- Netherlands

- /

- Medical Equipment

- /

- ENXTAM:PHIA

Assessing Philips (ENXTAM:PHIA) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Koninklijke Philips (ENXTAM:PHIA) has been drawing renewed market interest lately, sparked by its improving fundamentals and recent stock movement. Investors are analyzing what a 12% gain over the past 3 months could mean for the company’s outlook.

See our latest analysis for Koninklijke Philips.

Philips’ share price has gained real momentum in recent months. It has climbed over 12% in the last quarter as some of the business turnaround efforts took hold. While the share price is now at $24.78, it's worth noting that total shareholder return for the past year is still down more than 13%. Over the long run, however, the three-year total return sits above 100%, hinting at the company’s recovery potential and how quickly sentiment can shift when fundamentals improve.

If you’re interested in discovering other healthcare names making waves, check out See the full list for free.

But after this recent rally, is Philips still an undervalued healthcare play or has the rebound already factored in all the company’s progress and left little room for upside? Is there a real buying opportunity here, or is the market already pricing in future growth?

Price-to-Earnings of 138.6x: Is it justified?

At its last close of €24.78, Koninklijke Philips is trading at a price-to-earnings (P/E) ratio of 138.6x, which stands far above both the peer average (26.9x) and the European Medical Equipment industry average (29.5x). This signals that the current valuation is significantly richer than its rivals.

The price-to-earnings ratio shows how much investors are willing to pay per euro of earnings. For a healthcare technology name like Philips, this metric helps reflect growth expectations and perceived earnings quality relative to peers.

In Philips' case, the market appears to be paying a premium that is tough to justify given its recent turnaround status and profitability profile. The elevated P/E suggests either investors are expecting outsized growth, or the recovery is already priced in. Compared to industry averages, Philips’ multiple is stretched, meaning the market either sees something exceptional ahead or is overlooking lingering operational risks. If a fair ratio were available, it would serve as a benchmark to determine whether this premium could last or revert toward sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 138.6x (OVERVALUED)

However, persistent profit margin pressure and potential operational challenges could dampen the recovery story and prompt further shifts in investor sentiment.

Find out about the key risks to this Koninklijke Philips narrative.

Another View: Does the DCF Model Tell a Different Story?

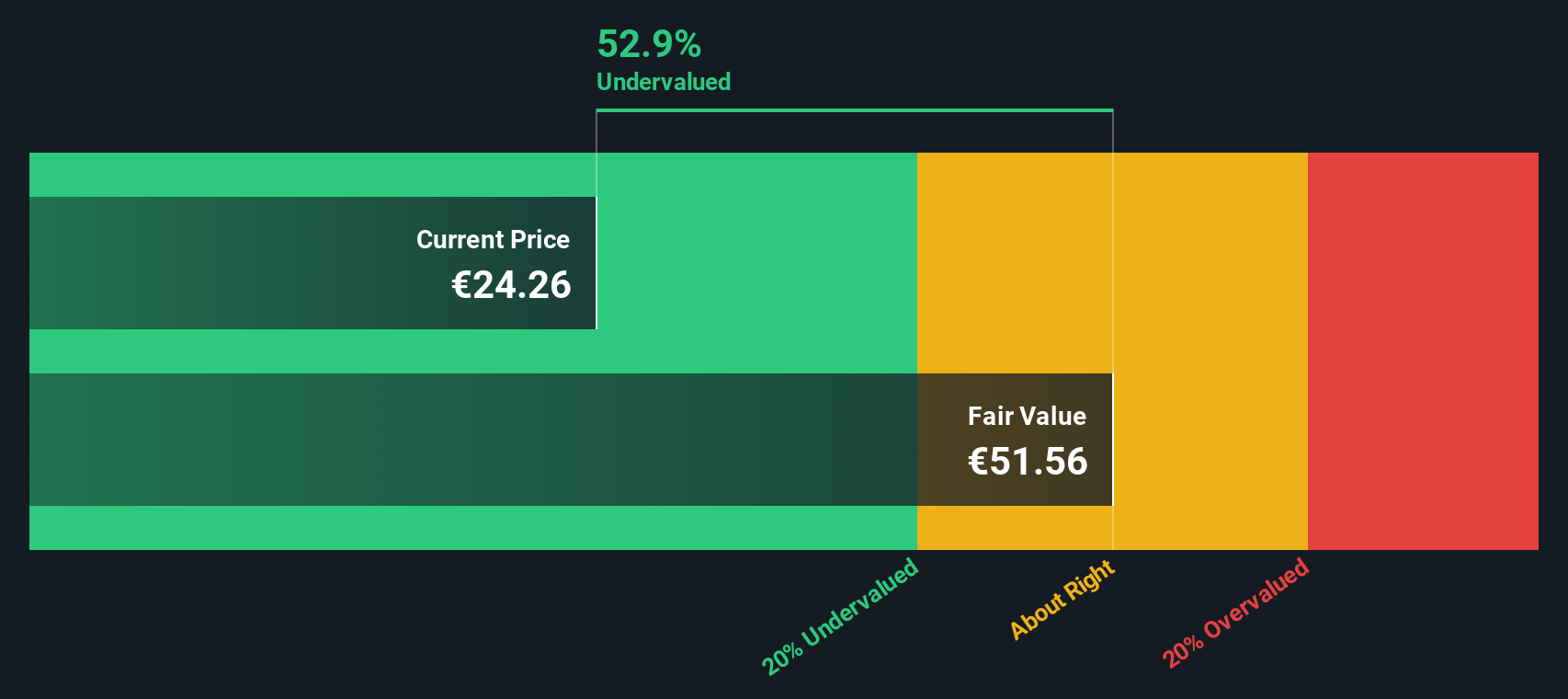

While the market is valuing Philips far above industry averages based on its price-to-earnings ratio, our SWS DCF model takes a different approach. Based on future cash flow projections, the model suggests Philips is trading at a steep 51% discount to its fair value. This points to significant undervaluation. Could the market be missing something, or is the recovery story less certain than the numbers imply?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Koninklijke Philips for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Koninklijke Philips Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can pull together your own analysis in just a few minutes. Do it your way

A great starting point for your Koninklijke Philips research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity when there’s a world of innovation and value out there. Make your next smart move with these powerful ideas:

- Capitalize on tomorrow’s technology trends by jumping into these 27 AI penny stocks, where artificial intelligence leaders are building the next wave of growth.

- Secure reliable income streams by tapping into these 17 dividend stocks with yields > 3%, which offers high yields and proven stability for your portfolio.

- Catch hidden standouts among these 879 undervalued stocks based on cash flows and find stocks trading below their true worth before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Philips might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PHIA

Koninklijke Philips

Operates as a health technology company in North America, the Greater China, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives