- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

ArcelorMittal (ENXTAM:MT): Assessing Valuation as France Pushes for Nationalization to Halt Job Cuts

Reviewed by Simply Wall St

France's lower house recently voted to nationalize ArcelorMittal (ENXTAM:MT) in an effort to block planned job cuts. This move puts increased political and operational uncertainty front and center for investors tracking the stock.

See our latest analysis for ArcelorMittal.

While France’s push to nationalize ArcelorMittal has added fresh uncertainty, the market seems to be running with it. A 1-day share price return of 1.45% capped a 65% climb so far this year, and the stock’s 1-year total shareholder return stands at a robust 56%. Despite the clouds of regulatory risk, momentum has been building fast and investors are weighing both policy threats and potential upside with each headline.

If all this volatility has you curious about what else is making moves, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares up over 65% this year and trading just shy of analyst price targets, is ArcelorMittal still undervalued amid all this turbulence, or are investors already pricing in every bit of future growth?

Most Popular Narrative: Fairly Valued

With the consensus fair value now at €36.80 and ArcelorMittal last closing at €37.18, the market and the narrative are closely aligned. Analysts have nudged outlooks slightly higher, but the gap between price and calculated value is almost negligible. This amplifies the focus on what really drives this valuation.

Strategic investments in green steel production (EAFs, DRI technology, renewable-backed projects) and early execution of decarbonization projects position ArcelorMittal to capture premium, higher-margin demand from eco-conscious customers. This may drive margin expansion and support long-term earnings.

Want to see which bold financial assumptions make this price tag tick? The narrative is powered by projected profit margin changes and a future earnings outlook that could surprise. Don’t miss out on the crucial numbers and the forecast tension included in this fair value call. Take a closer look to discover what could tip the scales next.

Result: Fair Value of €36.80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and significant capital requirements for decarbonization could pressure margins and undermine long-term earnings if not managed effectively.

Find out about the key risks to this ArcelorMittal narrative.

Another View: Market Ratios Tell a Different Story

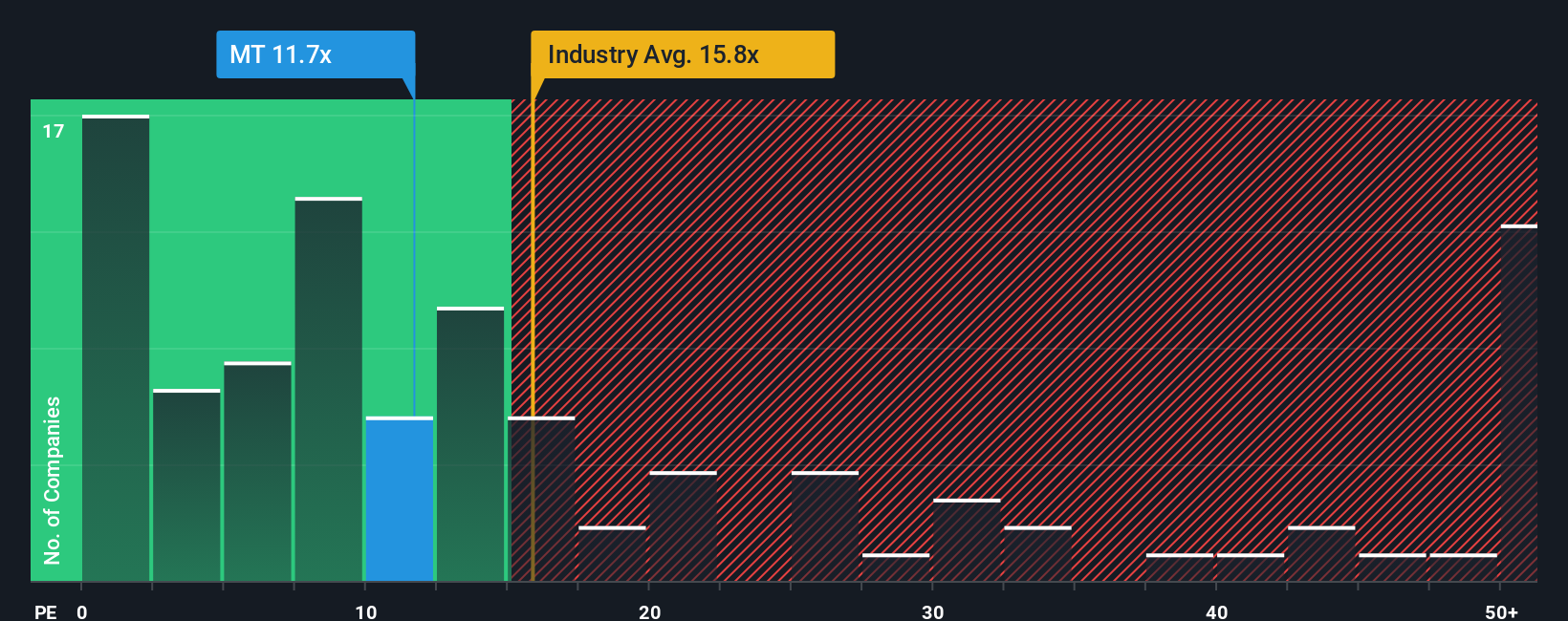

Looking at ArcelorMittal’s price-to-earnings ratio, it stands at 12.7x, well below both the European industry average of 15.5x and the peer average of 57.9x. It is also beneath the fair ratio of 20.3x that the market could drift toward. Does this undervaluation signal an opportunity, or could it point to hidden risks that explain the discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ArcelorMittal Narrative

If you think the current outlook misses something or want to weigh your own assumptions, you can shape a more personal take in just a few minutes. Do it your way

A great starting point for your ArcelorMittal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Pinpoint tomorrow’s stock leaders before everyone else with the right screening tools. There’s no reason to settle for ordinary when you could catch opportunities others are still missing.

- Unlock the growth potential in artificial intelligence by targeting these 25 AI penny stocks making headlines with innovative products and real-world applications.

- Capitalize on steady income streams and resilient returns by starting with these 15 dividend stocks with yields > 3% boasting yields over 3% and proven performance.

- Get ahead of industry shifts by seizing opportunities in digital finance via these 81 cryptocurrency and blockchain stocks at the cutting edge of blockchain and payments innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026