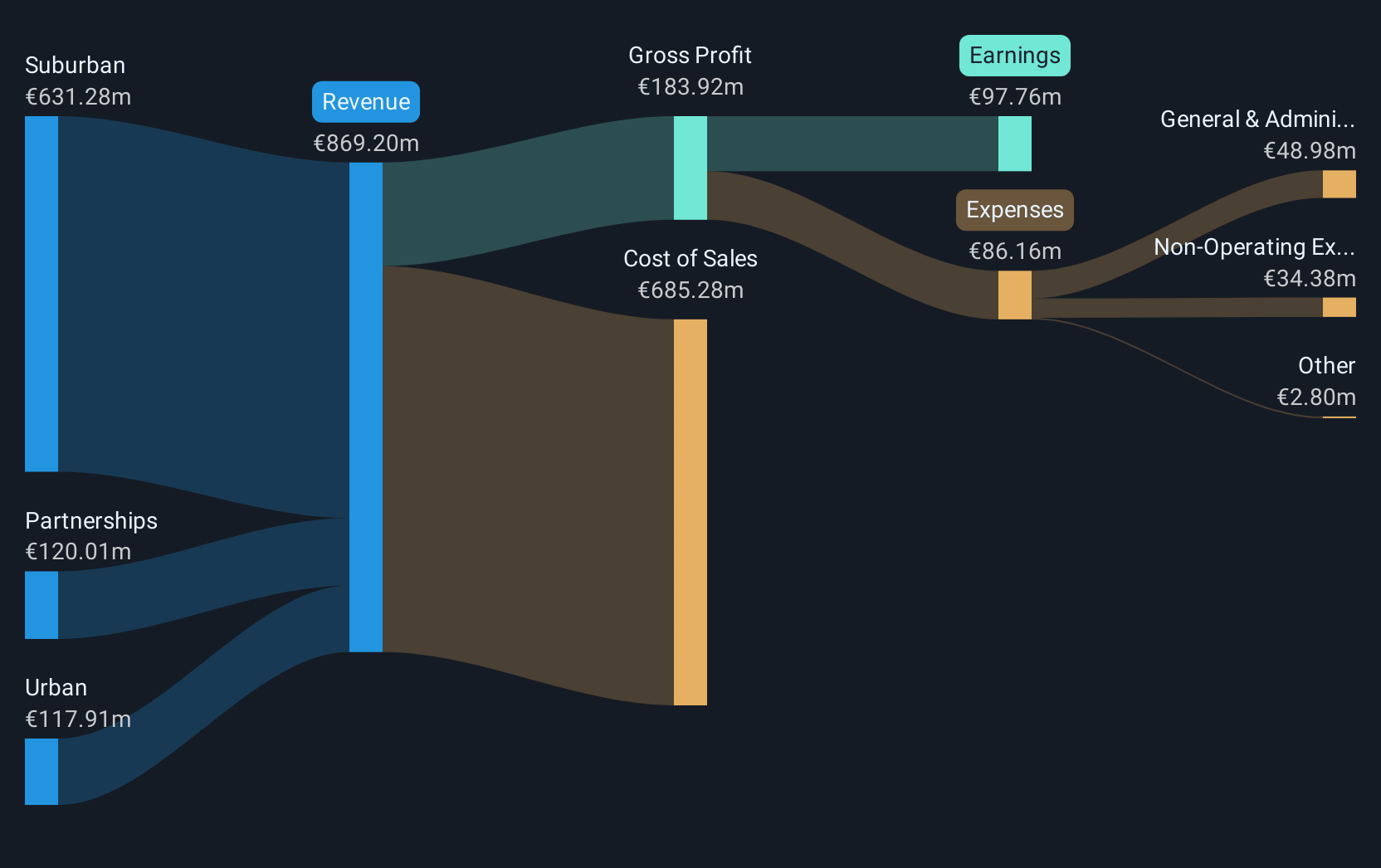

Operations: Glenveagh Properties generates revenue through three segments: Suburban (€631.28 million), Partnerships (€120.01 million), and Urban (€117.91 million).

Market Cap: €921.98M

Glenveagh Properties' recent performance underscores its position in the European penny stock landscape, with a market cap of €921.98 million and significant revenue growth to €869.2 million in 2024 from €607.94 million the previous year. The company has effectively managed short-term liabilities with assets of €1.1 billion and completed a share buyback representing 4.81% for €44.3 million, indicating confidence in its valuation strategy. Despite rising debt levels, net profit margins improved to 11.2%, supported by strong earnings growth of 107.5% over the past year, outpacing industry averages and reflecting robust operational execution across its segments.

- Get an in-depth perspective on Glenveagh Properties' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Glenveagh Properties' future.

Summing It All Up

- Unlock our comprehensive list of 445 European Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SOCP

SOCEP

Together with its subsidiary, SOCEFIN S.R.L., provides cargo handling services in the ports of Constanta and Agigea, Romania.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives