- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

Does ArcelorMittal’s 49.8% Rise Signal More Gains Ahead in 2025?

Reviewed by Bailey Pemberton

If you are trying to decide what to do with your ArcelorMittal shares, or thinking about jumping in for the first time, there is a lot to consider right now. The steel giant's stock has delivered some eye-catching returns: up 1.1% over the past week, 7.3% over the past month, and a striking 49.8% year-to-date. Looking at a longer time frame, the numbers get even more impressive, with the stock nearly tripling over the past five years with a return of 201.8%. These gains have caught the attention of investors everywhere, sparking plenty of speculation about what’s driving this momentum and whether the growth can continue.

Some of this excitement is based on recent developments in the global steel market, including shifting demand for infrastructure upgrades and new government policies aimed at boosting manufacturing capacity. While none of these headlines alone explain every increase in the share price, taken together they have eased concerns about risk and highlighted possible avenues for continued growth. For anyone worried about timing their decision, it may be helpful to dig beneath the surface and examine how ArcelorMittal measures up on valuation right now.

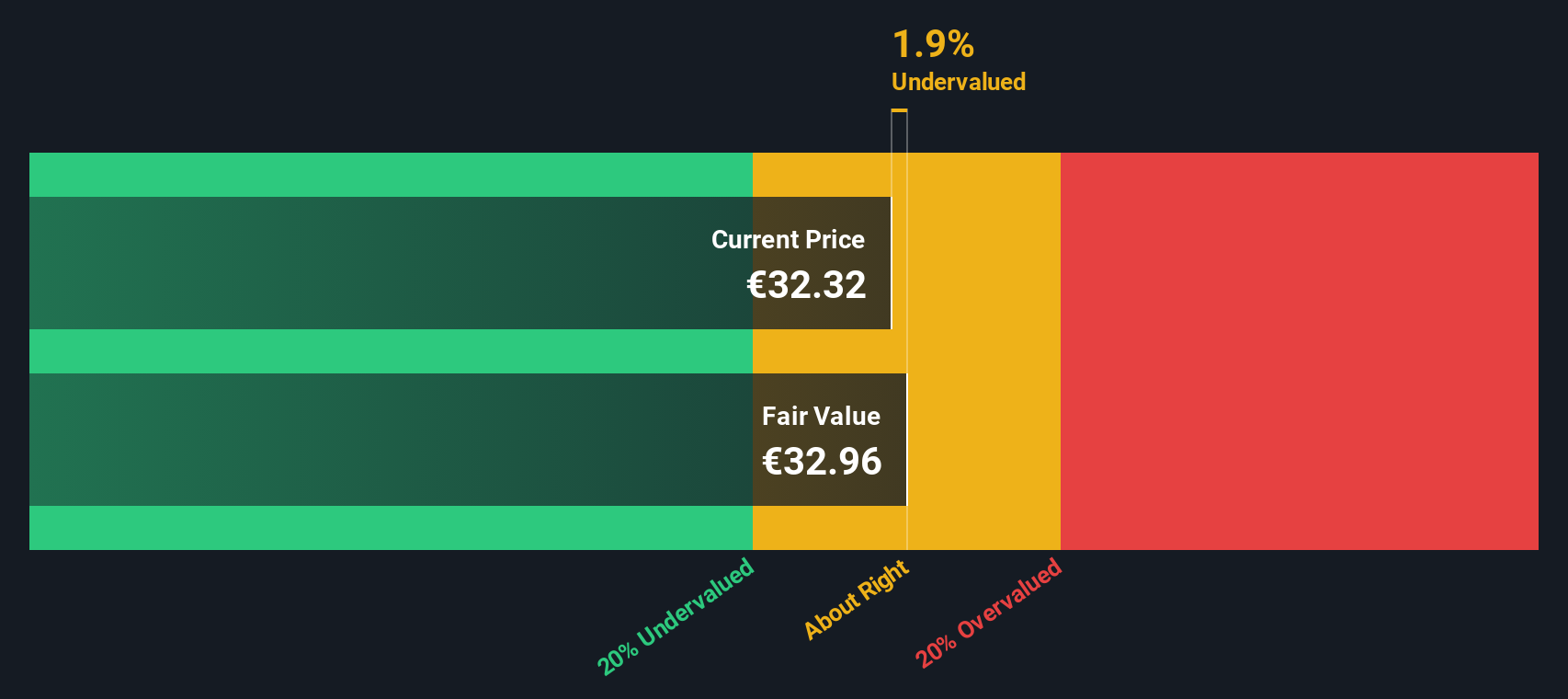

In terms of valuation, ArcelorMittal currently posts a value score of 3 out of 6, indicating it is considered undervalued on three out of six key valuation checks. But is this enough information to justify taking action? In the next section, we will break down what these valuation measures really mean and provide additional insights to help you understand the real value of ArcelorMittal’s stock.

Approach 1: ArcelorMittal Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them to today’s value. This allows investors to see what the business may be worth at present. For ArcelorMittal, DCF analysis uses a 2 Stage Free Cash Flow to Equity approach based on projections of actual and extrapolated free cash flow figures.

ArcelorMittal’s latest twelve months free cash flow stands at $898 million, and analysts forecast this to grow steadily over time. By 2029, projected free cash flow is expected to reach $1.47 billion. These forecasts are primarily based on analyst estimates for the next five years, with further values extrapolated by Simply Wall St beyond analyst coverage.

After discounting all these future cash flows to their present value, the estimated intrinsic value per share comes in at €28.99. However, this is about 16.3% below where the shares currently trade, according to the DCF discount. This suggests that, based on the current DCF assessment, the stock appears to be overvalued on a purely cash flow basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ArcelorMittal may be overvalued by 16.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ArcelorMittal Price vs Earnings

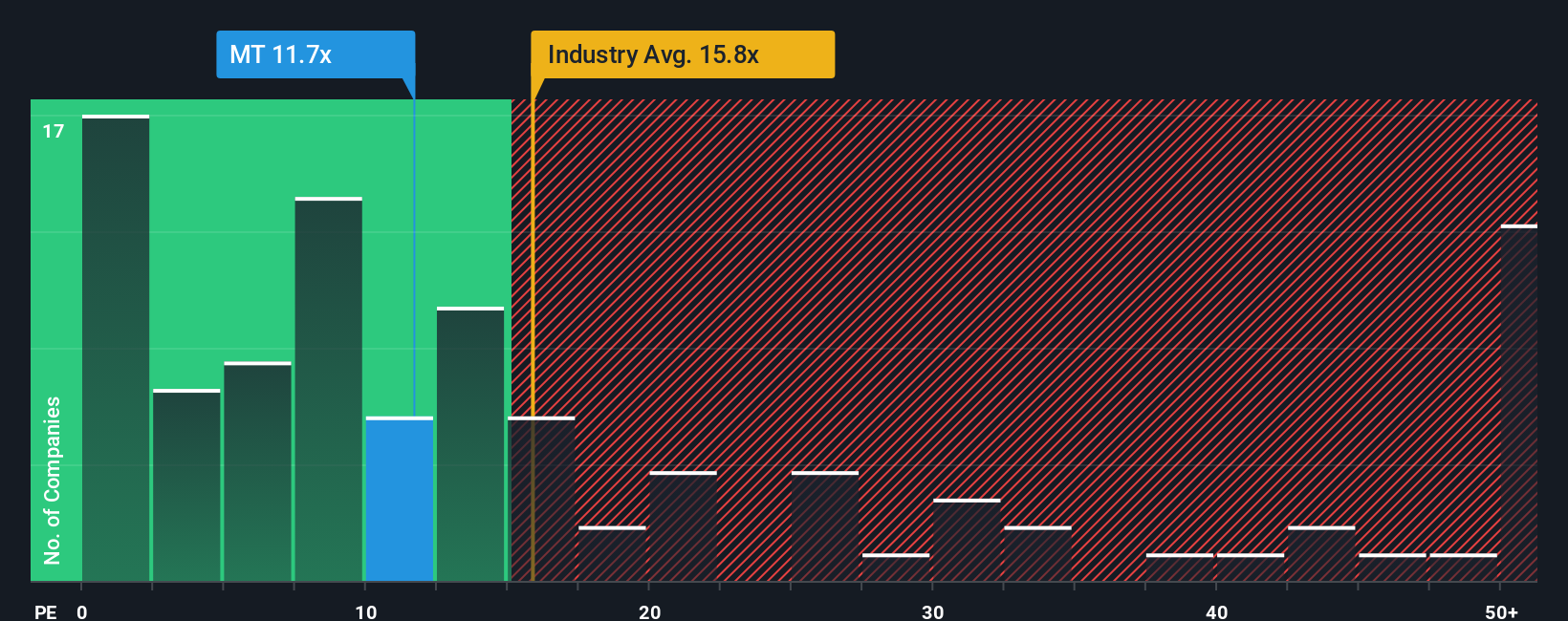

The Price-to-Earnings (PE) ratio is widely regarded as a reliable valuation metric for profitable companies, as it links the current share price to the company's earnings power. This ratio helps investors quickly assess how much the market is paying for each euro of earnings, making it a practical measure for mature, revenue-generating firms like ArcelorMittal.

Typically, growth expectations and perceived risks help determine what a “normal” or “fair” PE ratio should be. Companies with strong growth potential or lower risk profiles can justify higher PE ratios, while slower-growing or riskier businesses might be expected to trade at a discount.

ArcelorMittal currently trades at a PE ratio of 12x. For context, this is well below both the industry average PE of 21.2x for Metals and Mining companies and the peer group average of 60x. At first glance, ArcelorMittal appears undervalued compared to these benchmarks.

However, Simply Wall St’s proprietary “Fair Ratio” adds another layer by incorporating not just industry averages and peer valuations but also company-specific variables like earnings growth, profit margins, market cap, and risk factors. With a Fair PE Ratio calculated at 18.8x, the method gives a more tailored expectation of value beyond simple comparisons.

Looking at the numbers, ArcelorMittal’s current PE ratio of 12x is comfortably below its Fair Ratio of 18.8x. This means that the stock looks undervalued based on a holistic assessment of its market position, earnings, and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ArcelorMittal Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story about a company. It expresses your perspective and assumptions about ArcelorMittal’s future revenue, profit margins, earnings, and ultimately what you think a fair value is.

Rather than relying solely on backward-looking ratios or analyst estimates, Narratives bridge the gap between a company's business story, your financial forecasts, and a calculated fair value. This approach lets you map your reasoning into numbers, creating a clear connection from your beliefs about ArcelorMittal, such as the impact of green steel investments or the risks of volatile trade barriers, straight to your investment decisions.

Narratives are simple to set up on the Simply Wall St platform’s Community page, where millions of investors share and update their outlooks. Whenever important news or earnings changes come in, these Narratives update dynamically so you always have an up-to-date fair value and rationale tailored to your assumptions.

For example, with ArcelorMittal, one investor’s Narrative might project strong margin expansion and set a bullish price target of €39.55, while another focuses on global risks and lands at a more cautious €26.65. This can help you see at a glance how fair value can differ and decide if, when, and why to buy or sell.

Do you think there's more to the story for ArcelorMittal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives