- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

ArcelorMittal (ENXTAM:MT): Fresh Analyst Expectations and Goldman Downgrade Spark New Valuation Debate

Reviewed by Simply Wall St

ArcelorMittal (ENXTAM:MT) shares attracted fresh attention as the company published its third quarter 2025 analyst consensus figures. In addition, Goldman Sachs shifted its rating from 'Buy' to 'Neutral.' Both updates offer investors a clearer sense of market sentiment and near-term challenges.

See our latest analysis for ArcelorMittal.

ArcelorMittal’s share price has seen momentum build impressively in 2025, notching a robust 7.4% return over the past month and a stellar 49.3% share price return year-to-date. The latest news, including analyst downgrades and fresh consensus figures, has done little to derail what’s been a strong stretch for long-term investors. Total shareholder returns have topped 50% over the past year and soared by over 185% across five years, which are clear signs that recent optimism is rooted in both recovery and long-term growth potential.

If you’re curious about what else is capturing investors’ attention, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

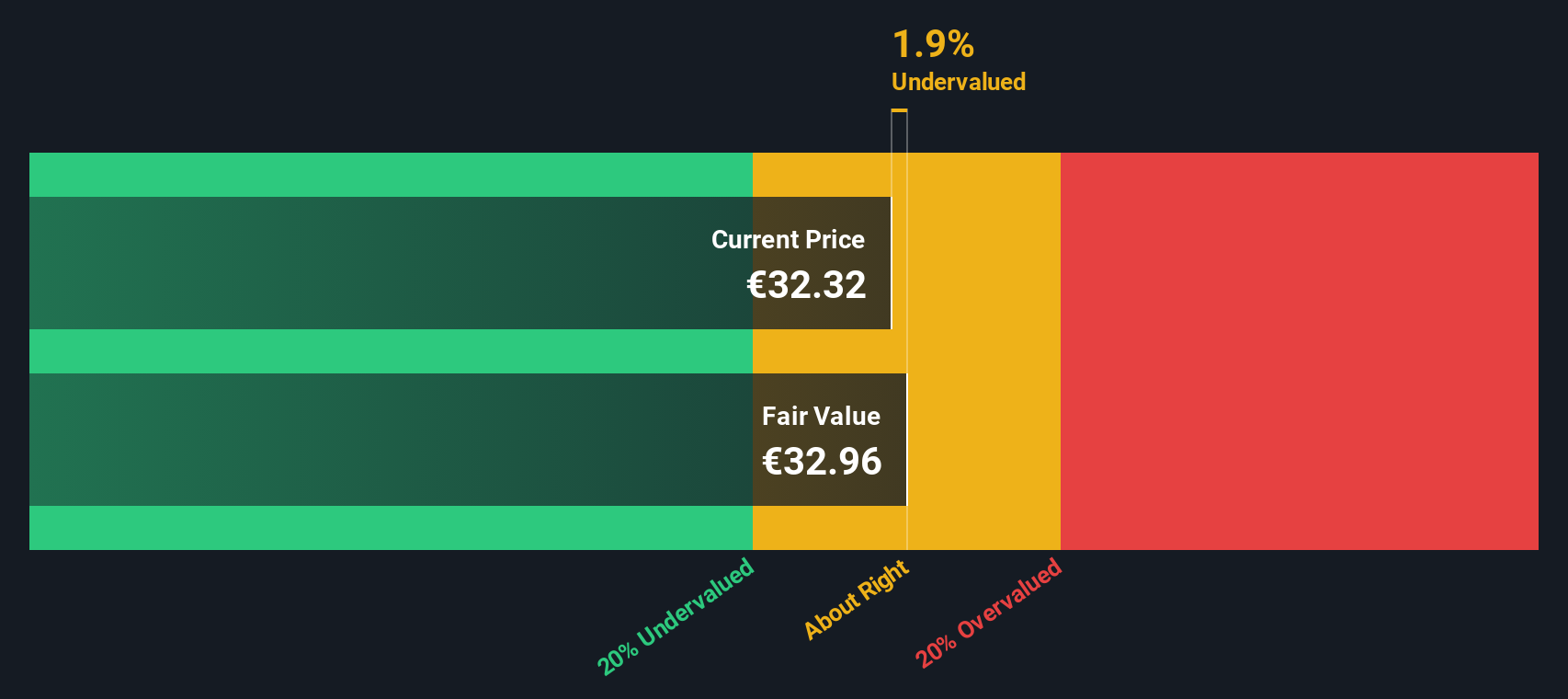

With ArcelorMittal’s rapid rally and new analyst data flooding in, investors are left wondering if further upside remains. Are shares undervalued, or has the market already accounted for the next phase of growth?

Most Popular Narrative: 20% Undervalued

ArcelorMittal’s widely followed narrative sets its fair value at €33.68, substantially above the previous close of €27.89. This divergence has market watchers dissecting catalyst assumptions and peering ahead at what justifies such a premium outlook.

Strategic investments in green steel production (EAFs, DRI technology, renewable-backed projects) and early execution of decarbonization projects position ArcelorMittal to capture premium, higher-margin demand from eco-conscious customers, driving margin expansion and supporting long-term earnings.

Curious what radical shifts in profit margins or future earnings per share underpin this target price? The real surprise lies in how analysts see ArcelorMittal redefining its entire growth model. One bold financial forecast stands at the center of this story. Unpack the controversial figures and find out where consensus breaks down.

Result: Fair Value of €33.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and high capital spending for green projects could pressure ArcelorMittal’s profitability. This could potentially derail the current bullish outlook.

Find out about the key risks to this ArcelorMittal narrative.

Another View: What Does the SWS DCF Model Say?

While analyst consensus suggests undervaluation based on earnings forecasts, our DCF model takes a different approach by calculating today's value using projected future cash flows. According to this model, ArcelorMittal is actually trading above its estimated fair value, implying the market might be pricing in more optimism than fundamentals suggest. Could the true worth be lower than both analysts and investors expect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ArcelorMittal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 854 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ArcelorMittal Narrative

Not convinced by the current consensus, or eager to create your own evidence-based view? Dive into the data yourself and shape your personal take on ArcelorMittal’s outlook in just a few minutes. Do it your way

A great starting point for your ArcelorMittal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by. Tap into more promising stocks by using hand-picked screens that spotlight sectors with real growth, value, and future potential. You’ll stay ahead of the curve and make smarter investing decisions.

- Boost your portfolio’s yield by targeting stable businesses with strong payouts through these 21 dividend stocks with yields > 3%, which consistently deliver returns above 3%.

- Capitalize on the rise of machine learning with these 26 AI penny stocks, poised to benefit from powerful trends in artificial intelligence and automation.

- Seize undervalued opportunities in today’s market by leveraging these 854 undervalued stocks based on cash flows, which screens for stocks trading below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives