- Netherlands

- /

- Chemicals

- /

- ENXTAM:DSFIR

DSM-Firmenich (ENXTAM:DSFIR): Assessing Valuation as Drug Delivery Innovations Take the Spotlight at PODD

Reviewed by Simply Wall St

DSM-Firmenich (ENXTAM:DSFIR) is set to present at the upcoming Partnership Opportunities in Drug Delivery (PODD) conference in Boston. Investors are watching closely, interested in potential updates on innovative drug delivery technologies.

See our latest analysis for DSM-Firmenich.

DSM-Firmenich’s scheduled appearance at PODD comes after a tough run for investors, with the 1-year total shareholder return sliding 33.9%. Recent momentum has faded, and shares sit at €69.8, reflecting a 28% year-to-date price decline. However, the spotlight on new drug delivery innovations may spark renewed attention from the market.

If breakthrough drug delivery is on your radar, now could be the perfect time to expand your search and discover See the full list for free.

With shares trading well below analyst targets and a year marked by lackluster returns, investors face a critical question: Is DSM-Firmenich undervalued at current levels, or is the market already factoring in its future prospects?

Most Popular Narrative: 34% Undervalued

DSM-Firmenich’s most followed narrative puts its fair value at €105.70, far above the recent close of €69.80. This wide gap draws attention to the catalysts that could shift the investment story in the months ahead.

Integration synergies and increased exposure to local and regional customers boost margin improvements and revenue stability amid tightening sustainability regulations. Heavy reliance on regional growth, narrowing focus, and currency risks threaten DSM-Firmenich's margin stability and cash flow amid uncertain recurring organic performance.

Want to know why analysts believe DSM-Firmenich could be poised for a comeback? The narrative’s high valuation rests on ambitious profit margin gains and a bold trajectory for earnings. Are you intrigued by the financial assumptions at play, along with the tough hurdles that must be overcome? Click through to see which projections are driving this surprising price target.

Result: Fair Value of €105.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if local sales momentum fades or ongoing currency volatility deepens, DSM-Firmenich’s growth story could quickly come under pressure.

Find out about the key risks to this DSM-Firmenich narrative.

Another View: What Do Earnings Ratios Reveal?

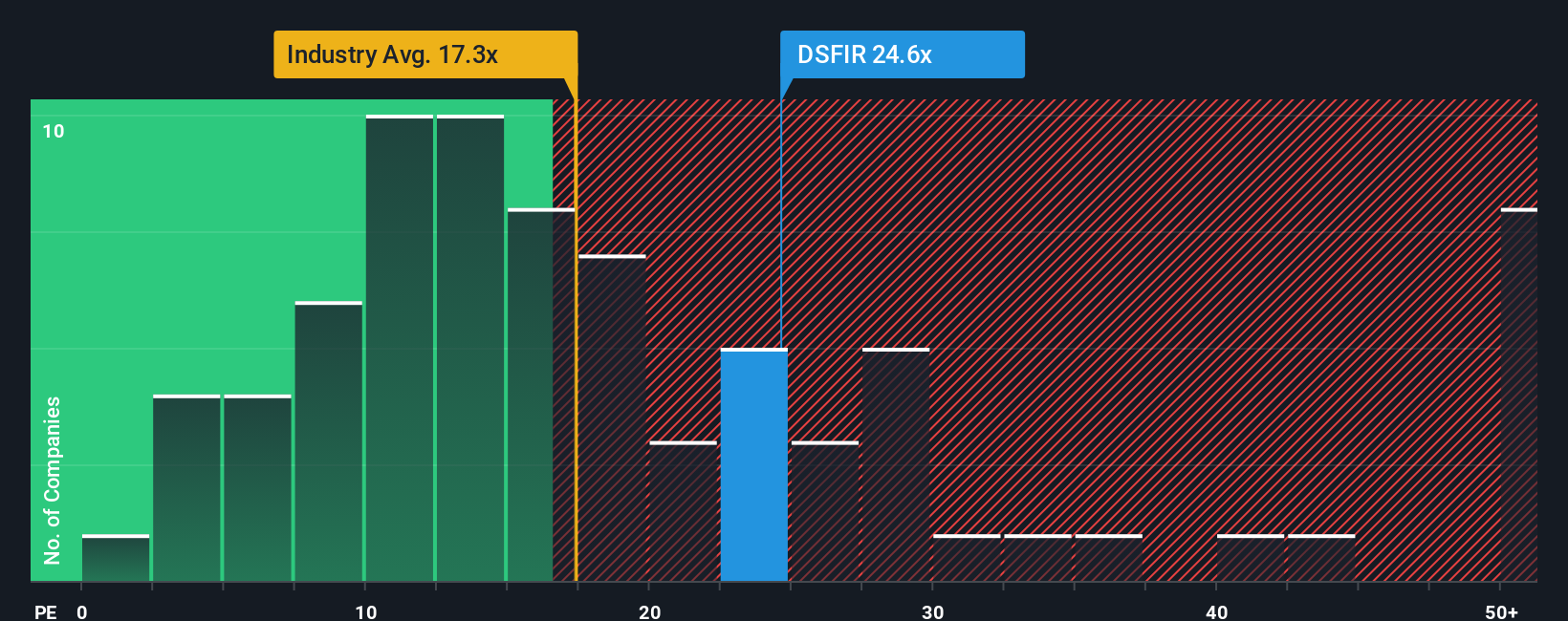

Looking at DSM-Firmenich through the lens of its price-to-earnings ratio, the valuation story shifts. Shares currently trade at 24.7 times earnings, which is above both the European Chemicals industry average of 17.4x and the fair ratio of 16.5x. This suggests investors may be taking on higher valuation risk compared to industry norms and where the market could eventually trend. Is the optimism priced in, or is there a hidden opportunity waiting to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DSM-Firmenich Narrative

If you see the DSM-Firmenich data differently, or want to run the numbers for yourself, you can shape your own narrative in just minutes. Do it your way

A great starting point for your DSM-Firmenich research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let opportunity pass you by. The smartest investors always look beyond the obvious. Spark your next great investment thesis by testing new stock approaches today.

- Uncover stocks trading below their true worth and start building value with these 843 undervalued stocks based on cash flows before the market catches on.

- Unlock higher yields for your portfolio by evaluating these 18 dividend stocks with yields > 3% providing reliable returns and steady income.

- Tap into tomorrow’s innovation with these 26 AI penny stocks reshaping industries through artificial intelligence and advanced automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:DSFIR

DSM-Firmenich

Provides nutrition, health, and beauty solutions in Switzerland, the Netherlands, rest of Europe, the Middle East and Africa, North America, Latin America, China, and rest of Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives