- Netherlands

- /

- Beverage

- /

- ENXTAM:HEIA

Heineken (ENXTAM:HEIA): A Fresh Look at Valuation Following Recent Share Price Movements

Reviewed by Simply Wall St

Heineken (ENXTAM:HEIA) shares have seen mixed performance this year, moving up nearly 4% over the past month but falling by about 11% over the past 3 months. Investors continue to assess the company's value in relation to recent results and growth prospects.

See our latest analysis for Heineken.

After a downturn earlier this year, Heineken’s share price has started to stabilize, with momentum picking up modestly in the past month. However, the past year’s total shareholder return of -11.4% puts the recent rebound in perspective and reminds investors that longer-term headwinds may still linger even as sentiment improves.

Want to see where the next wave of market momentum could come from? This could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Heineken’s shares still trading below analyst price targets despite recent gains, the key question emerges: is the stock undervalued at current levels, or is the market already factoring in the company’s future growth potential?

Most Popular Narrative: 20.6% Undervalued

Heineken's fair value as set by the most-followed narrative is €86.67, standing well above the last close price of €68.80. This sets up a striking potential upside, but the fundamentals behind the target warrant closer examination.

"Continued portfolio premiumization, including robust performance of global brands like Heineken, Amstel, and innovative extensions such as Heineken Silver and 0.0, enables higher average selling prices and improved profitability, pointing to sustainable margin and earnings growth."

Curious what underpins this bullish stance? The core of the narrative rests on ambitious growth in both earnings and margins, with financial assumptions rivals would envy. What sets these projections apart from the crowd? Unpack the critical factors, revealed only in the in-depth narrative.

Result: Fair Value of €86.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as pressure from rising input costs and ongoing weakness in key mature markets. These factors could challenge the bullish outlook.

Find out about the key risks to this Heineken narrative.

Another View: What Do Market Ratios Say?

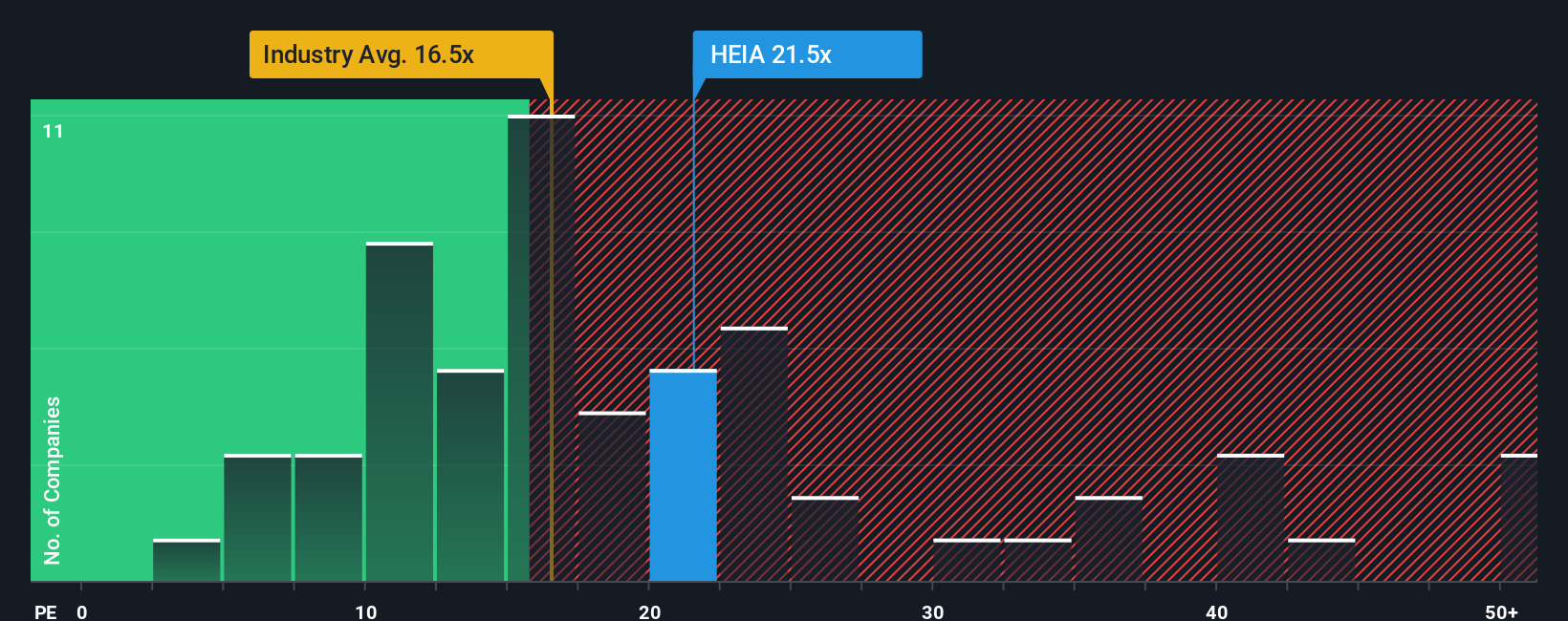

Looking at Heineken through the lens of its current price-to-earnings ratio, we get a less optimistic picture. The company trades at 21x earnings, higher than its peer average of 19.7x and well above the European beverage industry average of 16.7x. This premium could signal valuation risk if growth does not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heineken Narrative

If you want a fresh perspective or have your own research in mind, it's easy to craft your unique view on Heineken. Take a few moments to get started and Do it your way.

A great starting point for your Heineken research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Give yourself the edge in today's market by checking out other promising opportunities that might fit your investment style and goals.

- Amplify your income potential and tap steady cash flow with these 17 dividend stocks with yields > 3%, featuring companies offering yields above 3%.

- Target innovators driving breakthroughs in medicine and data with these 33 healthcare AI stocks, offering access to firms at the forefront of AI-powered healthcare.

- Seize the chance to pick up bargain shares by browsing these 877 undervalued stocks based on cash flows, selected for strong fundamentals and attractive prices based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heineken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIA

Heineken

Heineken N.V. brews and sells beer and cider in the Americas, Europe, Africa, the Middle East, and the Asia Pacific.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives