- Netherlands

- /

- Biotech

- /

- ENXTAM:PHARM

European Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

The European markets have shown resilience with the pan-European STOXX Europe 600 Index climbing 1.68% and major stock indexes across the continent experiencing gains, reflecting a robust economic outlook bolstered by strong business activity and consumer confidence. In this context, investors might find interest in penny stocks, which though often considered relics of past trading days, continue to offer potential for growth when backed by solid financial foundations. This article explores several European penny stocks that stand out for their financial strength and potential to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.666 | €1.27B | ✅ 5 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €1.99 | €27.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.55 | DKK115.04M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.962 | €77.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.495 | €1.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.076 | €8.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.906 | €30.34M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 274 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Impact Developer & Contractor (BVB:IMP)

Simply Wall St Financial Health Rating: ★★★★★★

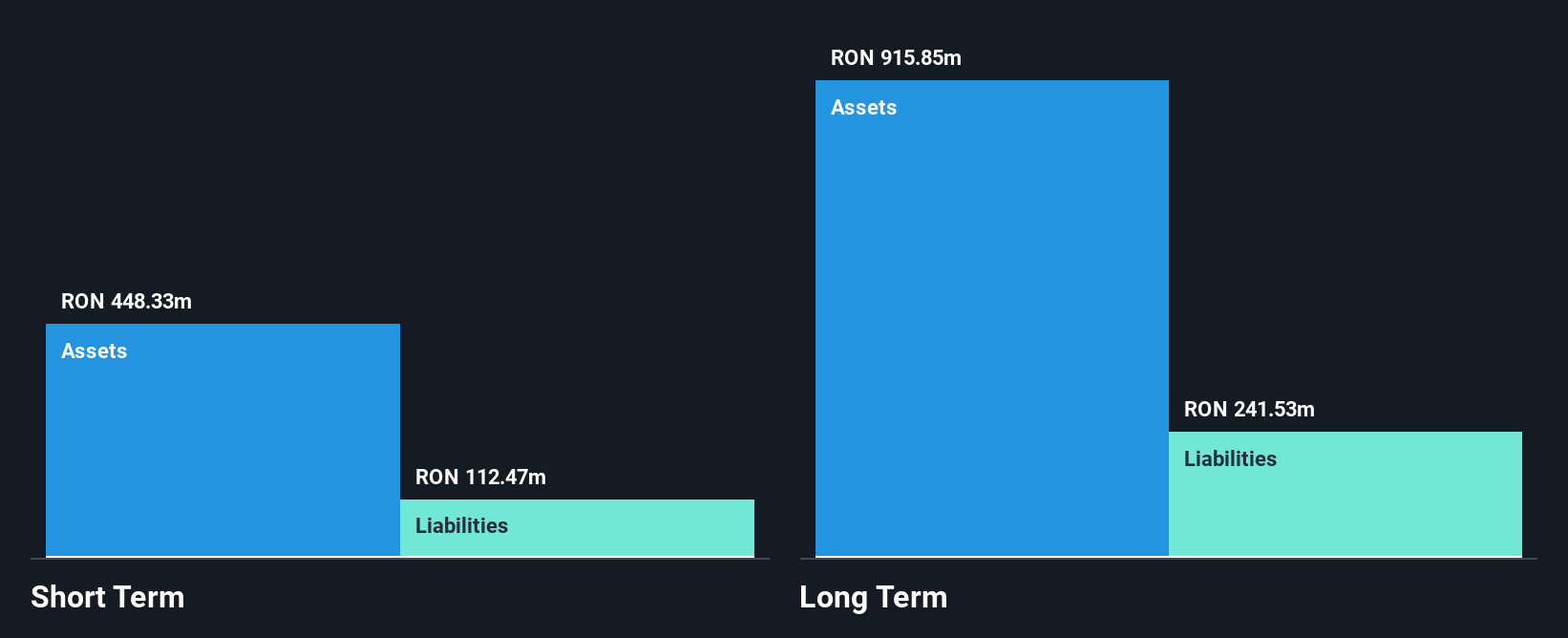

Overview: Impact Developer & Contractor S.A. is a real estate developer based in Romania with a market capitalization of RON490.73 million.

Operations: The company's revenue is entirely generated from its operations in Romania, amounting to RON386.94 million.

Market Cap: RON490.73M

Impact Developer & Contractor S.A. has shown a remarkable turnaround, reporting RON 176.65 million in sales and a net income of RON 43.88 million for the first half of 2025, reversing a loss from the previous year. The company's debt management appears prudent, with a satisfactory net debt to equity ratio and strong coverage of interest payments by EBIT. Although it has recently become profitable, past earnings have been impacted by significant one-off gains and have declined over five years. The stock trades significantly below its estimated fair value, offering potential upside if profitability continues to stabilize without further dilution or unusual income items impacting results.

- Jump into the full analysis health report here for a deeper understanding of Impact Developer & Contractor.

- Gain insights into Impact Developer & Contractor's historical outcomes by reviewing our past performance report.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Financial Health Rating: ★★★★★★

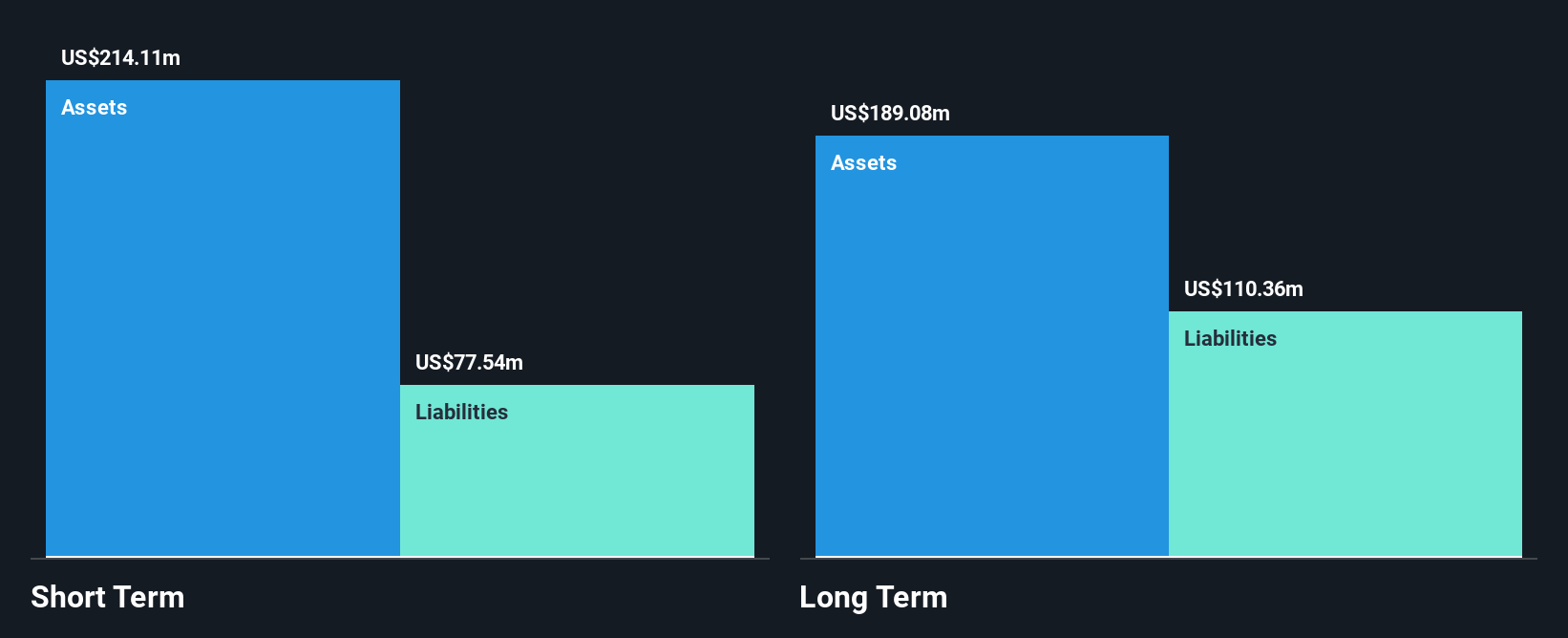

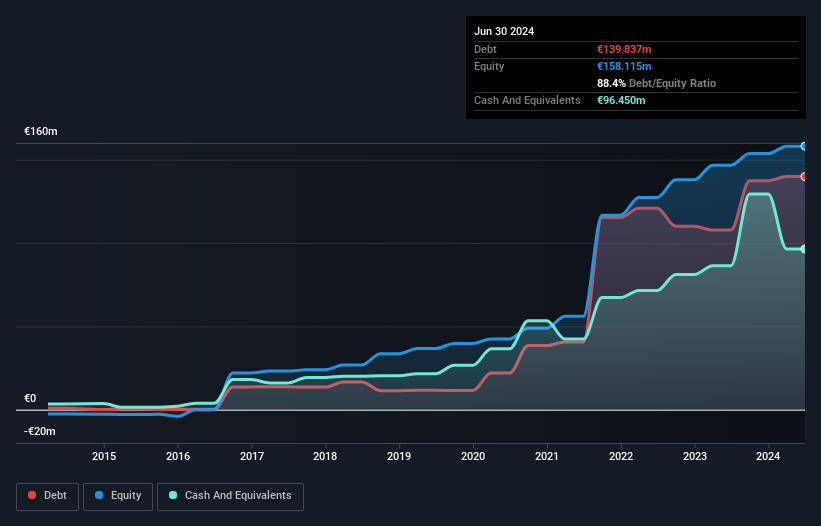

Overview: Pharming Group N.V. is a biopharmaceutical company that develops and commercializes protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of approximately €785.18 million.

Operations: The company's revenue is primarily derived from its Ruconest® product, generating $292.27 million, and Joenja®, contributing $47.57 million.

Market Cap: €785.18M

Pharming Group N.V., a biopharmaceutical company, has been navigating challenges typical of penny stocks, with notable developments and financial metrics. Despite being currently unprofitable with a negative return on equity, the company maintains a robust cash runway exceeding three years. Recent restructuring aims to optimize capital allocation by reducing general and administrative expenses by 15%, aligning with their growth strategy. The FDA's acceptance of their supplemental New Drug Application for leniolisib marks progress in expanding treatment options for rare diseases. Pharming's management and board are experienced, supporting strategic execution amidst share price volatility and debt reduction efforts over the past five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Pharming Group.

- Understand Pharming Group's earnings outlook by examining our growth report.

Freelance.com (ENXTPA:ALFRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Freelance.com SA facilitates intermediation between companies and intellectual service providers across multiple countries including France, Germany, and Singapore, with a market cap of €126 million.

Operations: The company generates its revenue primarily from Business Services, amounting to €1.06 billion.

Market Cap: €126M

Freelance.com SA, a European penny stock, has demonstrated significant financial growth with half-year sales reaching €530.1 million and net income rising to €15.6 million. The company's earnings have surged by 53.2% over the past year, outpacing industry trends and improving profit margins from 1.6% to 2.2%. Despite a stable weekly volatility of 3%, future earnings are forecasted to decline slightly by an average of 4.9% annually over the next three years. Freelance.com maintains strong short-term asset coverage for liabilities but faces challenges with its increasing debt-to-equity ratio now at 70.5%.

- Get an in-depth perspective on Freelance.com's performance by reading our balance sheet health report here.

- Gain insights into Freelance.com's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Unlock more gems! Our European Penny Stocks screener has unearthed 271 more companies for you to explore.Click here to unveil our expertly curated list of 274 European Penny Stocks.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHARM

Pharming Group

A biopharmaceutical company, develops and commercializes protein replacement therapies and precision medicines for the treatment of rare diseases in the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives