- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

How Heineken’s EverGreen 2030 Overhaul and Share Buyback May Shape ENXTAM:HEIA Investor Outlook

Reviewed by Sasha Jovanovic

- Heineken recently unveiled its EverGreen 2030 strategy, outlining plans for global growth, digital transformation, productivity gains, and new sustainability targets, while launching a €1.5 billion share buyback program and confirming reduced sales guidance amid economic pressures.

- An important aspect from these updates is Heineken’s focus on optimizing its global footprint, including targeted market exits and expansion in key emerging regions, while doubling down on premium, low- and no-alcohol, and innovative beverage segments to capture shifting consumer preferences.

- We'll look at how Heineken's accelerated digital transformation and cost-saving measures could shape the company’s investment narrative moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Heineken Investment Narrative Recap

To believe in Heineken as a shareholder, you need confidence in its ability to balance growth in emerging markets and premium segments with disciplined cost management, especially amid shifting consumer habits and economic headwinds. Heineken’s recent confirmation of softer 2025 sales guidance highlights the pressure from consumer affordability and slowing beer volumes, which remains the key short-term catalyst, while the most material risk is persistent weakness in Europe and exposure to macro volatility. This news does not fundamentally alter either dynamic in a significant way.

One of the most relevant recent announcements is Heineken’s launch of the EverGreen 2030 strategy, which includes greater investment in digital transformation, productivity initiatives, and a €1.5 billion share buyback. These actions directly address near-term operational efficiency and profitability, core to the company’s investment story as it navigates weaker volume growth and margin pressures in major markets.

But investors should also be alert to the risk that, despite optimizing its portfolio and presence, Heineken’s ongoing exposure to foreign exchange swings and challenging economics in key regions...

Read the full narrative on Heineken (it's free!)

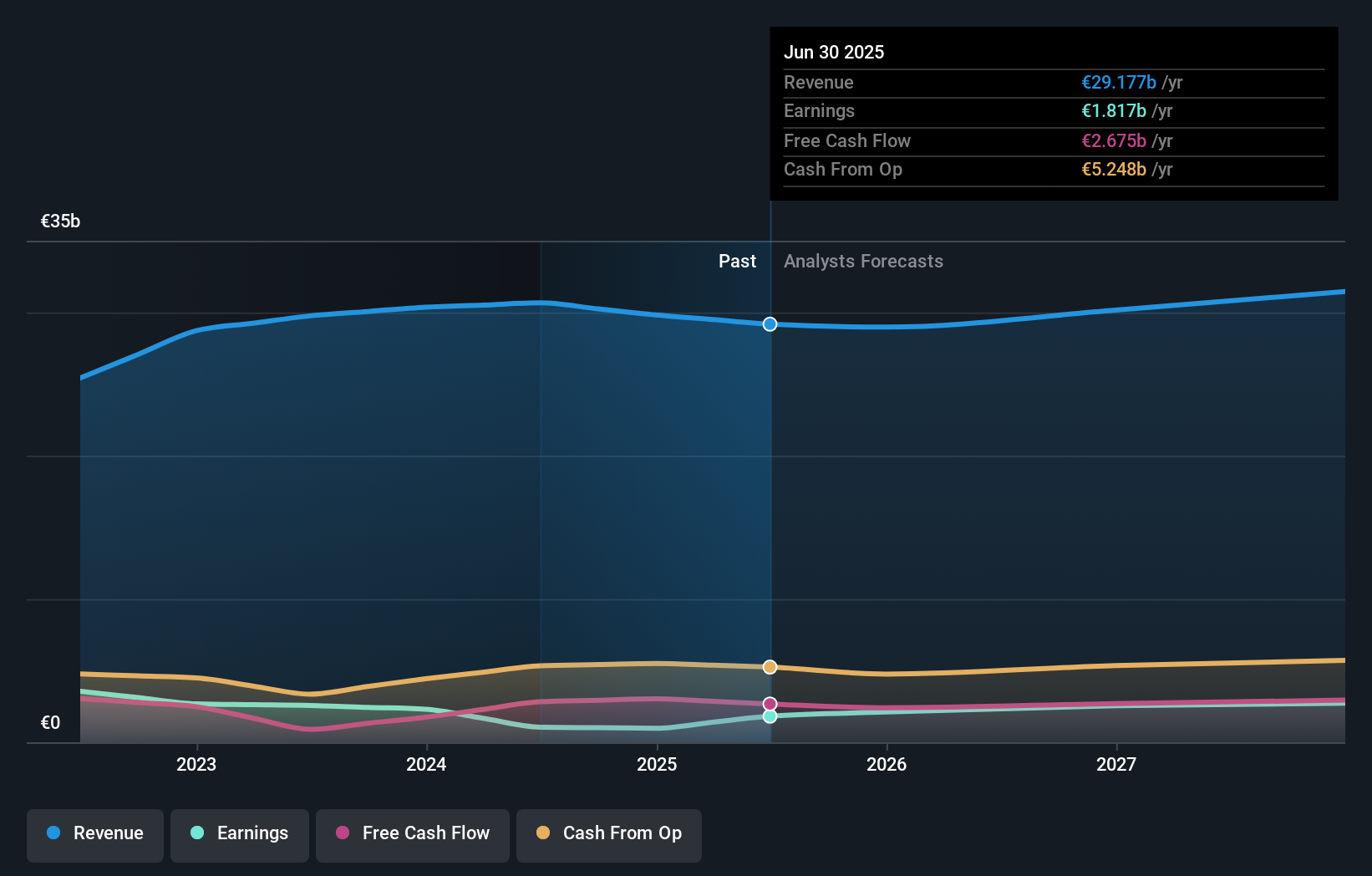

Heineken's narrative projects €32.8 billion in revenue and €3.0 billion in earnings by 2028. This requires 4.0% yearly revenue growth and a €1.2 billion increase in earnings from the current €1.8 billion.

Uncover how Heineken's forecasts yield a €86.67 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Seven distinct fair value estimates from the Simply Wall St Community place Heineken’s price expectations between €65 and €157.42 per share. While investors weigh these divergent valuations, Heineken’s response to challenging European demand will influence how the company sustains performance in mature markets.

Explore 7 other fair value estimates on Heineken - why the stock might be worth over 2x more than the current price!

Build Your Own Heineken Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Heineken research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heineken's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives