- Netherlands

- /

- Oil and Gas

- /

- ENXTAM:VPK

Vopak’s Duqm Energy Hub Partnership Might Change the Case for Investing in Koninklijke Vopak (ENXTAM:VPK)

Reviewed by Sasha Jovanovic

- In October 2025, Oman Tank Terminal Company (OTTCO) and Royal Vopak signed a shareholder agreement to form a joint venture in the Special Economic Zone at Duqm, aiming to develop and operate large-scale energy storage and terminal infrastructure for both traditional and renewable fuels.

- This move gives Vopak expanded access to one of the region's fastest-growing industrial hubs, supporting Oman's national goal to become a global logistics and sustainable energy centre.

- We'll explore how Vopak's partnership with OTTCO in Duqm could reshape its global energy infrastructure ambitions and earnings outlook.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Koninklijke Vopak Investment Narrative Recap

Owning shares of Koninklijke Vopak requires belief in the company’s ability to capture value from the global energy transition by investing in infrastructure for both traditional fuels and emerging energy carriers. The recent joint venture with OTTCO in Duqm directly supports Vopak’s long-term positioning but does not materially change the most immediate catalyst, successful ramp-up of new energy terminals, nor does it resolve the largest risk: ongoing delays and utilization challenges at legacy assets. One recent announcement closely related to the Duqm partnership is Vopak’s agreement with Falcker for advanced tank inspection technology. This move underlines Vopak’s effort to address operational efficiency, a critical factor as the company integrates new assets and navigates project execution risks in its energy transition pipeline. However, investors should also pay close attention to the potential impact of regulatory and investment decision delays in major energy projects...

Read the full narrative on Koninklijke Vopak (it's free!)

Koninklijke Vopak's narrative projects €1.4 billion in revenue and €447.8 million in earnings by 2028. This requires 1.9% yearly revenue growth and an earnings decrease of €34 million from current earnings of €481.8 million.

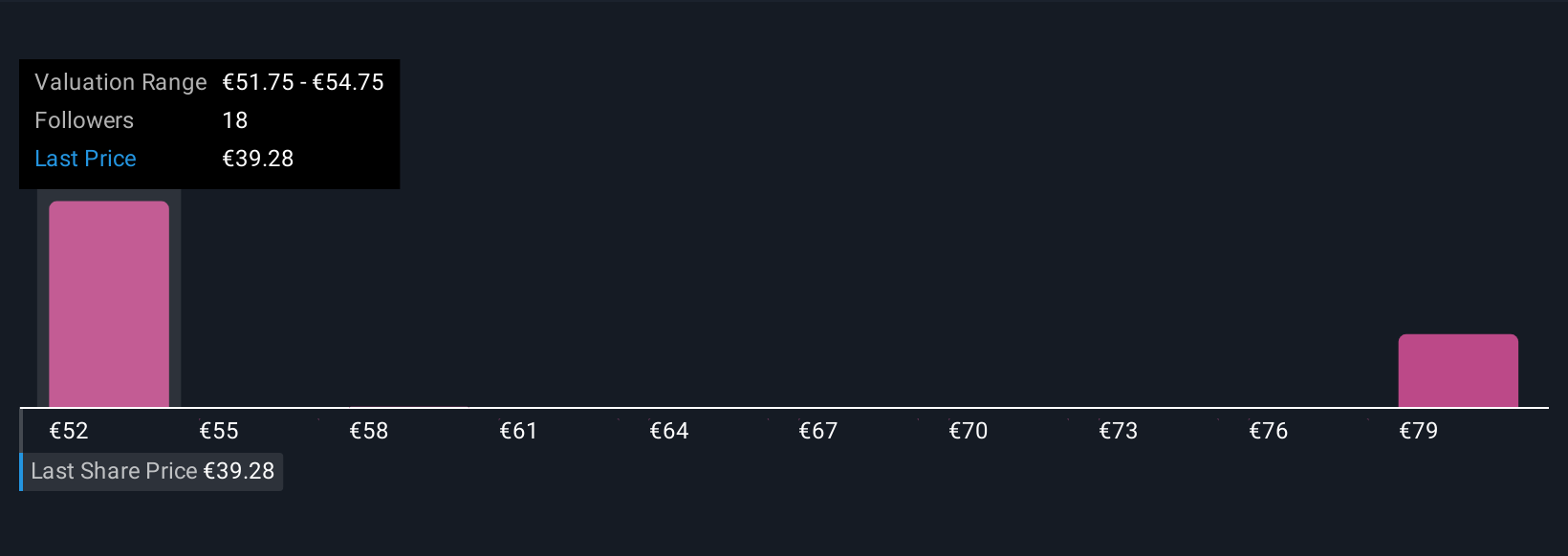

Uncover how Koninklijke Vopak's forecasts yield a €51.75 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted three fair value estimates for Vopak ranging from €51.75 to €99.20, displaying strong differences in opinion. As the company’s energy transition projects expand, many see execution and permitting uncertainty as a key factor shaping future results, explore the full range of these views to understand what could drive performance.

Explore 3 other fair value estimates on Koninklijke Vopak - why the stock might be worth over 2x more than the current price!

Build Your Own Koninklijke Vopak Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Koninklijke Vopak research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Koninklijke Vopak research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Koninklijke Vopak's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Vopak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VPK

Koninklijke Vopak

An independent tank storage company, stores and handles liquid chemicals, gases, and oil products to the energy and manufacturing markets worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives