- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Can Steady Profitability Amid Modest Sales Shift Reveal Philips’ Transformation Strategy? (ENXTAM:PHIA)

Reviewed by Sasha Jovanovic

- Earlier this month, Koninklijke Philips reported its third-quarter 2025 earnings, posting sales of €4.30 billion and net income of €184 million, alongside reiterating its full-year guidance for 1%-3% comparable sales growth.

- An interesting insight is that while sales slipped slightly compared to the prior year, Philips' profitability and earnings per share remained stable, offering consistency during a period of transformation for the company.

- We’ll now explore how this steady earnings performance and reaffirmed growth outlook factor into Philips’ broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Koninklijke Philips' Investment Narrative?

For anyone considering Koninklijke Philips as a potential investment, the essential belief lies in the company’s ability to deliver consistent operating performance throughout a period of significant organizational and regulatory change. Despite the latest quarterly results showing a small dip in sales, the company maintained stable net income and earnings per share, as well as reaffirmed its outlook for modest top-line growth. This consistency could support short-term sentiment, as management’s ability to maintain profitability during a transition phase is likely to matter most in the near term. That said, the latest developments have not shifted the most important catalysts: Philips’ ongoing product innovation and substantial investment in new healthcare technology are still front and center. However, the biggest risks remain unchanged. Recent regulatory scrutiny of manufacturing practices and unresolved class action litigation remain significant uncertainties for the business and may continue to weigh on the stock. On the other hand, regulatory risks are still front of mind and could impact sentiment further.

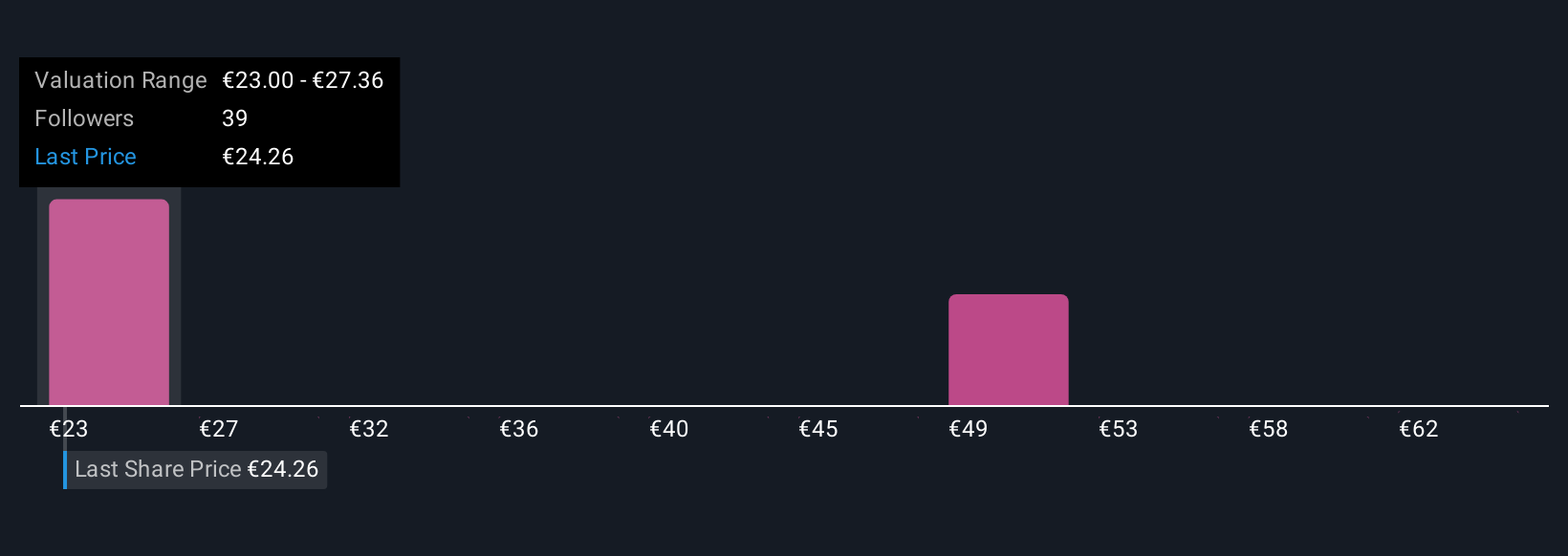

Koninklijke Philips' shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on Koninklijke Philips - why the stock might be worth over 2x more than the current price!

Build Your Own Koninklijke Philips Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Koninklijke Philips research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Koninklijke Philips' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives