- Netherlands

- /

- Chemicals

- /

- ENXTAM:HYDRA

Hydratec Industries (AMS:HYDRA) Has A Pretty Healthy Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hydratec Industries NV (AMS:HYDRA) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hydratec Industries

How Much Debt Does Hydratec Industries Carry?

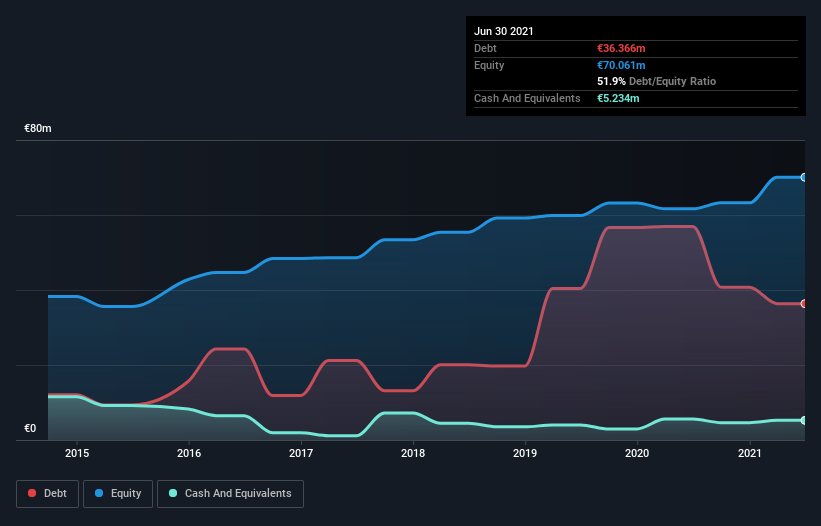

You can click the graphic below for the historical numbers, but it shows that Hydratec Industries had €25.5m of debt in June 2021, down from €57.0m, one year before. On the flip side, it has €5.23m in cash leading to net debt of about €20.3m.

How Strong Is Hydratec Industries' Balance Sheet?

We can see from the most recent balance sheet that Hydratec Industries had liabilities of €92.8m falling due within a year, and liabilities of €35.5m due beyond that. On the other hand, it had cash of €5.23m and €55.8m worth of receivables due within a year. So its liabilities total €67.2m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of €95.7m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hydratec Industries has a low debt to EBITDA ratio of only 1.0. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So there's no doubt this company can take on debt while staying cool as a cucumber. In addition to that, we're happy to report that Hydratec Industries has boosted its EBIT by 59%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is Hydratec Industries's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Hydratec Industries recorded free cash flow worth 72% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Hydratec Industries's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its level of total liabilities. Taking all this data into account, it seems to us that Hydratec Industries takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Hydratec Industries (of which 1 doesn't sit too well with us!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Hydratec Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hydratec Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:HYDRA

Hydratec Industries

Through its subsidiaries, manufactures and sells industrial systems and plastic components for food, health, and mobility markets in the Netherlands, rest of Europe, Asia, North America, South America, Africa, and Oceania.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives